FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

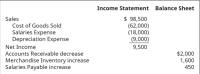

- Use the following information from Chocolate Company’s financial statements to determine operating net

cash flows (indirect method).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare a statement of cash flows using the indirect methodarrow_forwardWhich of the following sections from the statement of cash flows includes activities that affect current assets and current liabilities on the balance sheet? a. Investing b. None-cash investing and financing. c. Operating d. Financingarrow_forwardWhich of the following describes the operating activities as shown in the statement of cash flows? a. Includes increases and decreases in long-term assets b. Includes transactions that primarily impact current assets and current liabilities c. Shows the beginning and ending balance of cash d. Includes transactions affecting the capitalization of the businessarrow_forward

- what are the two methods to prepare cash flow statement? Discuss in detail how cash from operating activities is determined in both the methods. Describe the entire processarrow_forwardClassifying Items in the Statement of Cash Flows The following items are commonly reported in a statement of cash flows (indirect method presentation). For each item 1 through 20, determine (a) in which section the item is presented (operating, investing, or financing) and (b) whether the associated dollar amount is added or subtracted in the statement. (a) (b) 1. Payments of short-term debt. Answer Answer 2. Repurchases of common stock. Answer Answer 3. Purchases of property and equipment. Answer Answer 4. Sale of investments classified as long-term. Answer Answer 5. Proceeds from the issuance of common stock. Answer Answer 6. Increase in prepaid expenses and other current assets. Answer Answer 7. Acquisition for cash of a competitor. Answer Answer 8. Increase in current income tax payable. Answer Answer 9. Decrease in accounts payable. Answer Answer 10. Dividends paid to stockholders. Answer Answer 11.…arrow_forwardHelparrow_forward

- When using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forwardA measure that helps estimate the amount and timing of cash flows from operating activities is the cash flow on total assets ratio. True or False True Falsearrow_forwardView previous at Required information Assume a company prepares the statement of cash flows using the indirect method. The company purchases its Inventory on credit from suppliers. How should a decrease in accounts payable be reflected In the section that reconciles net income to cash flow from operating activitles? Multiple Choice It would be added if the section starts with net income and subtracted if it starts with a net loss It would be added in reconciling net income to cash flow from operafing activities It would be subtracted in reconciling net income to cash flow from operating activities A change in accounts payable does not affect the reconciliation of net income to cash flow from operating activities < Prev 15 of 15 Next Form 1040Sch...pdf 6 Form1040 Sch...pdf B1040 Sohedul...pdf Form8829 (1).pdf MacBook Airarrow_forward

- Assuming Sherban reports dividends paid as a financing activity: Calculate net cash flow from operating activities. Use a proper three-line title. Calculate Sherban’s current cash debt coverage ratio, cash debt coverage ratio and free cash flow. Using your answers in part (b) and comment on Sherban’s liquidity and financial flexibility. Under IFRS, how else might Sherban account for cash dividends paid in the cash flow statement?arrow_forwardSelect the item that matches with the description. Descriptions a. Begins with net income and then lists adjustments to net income in order to arrive at operating cash flows. b. Item included in net income, but excluded from net operating cash flows. c. Net cash flows from operating activities divided by average total assets. d. Cash transactions involving lenders and investors. e. Cash transactions involving net income. f. Cash transactions for the purchase and sale of long-term assets. g. Purchase of long-term assets by issuing stock to seller. h. Shows the cash inflows and outflows from operations such as cash received from customers and cash paid for inventory, salaries, rent, interest, and taxes. Termsarrow_forwardD&D Company reports select items from its statement of cash flows. Identify those items related to investing activities and co- net cash flows from investing activities. Activity Cash paid to purchase property Cash from selling merchandise Cash paid for income taxes Cash received from a long-term note Cash paid to repurchase stock Cash received from sale of investments Cash received from issuing equity shares Cash paid to purchase merchandise Cash paid to purchase investment securities Cash paid in salaries and wages Note: Cash outflows should be indicated by a minus sign. Activity Net cash flows from investing activities $ Amount 0 Amount $ 400,000 688,000 135,000 850,000 100,000 40,000 500,000 710,000 50,000 410,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education