FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Don't give answer in image format

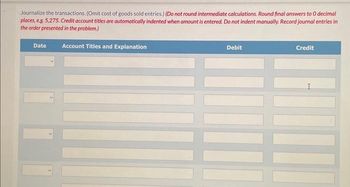

Transcribed Image Text:Journalize the transactions. (Omit cost of goods sold entries.) (Do not round intermediate calculations. Round final answers to O decimal

places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in

the order presented in the problem.)

Account Titles and Explanation

Date

Debit

Credit

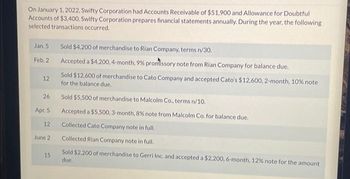

Transcribed Image Text:On January 1, 2022, Swifty Corporation had Accounts Receivable of $51,900 and Allowance for Doubtful

Accounts of $3,400. Swifty Corporation prepares financial statements annually. During the year, the following

selected transactions occurred.

Jan. 5

Feb. 2

12

26

Apr. 5

12

June 2

15

Sold $4,200 of merchandise to Rian Company, terms n/30.

Accepted a $4,200,4-month, 9% promissory note from Rian Company for balance due.

Sold $12,600 of merchandise to Cato Company and accepted Cato's $12,600, 2-month, 10 % note

for the balance due.

Sold $5,500 of merchandise to Malcolm Co., terms n/10.

Accepted a $5,500, 3-month, 8% note from Malcolm Co. for balance due.

Collected Cato Company note in full.

Collected Rian Company note in full.

Sold $2,200 of merchandise to Gerri Inc. and accepted a $2,200, 6-month, 12% note for the amount

due.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date May 31 August 1 September 7 Principal $570,000 93,600 115,000 Annual Interest Rate 10 % % 11 % $ tA $ Total Interest $702arrow_forwardRepost the complete question and add sub-parts to be solarrow_forwardhelp please, the answers I put are not correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education