FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

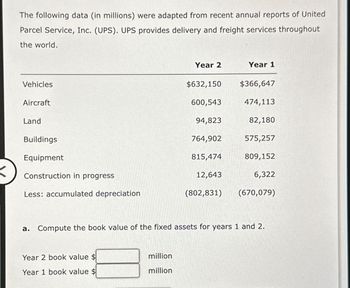

Transcribed Image Text:The following data (in millions) were adapted from recent annual reports of United

Parcel Service, Inc. (UPS). UPS provides delivery and freight services throughout

the world.

Vehicles

Aircraft

Land

Buildings

Equipment

Construction in progress

Less: accumulated depreciation

Year 2 book value $

Year 1 book value

Year 2

million

million

$632,150

600,543

94,823

764,902

815,474

12,643

(802,831)

Year 1

$366,647

474,113

82,180

575,257

809,152

6,322

a. Compute the book value of the fixed assets for years 1 and 2.

(670,079)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Year-End Balance Sheets 2021 Plant assets Equipment Accumulated depreciation Equipment Equipment, net Buildings Accumulated depreciation-Buildings Buildings, net $ 245,000 (125,000) $ 119,000 1 Cash received from the sale of building 2. Depreciation expense 3 Purchase of building $ 445,000 (139,000) $306,000 2020 $335,000 (236,000) $ 99,000 $ 465,000 (324,000) $ 141,000 During 2021, a building with a book value of $83,000 and an original cost of $365,000 was sold at a gain of $73,000. 1. How much cash did Anders receive from the sale of the building? 2. How much depreciation expense was recorded on buildings during 2021? 3. What was the cost of buildings purchased by Anders during 2021?arrow_forwardSubject : Accountingarrow_forwardWant Answer please provide itarrow_forward

- Please do not give solution in image format thankuarrow_forwardI want the Correct answer in text Formatarrow_forwardThe trucks account (at cost) of a business for the year ended 31 December 20X1 was as follows. TRUCKS - COST 20X1 1 Jan balance 30 June cash - purchase of vans $ 240,000 160,000 400,000 A B C D 20X1 $68,000 $57,000 $53,000 $21,000 31 Mar disposal account 31 Dec balance Brought forward accumulated depreciation at 1 January 20X1 was $115,000. The truck disposed of on 31 March had a carrying value of $20,000. $ 60,000 340,000 400,000 The company's policy is to charge depreciation at 20% per year on the reducing balance, and charges a full year's depreciation in the year of acquisition and none in the year of disposal. What should be the depreciation charge for the year ended 31 December 20X1?arrow_forward

- Required information [The following information applies to the questions displayed below.] The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Year-End Balance Sheets 2021 Plant assets Equipment Accumulated depreciation-Equipment Equipment, net Buildings Accumulated depreciation-Buildings Buildings, net 1. Cash received from the sale of equipment 2. Depreciation expense 3. Purchase of equipment $ 180,000 (100,000) $ 80,000 $ $ 380,000 (100,000) $ 280,000 During 2021, equipment with a book value of $40,000 and an original cost of $210,000 was sold at a loss of $3,000. 1. How much cash did Anders receive from the sale of equipment? 2. How much depreciation expense was recorded on equipment during 2021? 3. What was the cost of new equipment purchased by Anders during 2021? 2020 37,000 $ 270,000 (210,000) $ 60,000 $ 400,000 (285,000) $ 115,000arrow_forwardHasbro, Inc. Consolidated Statements of Operations - USD ($) $ in Thousands 12 Months Ended Dec. 31, 2018 Consolidated Statements of Operations [Abstract] Net revenues, external $ 4,579,646 Costs and expenses Cost of sales 1,850,678 Royalties 351,660 Product development 246,165 Advertising 439,922 Amortization of intangibles 28,703 Program production cost amortization 43,906 Selling, distribution and administration 1,287,560 Total expenses 4,248,594 Operating profit 331,052 Non-operating (income) expense Interest Expense 90,826 Interest income (22,357) Other (income) expense, net (7,819) Total non-operating expense, net 60,650 Earnings before income taxes 270,402 Income taxes 49,968 Net earnings 220,434 Net Loss Attributable to Noncontrolling Interests 0 Net Earnings Attributable to Hasbro, Inc. $ 220,434 Net earnings attributable to Hasbro, Inc. per common share: Basic (in dollars per share) $ 1.75 Diluted (in dollars per…arrow_forwardProvide correct answer for this questionarrow_forward

- From the following data, prepare a profit and loss a/c and a balance sheet as on 31-3-2023. Particulars Shs. Particulars Shs. Drawings 10,000 Capital 30, 000 Purchases 30,000 Purchase returns 1,000 Sales Returns 5,000 Sales 60, 000 Carriage in 2,000 Wages outstanding 2,000 Carriage out 3, 000 Rent received 1,000 Depreciation on Plant 4,000 Reserve for doubtful 1,000 debts Plant account 20,000 Interest (Cr) 5,000 Salaries & wages 3,000 Sundry creditors 6, 000 Bad debts 2,000 Loans 38,000 Premises 20, 000 Interest 5,000 Stock 1.4.95 25,000 Sundry debtors 15,000 1,44,000 1, 44,000 Adjustment: a) Stock on 31-3-23 was Shs.40,000. A fire broke -out in the godown and destroyed stock worth Shs.5, 000. Insurance company had accepted the claim in full. b) Provide for bad debts @ 10% and provide for discount on debtors @ 5% and on creditors @ 10% c) Depreciate buildings at the rate of 15% p.a. d) Rent outstanding amounted to Shs.1,000 e) Closing stock includes samples worth of Shs.2,000. f)…arrow_forwardQ1. The data below was extracted from the books of Talata Enterprise: Non-Current Assets Cost Date of purchase GHC Machine No. 1 Machine No. 2 Machine No. 3 Machine No. 4 200,000 350,000 400,000 540,000 01/01/19 30/06/19 01/01/20 01/12/20 Date of disposal 01/10/21 30/06/21 Additional information: i. It is the policy of the company to charge a full year's depreciation on machinery in use by the end of the financial year. ii. Machine 1 and 3 are depreciated at 20% on reducing balance while machine 2 and 4 are depreciated 10% on straight line basis. iii. Accounts are prepared to December 31" each year. iv. Machine 1 and 2 were sold for GHC150,000 and GHC250,000 respectively. You are required to: i. Show the relevant entries to record these transactions for the relevant years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education