FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

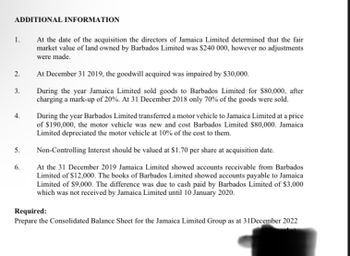

Transcribed Image Text:ADDITIONAL INFORMATION

1.

2.

3.

4.

5.

6.

At the date of the acquisition the directors of Jamaica Limited determined that the fair

market value of land owned by Barbados Limited was $240 000, however no adjustments

were made.

At December 31 2019, the goodwill acquired was impaired by $30,000.

During the year Jamaica Limited sold goods to Barbados Limited for $80,000, after

charging a mark-up of 20%. At 31 December 2018 only 70% of the goods were sold.

During the year Barbados Limited transferred a motor vehicle to Jamaica Limited at a price

of $190,000, the motor vehicle was new and cost Barbados Limited $80,000. Jamaica

Limited depreciated the motor vehicle at 10% of the cost to them.

Non-Controlling Interest should be valued at $1.70 per share at acquisition date.

At the 31 December 2019 Jamaica Limited showed accounts receivable from Barbados

Limited of $12,000. The books of Barbados Limited showed accounts payable to Jamaica

Limited of $9,000. The difference was due to cash paid by Barbados Limited of $3,000

which was not received by Jamaica Limited until 10 January 2020.

Required:

Prepare the Consolidated Balance Sheet for the Jamaica Limited Group as at 31 December 2022

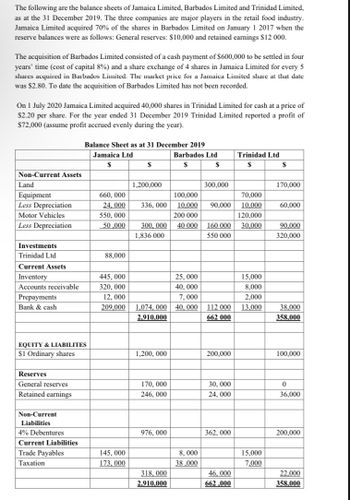

Transcribed Image Text:The following are the balance sheets of Jamaica Limited, Barbados Limited and Trinidad Limited,

as at the 31 December 2019. The three companies are major players in the retail food industry.

Jamaica Limited acquired 70% of the shares in Barbados Limited on January 1 2017 when the

reserve balances were as follows: General reserves: $10,000 and retained earnings $12 000.

The acquisition of Barbados Limited consisted of a cash payment of $600,000 to be settled in four

years' time (cost of capital 8%) and a share exchange of 4 shares in Jamaica Limited for every 5

shares acquired in Barbados Limited. The market price for a Jamaica Limited share at that date

was $2.80. To date the acquisition of Barbados Limited has not been recorded.

On 1 July 2020 Jamaica Limited acquired 40,000 shares in Trinidad Limited for cash at a price of

$2.20 per share. For the year ended 31 December 2019 Trinidad Limited reported a profit of

$72,000 (assume profit accrued evenly during the year).

Non-Current Assets

Land

Equipment

Less Depreciation

Motor Vehicles

Less Depreciation

Investments

Trinidad Ltd

Current Assets

Inventory

Accounts receivable

Prepayments

Bank & cash

EQUITY & LIABILITES

$1 Ordinary shares

Reserves

General reserves

Retained earnings

Non-Current

Liabilities

Balance Sheet as at 31 December 2019

Jamaica Ltd

$

4% Debentures

Current Liabilities

Trade Payables

Taxation

660, 000

24,000

550,000

50,000

88,000

$

145, 000

173,000

1,200,000

336, 000

300,000

1,836 000

445, 000

320, 000

12, 000

209.000 1,074, 000

2.910.000

1,200,000

170,000

246, 000

976, 000

318,000

2.910,000

Barbados Ltd

$

$

100,000

10,000

200 000

40 000

25,000

40,000

7,000

40,000

8,000

38,000

300,000

70,000

90,000 10,000

120,000

30,000

160 000

550 000

112 000

662 000

200,000

30, 000

24, 000

362, 000

Trinidad Ltd

S

46,000

662,000

15,000

8,000

2,000

13.000

15,000

7.000

$

170,000

60,000

90,000

320,000

38,000

358,000

100,000

0

36,000

200,000

22,000

358,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.004 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 804,000 Inventory 1,304,000 Property, plant, and equipment 4,004,000 Notes payable (2,108,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.006 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary's assets and liabilities were as follows: Cash CHF Inventory Property, plant, and equipment Notes payable 806,000 1,306,000 4,006,000 (2,112,000) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. a. Determine the translation adjustment to be reported on Stephanie's December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in Stephanie's 2020…arrow_forwardChristina Company (a U.S.-based company) has a subsidiary in Canada that began operations at the start of 2020 with assets of 143,000 Canadian dollars (CAD) and liabilities of CAD 76,000. During this initial year of operation, the subsidiary reported a profit of CAD 37,000. It distributed two dividends, each for CAD 6,100 with one dividend declared on March 1 and the other on October 1. Applicable U.S. dollar ($) exchange rates for 1 Canadian dollar follow: January 1, 2020 (start of business) March 1, 2020 Weighted average rate for 2020 October 1, 2020 December 31, 2020 $0.80 0.78 0.77 0.76 0.75 a. Assume that the Canadian dollar is this subsidiary's functional currency. What translation adjustment would the company report for the year 2020? b. Assume that on October 1, 2020, Christina entered into a forward exchange contract to hedge the net investment in this subsidiary. On that date, the company agreed to sell CAD 160,000 in three months at a forward exchange rate of $0.76/CAD1.…arrow_forward

