FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using the indirect method, prepare a statement of cash flows for Sullivan Corp.

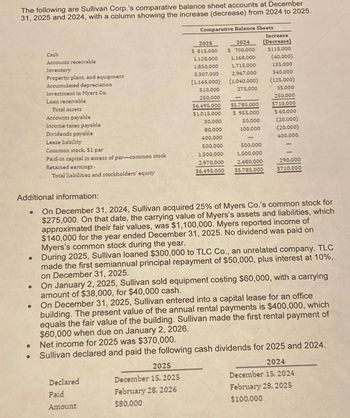

Transcribed Image Text:The following are Sullivan Corp.'s comparative balance sheet accounts at December

31, 2025 and 2024, with a column showing the increase (decrease) from 2024 to 2025.

Comparative Balance Sheets

2025

Cash

Accounts receivable

Inventory

Property: plant, and equipment

Accumulated depreciation

Investment in Myers Co.

Loan receivable

Total assets

Accounts payable

Income taxes payable

$ 815,000

1.128,000

2024

$700,000

1.168.000

Increase

(Decrease)

$115,000

(40,000)

1,850,000

1,715.000

135,000

3,307,000

2,967,000

340,000

(1,165,000)

(1,040,000)

(125,000)

310,000

275,000

35,000

250,000

$6.495.000

$5,785,000

250,000

$710,000

$1,015,000

$ 955,000

$ 60,000

30,000

50.000

(20.000)

Dividends payable

80,000

100,000

(20,000)

Lease liability

400,000

400,000

Common stock. $1 par

500,000

500.000

Paid-in capital in excess of par-common stock

1,500,000

1,500,000

Retained earnings.

2.970,000

2,680.000

290,000

Total liabilities and stockholders' equity

$6.495.000

$5.785.000

$710,000

Additional information:

0

•

On December 31, 2024, Sullivan acquired 25% of Myers Co.'s common stock for

$275,000. On that date, the carrying value of Myers's assets and liabilities, which

approximated their fair values, was $1,100,000. Myers reported income of

$140,000 for the year ended December 31, 2025. No dividend was paid on

Myers's common stock during the year.

During 2025, Sullivan loaned $300,000 to TLC Co., an unrelated company. TLC

made the first semiannual principal repayment of $50,000, plus interest at 10%,

on December 31, 2025.

On January 2, 2025, Sullivan sold equipment costing $60,000, with a carrying

amount of $38,000, for $40,000 cash.

On December 31, 2025, Sullivan entered into a capital lease for an office

building. The present value of the annual rental payments is $400,000, which

equals the fair value of the building. Sullivan made the first rental payment of

$60,000 when due on January 2, 2026.

Net income for 2025 was $370,000.

Sullivan declared and paid the following cash dividends for 2025 and 2024.

2024

2025

Declared

December 15, 2025

Paid

February 28, 2026

Amount

$80,000

December 15, 2024

February 28, 2025

$100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forwardWhat are the objectives related to the statement of cash flows?arrow_forwardWhat are the key steps in preparing the Statement of Cash Flows, using the indirect method? What are the advantages of using the indirect method for reporting cash flows from operating activities?arrow_forward

- Please explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forwardExplain how to prepare statement of cash flows.arrow_forwardWhat are the differences between cash flows from operating activities and the elements of an income statement?arrow_forward

- Prepare a basic statement of cash flows.arrow_forwardThe two approaches to reporting cash flows provided by operating activities are the a. the liquidity and profitability methods. b. the basic and standard methods. c. direct and indirect methods. d. the gross margin and contribution margin methods.arrow_forwardDescribe the two formats for reporting operating activities on the statement of cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education