FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The following balances (in thousands of dollars) are from the accounts of Birwood Furniture:

| January 1 (Beginning) ($000) | December 31 (Ending) ($000) | |

|---|---|---|

| Direct materials inventory | $ 752 | $ 824 |

| Work-in-process inventory | 1,194 | 1,370 |

| Finished goods inventory | 179 | 304 |

Direct materials used during the year amount to $1,496,000 and the cost of goods sold for the year was $1,678,000.

Required:

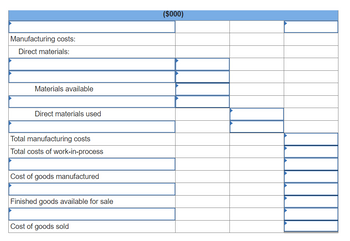

Prepare a cost of goods sold statement.

Note: Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234).

Transcribed Image Text:Manufacturing costs:

Direct materials:

Materials available

Direct materials used

Total manufacturing costs

Total costs of work-in-process

Cost of goods manufactured

Finished goods available for sale

Cost of goods sold

($000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following transactions for Sheridan Company. (a) Purchased 5,900 units of raw materials on account for $16.930. The standard cost was $17,700. (b) Issued 5,800 units of raw materials for production. The standard units were 5.890. List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually) No. Account Titles and Explanation (a) (b) Debit Creditarrow_forwardRequired information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Garcon Pepper Company Company $ $ 13,200 18,550 Work in process inventory, beginning 17,700 22,500 Raw materials inventory, beginning 7,700 14,100 Rental cost on factory equipment 31,000 24,100 Direct labor 24,200 43,800 Finished goods inventory, 19,700 13,800 ending Work in process inventory, ending 24,400 21,000 Raw materials inventory, ending 6,700 7,600 Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 12,300 17,000 34,000 53,500 13,000 14,000 6,500 3,550 36,000 68,000 50,400 56,800 297,600 379,360 27,000 24,200 15,000 20,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the…arrow_forward

- Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. . Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses. Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,200,000 52,000 68,000 88,000 239,000 287,000 43,000 34,000 68,000 109,000 174,000 62,000 82,000 106,000arrow_forwardRequired: If the December 1 balance in the Direct Materials Inventory account was $20,000, the December 31 balance was $22,000, and $130,000 of direct materials were issued to production during December, what was the amount of direct materials purchased during the month? Purchased amount of direct materialarrow_forwardAdelphia Manufacturing issued $70,000 of direct materials and $9,000 of indirect materials for production. Which of the following journal entries would correctly record the transaction? O A. Work-in- Process Inventory Raw Materials Inventory B. Manufacturing Overhead Raw Materials Inventory OC. Work-in - Process Inventory Manufacturing Overhead Raw Materials Inventory D. Raw Materials Inventory Finished Goods Inventory Work-in - Process Inventory 79,000 79,000 70,000 9,000 79,000 79,000 79,000 79,000 70,000 9,000arrow_forward

- The following information has been taken from the perpetual inventory system of Elite Manufacturing Company for the month ended August 31: Purchases of direct materials. Direct materials used Direct labor costs assigned to production Manufacturing overhead costs incurred (and applied) Balances in inventory Materials Work in Process Finished Goods Multiple Choice The cost of finished goods manufactured in August is: $147,000. $92,000. $57,000. August 31 August 1 $ 25,000 $ 47,000 $ 43,000 Some other amount. $ 65,000 $ 60,000 $ 60,000 $ 50,000 $ 25,000 $ 35,000arrow_forwardi want answers in all questions mention in below snaparrow_forwardThe following balances (in thousands of dollars) are from the accounts of Birwood Furniture: January 1 December 31 (Beginning) (Ending) ($000) $ 892 ($000) $ 964 1,510 444 Direct materials inventory Work-in-process inventory Finished goods inventory Direct materials used during the year amount to $2,896,000 and the cost of goods sold for the year was $3,078,000. Required: Prepare a cost of goods sold statement. Note: Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234). Manufacturing costs: Direct materials: Materials available Direct materials used Total manufacturing costs Total costs of work-in-process 1,334 319 Cost of goods manufactured BIRWOOD FURNITURE Cost of Goods Sold Statement For the Year Ended December 31 ($000)arrow_forward

- During July 20X1, Kali Co. purchased and issued the following materials and supplies. Purchases Issues from Storeroom Materials $ 62,000 Direct materials $ 52,000 Manufacturing supplies 4,200 Manufacturing supplies 3,700 Required: Give the entry in general journal form to record the cost of the materials purchasearrow_forwardThe following data (in thousands of dollars) have been taken from the accounting records of Rayburn Corporation for the current year: Sales $1,980 Selling expenses 280 Factory overhead 460 Direct labor 400 Administrative expenses 300 Direct materials purchased during year 240 Finished goods inventory, January 1 240 Finished goods inventory, December 31 320 Materials inventory, January 1 80 Materials inventory, December 31 140 Work in process inventory, January 1 140 Work in process inventory, December 31 100 Required: Enter all amounts in thousands of dollars. a. Determine of the direct materials used in production during the year.$fill in the blank 1 thousand b. Determine of goods manufactured for the year.$fill in the blank 2 thousand c. Determine cost of goods sold for the year.$fill in the blank 3 thousand d. Determine net income for the year.$fill in the blank 4 thousandarrow_forwardFortune Company had beginning raw materials inventory of $9,900. During the period, the company purchased $55,500 of raw materials on account. If the ending balance in raw materials was $6,900, the amount of raw materials transferred to work in process is: Multiple Choice $52,500. $58,500. $55,500. $62,400.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education