Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

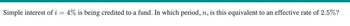

Transcribed Image Text:Simple interest of i = 4% is being credited to a fund. In which period, n, is this equivalent to an effective rate of 2.5%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are given the following cash flows. What is the present value (t = 0) if the discount rate is 12 percent? 0 1 2 3 4 5 6 (Periods) 0 2,000 2,000 2,000 0 -2,000 -2,000 (cash flows) Select one: a. $4,289 b. $2,804 c. $2,656 d. $4,804 e. $5,302arrow_forwardPV = Cash Flow/Interest Rate is the present value shortcut formula for which of the following: * A perpetuity A single cash flow in the future A growing perpetuity An annuityarrow_forward1. Discounted Payback (DCPB) and IRR analysis. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 8.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 1 -5500 +1500 2 +1800 3 +1500 4 +1800 5 6 +1500 +1800 7 +1500arrow_forward

- j. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 8%. Year 1 $100, Year 2 $200, Year 3 $400 Year Payment 1 100 2 200 3 400 Rate 8% To find the PV, use the NPV function: Pv= $581.59 Year Payment x (1+ I)^(N- t) = FV 1 100 2 200 3 400arrow_forwardConsider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at t=2, and $10 at t=3. Asset B generates $2 at t=1, $X at t=2, and $10 at t=3. Suppose X=6 and the interest rate r is constant. For r=0.1, calculate the present value of the two assets. Determine the set of all interest rates {r} such that asset A is more valuable than asset Draw the present value of the assets as a function of the interest rate. Suppose r=0.2. Find the value X such that the present value of asset B is 12. Suppose the (one-period) interest rates are variable and given as follows: r01=0.1,r12=0.2, r23=0.3. Calculate the yield to maturity of asset A. (You can use Excel or ascientific calculator to find the solution numerically.)arrow_forward3. If a capital investment is $28,752.7 and equal annual cash inflows are 69,943.5, state the internal rate of return factor rounded to two decimal places.arrow_forward

- Assume that at time 0 a sum L is lent for a series of n yearly payments. The rth payment, of amount xr, is due at the end of the rth year. Let the effective annual interest rate for the rth year be ir. Give an identity which expresses L in terms of the xr and ir.arrow_forwardUse the compound interest formula A = P(1 + i)n to find the indicated values A = $6,000; i = 0.03; n = 24; P =?arrow_forwardFind the effective yield on a discount loan with the given discount rate r and the time. (Round your answer to two decimal places.) r = 2%, 2 monthsarrow_forward

- 20. What is X in the formula: FV = X(1+r) ? Select one: a. The future value of an annuity with X cash flows b. The present value of a single cash flow in one period's time c. The future value of a single cash flow in one period's time d. The present value of an annuity with X cash flowsarrow_forwardExample 26a (Varying Force of Interest) A fund earns interest at a force of interest 8, = kt . A deposit of RM100 at time t=0 will grow to RM250 at the end of 5 years. Determine k.arrow_forwardThe of the present values of all the payments required to pay off a loan is equal to the original principal of the loan. square root sum economic rate equivalent paymentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education