- Northwest Paperboard Company, a paper and allied products manufacturer, was seeking to gain a foothold in Canada. Toward that end, the company bought 40% of the outstanding common shares of Vancouver Timber and Milling, Inc., on January 2, 2021, for $400 million. At the date of purchase, the book value of Vancouver’s net assets was $775 million. The book values and fair values for all balance sheet items were the same except for inventory and plant facilities. The fair value exceeded book value by $5 million for the inventory and by $20 million for the plant facilities. The estimated useful life of the plant facilities is 16 years. All inventory acquired was sold during 2021. Vancouver reported net income of $140 million for the year ended December 31, 2021. Vancouver paid a cash dividend of $30 million.Required:1. Prepare all appropriate journal entries related to the investment during 2021.2. What amount should Northwest report as its income from its investment in Vancouver for the…arrow_forwardWhite Perfect Berhad, a Malaysian listed company, has regular acquisitions of silver from a Japanese supplier. Therefore, White Perfect Berhad designates a future purchase of silver as a hedged item in a cash flow hedge. On 1 January 2017, White Perfect Berhad purchased the silver. On the same date, a cumulative gain on the hedging instrument of RM6 million had been credited to other comprehensive income. At the year end of 31 December 2017, the carrying amount of the silver was RM16 million and its net realizable value was RM12 million. The silver was finally sold on 31 March 2018 for RM12.4 million. Required: Show how White Perfect Berhad should recognize and measure the cash flow hedge for the year 2017. and 2018.arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.002 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 802,000 Inventory 1,302,000 Property, plant, and equipment 4,002,000 Notes payable (2,104,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forward

- Board Company has a foreign subsidiary that began operations at the start of 2017 with assets of 144,000 kites (the local currency unit) and liabilities of 78,000. During this initial year of operation, the subsidiary reported a profit of 38,000 kites. It distributed two dividends, each for 6,200 kites with one dividend declared on March 1 and the other on October 1. Applicable exchange rates for 1 kite follow: January 1, 2017 (start of business) $0.81 March 1, 2017 0.79 Weighted average rate for 2017 0.78 October 1, 2017 0.77 December 31, 2017 0.76 Assume that the kite is this subsidiary’s functional currency. What translation adjustment would Board report for the year 2017? Assume that on October 1, 2017, Board entered into a forward exchange contract to hedge the net investment in this subsidiary. On that date, Board agreed to sell 170,000 kites in three months at a forward exchange rate of $0.77/1 kite. Prepare the journal entries required by this…arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.018 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 818,000 Inventory 1,318,000 Property, plant, and equipment 4,018,000 Notes payable (2,136,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forwardTransWorld Communications Inc., a large telecommunications company, is evaluating the possible acquisition of Georgia Cable Company (GCC), a regional cable company. TransWorld's analysts project the post-merger data for GCC (in thousands of dollars) gathered in the Excel Online file below. If the acquisition is made, it will occur on January 1, 2018. All cash flows shown in the income statements are assumed to occur at the end of the year. GCC currently has a capital structure of 40% debt, but Trans World would increase that to 50% if the acquisition were made. GCC, if independent, would pay taxes at 20%; but its income would be taxed at 30% if it were consolidated. GCC's current market-determined beta is 1.35, and its investment bankers think that its beta will rise to 1.50 if the debt ratio were increased to 50%. The cost of goods sold is expected to be 65% of sales, but it could vary somewhat. Depreciation-generated funds would be used to replace worn-out equipment, so they would…arrow_forward

- Christina Company (a U.S.-based company) has a subsidiary in Canada that began operations at the start of 2020 with assets of 151,000 Canadian dollars (CAD) and liabilities of CAD 92,000. During this initial year of operation, the subsidiary reported a profit of CAD 45,000. It distributed two dividends, each for CAD 6,900 with one dividend declared on March 1 and the other on October 1. Applicable U.S. dollar ($) exchange rates for 1 Canadian dollar follow: January 1, 2020 (start of business) $0.77 March 1, 2020 0.75 Weighted average rate for 2020 0.74 October 1, 2020 0.73 December 31, 2020 0.72 Assume that the Canadian dollar is this subsidiary’s functional currency. What translation adjustment would the company report for the year 2020? Assume that on October 1, 2020, Christina entered into a forward exchange contract to hedge the net investment in this subsidiary. On that date, the company agreed to sell CAD 185,000 in three months at a forward…arrow_forwardOn December 18, 2017, Stephanie Corporation acquired 100 percent of a Swiss company for 4.0 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2017, the book and fair values of the subsidiary’s assets and liabilities were: Cash CHF 804,000 Inventory 1,304,000 Property, plant & equipment 4,000,000 Notes payable (2,108,000 ) Stephanie prepares consolidated financial statements on December 31, 2017. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2017, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss to be…arrow_forwardNorthwest Paperboard Company, a paper and allied products manufacturer, was seeking to gain a foothold in Canada. Toward that end, the company bought 40% of the outstanding common shares of Vancouver Timber and Milling, Inc., on January 2, 2021, for $540 million.At the date of purchase, the book value of Vancouver's net assets was $845 million. The book values and fair values for all balance sheet items were the same except for inventory and plant facilities. The fair value exceeded book value by $5 million for the inventory and by $30 million for the plant facilities.The estimated useful life of the plant facilities is 15 years. All inventory acquired was sold during 2021.Vancouver reported net income of $160 million for the year ended December 31, 2021. Vancouver paid a cash dividend of $50 million.Required:1. Prepare all appropriate journal entries related to the investment during 2021. 2. What amount should Northwest report as its income from its investment in Vancouver for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education