FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

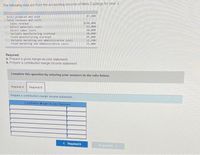

Transcribed Image Text:The following data are from the accounting records of Niles Castings for year 2

87,000

Units produced and sold

Total revenues and costs

$250,000

63,000

38,000

20,000

45,000

12,500

33,000

Sales revenue

Direct naterials costs

Direct labor costs

Variable manufacturing overhead

Fixed manufacturing overhead

Variable marketing and administrative costs

Fixed marketing and administrative costs

Required:

a. Prepare a gross margin income statement.

b. Prepare a contribution margin income statement.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a contribution margin income statement.

Contribution Margin Income Statement

< Required A

Requireda

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Domesticarrow_forwardIncome Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (70,400 units) during the first month, creating an ending inventory of 6,400 units. During February, the company produced 64,000 units during the month but sold 70,400 units at $90 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Cost of goods sold: 6,400 $36.00 6,400 14.00 64,000 64,000 Unit Cost 70,400 70,400 Total Cost $230,400 89,600 $50.00 $320,000 $36.00 $2,304,000 15.40 985,600 $51.40 $3,289,600 $18.20 $1,281,280 7.00 492,800 $25.20 $1,774,080 a. Prepare an income statement according to the absorption…arrow_forwardA company reports the following contribution margin income statement. Contribution Margin Income Statement For Year Ended December 31 Sales (19,200 units at $22.50 each) Variable costs (19,200 units at $18.00 each) Contribution margin. Fixed costs Income The manager believes the company can increase sales volume to 22,000 total units by increasing advertising costs by $16,200. Required A Required B Complete this question by entering your answers in the tabs below. Contribution Margin Income Statement For Year Ended December 31 $ 432,000 345,600 Prepare a contribution margin income statement assuming the company incurs the additional advertising costs and sales volume increases to 22,000 units. Sales Variable costs Contribution margin 86,400 64,800 $ 21,600 Fixed costs Incomearrow_forward

- Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,600 units at $225 each) Variable costs (11,600 units at $180 each) Contribution margin Fixed costs Income $ 2,610,000 2,088,000 522,000 315,000 $ 207,000 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forwardV. Prepare a CONTRIBUTION MARGIN (also known as variable costing) income statement given a traditional (also known as absorption costing) income statement Bruno Industries manufactures and sells a single product. The controller has prepared the following income statement for the most recent year: B C D 1 2 3 Bruno Industries Traditional Income Statement (Absorption Costing) For the Year Ended December 31 4 5 Sales revenue 6 Less: Cost of goods sold 7 Gross profit 8 Less: Operating expenses 9 Operating income $ 406,000 329,000 $ 77,000 73,000 $ 4,000 10 The company produced 8,000 units and sold 7,000 units during the year ending December 31. Fixed manufacturing overhead (MOH) for the year was $152,000, while fixed operating expenses were $62,000. The company had no beginning inventory. Requirements 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? 2. Prepare a variable costing income…arrow_forwardThe GAAP income statement for Carla Vista Company for the year ended December 31, 2022,s shows sale $930,000, cost of good sold $555,000, and operating expenses $235,000. Assuming all costs and expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.arrow_forward

- Required information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 10,000 5,500 4,500 2,250 Sales Variable expenses Contribution margin Fixed expenses Net operating income 2,250 2. What is the contribution margin ratio? Contribution margin ratioarrow_forwardA. Manufacturing margin? b. Contribution margin? C. Operating income for PhiladelPho's company ?arrow_forwardPhiladelphia Company has the following information for March: Sales $484,795 Variable cost of goods sold 205,574 Fixed manufacturing costs 76,273 Variable selling and administrative expenses 52,568 Fixed selling and administrating expenses 35,254 a. Determine the March manufacturing margin.$fill in the blank 1 b. Determine the March contribution margin.$fill in the blank 2 c. Determine the March income from operations for Philadelphia Company.$fill in the blank 3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education