ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

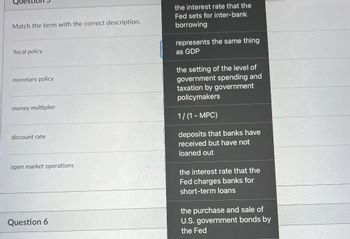

Transcribed Image Text:Match the term with the correct description.

fiscal policy

monetary policy

money multiplier

discount rate

open market operations

Question 6

the interest rate that the

Fed sets for inter-bank

borrowing

represents the same thing

as GDP

the setting of the level of

government spending and

taxation by government

policymakers

1/(1-MPC)

deposits that banks have

received but have not

loaned out

the interest rate that the

Fed charges banks for

short-term loans

the purchase and sale of

U.S. government bonds by

the Fed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Aplia Homework: Federal Budgets and Public Policy The following table contains approximate figures for gross domestic product (GDP) and the national debt in the United States for June 2001 and June 2010. The national debt represents the total amount of money owed by the federal government to holders of U.S. securities. All numbers are in trillions of dollars. Debt Held Outside Fed. Govt. and Fed. Total National Reserve GDP Debt Debt Held by (Trillions of (Trillions of Federal Foreign Ownership U.S. Ownership Dollars) Dollars) Government and Federal (Trillions of (Trillions of Reserve Dollars) Dollars) (Trillions of Dollars) 3.0 1.0 1.7 June 2001 10.1 5.7 4.6 4.0 4.6 June 2010 14.5 13.2 Source: "U.S. Treasury, Bureau of Economic Analysis." Publicly held debt is the portion of the national debt that is held outside the federal government and the Federal Reserve System. In June 2001, the publicly held debt as a percentage of total national debt was In June 2001, the percentage of the U.S.…arrow_forwardCompare and contrast the strengths and weaknesses of fiscal policy and monetary policy. In 1300 wordsarrow_forward38. Budget deficits are inflationary when a. b. the Federal Reserve contracts the money supply. the economy has lots of slack and the aggregate supply curve is horizontal. C. the economy is at full employment and the aggregate supply curve is vertical. d. private citizens buy the bonds to finance the debt.arrow_forward

- Answer the question on the basis of the following aggregate demand and supply schedules for a hypothetical economy: Amount of Real Output Demanded Price Level (Index Value) Amount of Real Output Supplied $200 300 $500 $300 250 $450 $400 200 $400 $500 150 $300 $600 100 $200 Refer to the data. If the amount of real output demanded at each price level falls by $200, the equilibrium price level and equilibrium level of real domestic output will fall to: 250 and $200, respectively. O 150 and $200, respectively. 200 and $300, respectively. O 150 and $300, respectively.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardExplain the difference between fiscal policy and monetary policy. Explain also 2 advantages and 2 disadvantages of both policies.arrow_forward

- B. Move the Economy back to Potential GDP C. Do nothing D. Decrease Inflation, Lower Interest Rates, Increase Spending 33. If an Economy is producing below Potential GDP, the correct form of action is: A. Expansionary Monetary Policy combined with Contractionary Fiscal Policy B. Contractionary Monetary Policy combined with Expansionary Fiscal Policy C. Expansionary Monetary Policy or Expansionary Contractionary Policy or some Combination of both D. Contractionary Monetary and Fiscal Policy in the Same Amounts xt Predictions: On Editor Suggestions: Showing Et P + 51°arrow_forwardPlease answer number #11arrow_forwardFiscal policy is conducted by the U.S. Treasury the U.S. Mint the federal government the Federal Reserve bank and involves government spending and taxes. quantitative easing. printing money. open market operations.arrow_forward

- 26. A contractionary monetary policy combined with an expansionary fiscal policy will (A) decrease both income and consumption (B) increase both income and consumption (C) have uncertain effects on the interest rate and investment D) increase the interest rate and decrease investment (E) increase both the interest rate and investmentarrow_forwardDetermine whether each policy below is expansionary (increasing aggregate demand) or contractionary (decreasing aggregate demand) and whether it is fiscal or monetary policy. 1. The Federal Reserve buys bonds ✓ [Select] Contractionary Fiscal Policy Expansionary Fiscal Policy Expansionary Monetary Policy Contractionary Monetary Policy 3. The Federal Reserve raises the required reserve ratio. [Select] 2. Congress increases Medicare sp 4. Congress cuts defense spending. [Select]arrow_forwardCan a government that borrows exclusively in its own fiat currency involuntarily go bankrupt (i.e., inability to pay back debt)? Explain your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education