Concept explainers

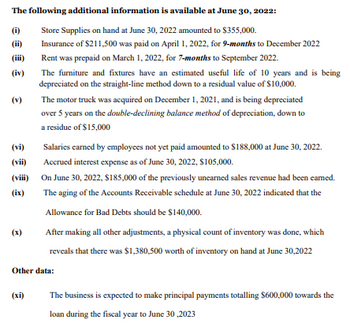

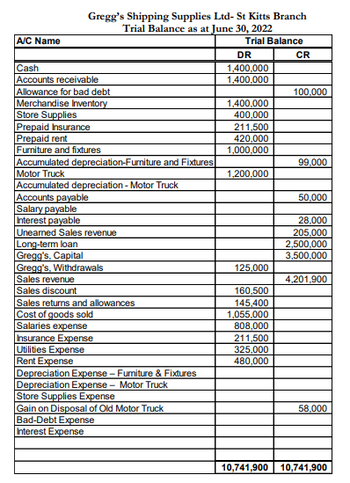

Gregg’s Shipping Supplies Ltd (GSSL) trades in the buying and selling of ship spares and has several branches within the Caribbean. Recently the company has seen a rapid increase in demand of its products across all branches and is therefore in need of additional financing to adequately boost its supply inventory. The corporate banking head of Bankers Choice Bank is requesting a full set of financial statements to ensure that granting the loan to GSSL would be financially feasible during a period when many businesses are facing financial challenges. The company financial year ends on June 30 each year and you have been tasked with the responsibility to prepare the financial information for the St. Kitts branch.

1. Prepare the Adjusted

Step by stepSolved in 2 steps with 2 images

BALANCE SHEET

5. Prepare the company’s classified

4. Prepare the company’s statement of owner’s equity at June 30, 2022.

3. Prepare the company’s multiple-step income statement for the period ending June 30, 2022.

BALANCE SHEET

5. Prepare the company’s classified

4. Prepare the company’s statement of owner’s equity at June 30, 2022.

3. Prepare the company’s multiple-step income statement for the period ending June 30, 2022.

- What is The business risk impact and the accounts (as well as the related assertions) most likely affected by the events outlined in relation to Knights Ltd. Knights Ltd Wayne tells you he is planning the 30 June 2021 Audit of Knights Ltd, a company that produces and exports timber products to South East Asian countries. Knights contracts timber cutters to deliver set tonnages of logs to its mill throughout the year. The timber is then transported to Asia on charter vessels, which make an average of one trip a month. Timber is purchased in 50 hectare lots from plantations and state forests. In the past, 75% of timber was sourced from plantations, however this has fallen to 40% in the current year. The corresponding increase in timber sourced from state forests has angered environmental groups. Protests have been held in several forests, which has slowed production and frustrated the contractors, who are only paid once set tonnages of timber are delivered to the mill. These issues…arrow_forwardDuring the class lecture we learned that the U.S. commercial paper market collapsed during the 2008 Financial Crisis. --- Commercial paper are simply unsecured notes that large corporations sell to investors. This is a common method that large firms use to raise quick cash without having to make a formal bank loan application. During 2008-2009, the Federal Reserve Bank was forced to enter into this marketplace to buy commercial paper in order to prevent the crisis from getting worse. (Free Gift: Mark True - This Is True - Gee Thanks Mr. Torres !) True or False True Falsearrow_forwardMetroBank is a fast-growing bank that serves the region around Jacksonville, Flordia. The bank provides commercial and individual banking services, including investment and mortgage banking services. The firm's strategy is to continue to grow by acquiring smaller banks in the area to broaden the base and variety of services it can offer. The bank now has 87 strategic business units, which represent different areas of service in different locations. To support its growth, MetroBank has invested several million dollars in upgrading its information services function. The number of networked computers and of support personnel have more than doubled in the last 4 years and now accounts for 13% of total operating expenses. Two years ago, MetroBank decided to charge information services to the SBUs based on the headcount (number of employees) in each SBU. Recently, some of the larger SBUs have complained that this method overcharges them and that some of the smaller SBUs are actually…arrow_forward

- Ford Motor has a division that finances consumer purchases of autos. To estimate the beta of their division, who would be a comparable firm? Hertz (Auto Rental and Leasing) Bank of America (grants auto loans, mortgages, credit cards) General Motors (another auto manufacturer) Ally Financial (auto financing company)arrow_forwardAssume you serve on the board of a local golf and country club. In preparation for renegotiating the club’s bank loans, the president indicates that the club needs to increase its operating cash flows before the end of the current year. The club’s treasurer reassures the president and other board members that he knows a couple of ways to boost the club’s operating cash flows. First, he says, the club can sell some of its accounts receivable to a collections company that is willing to pay the club $97,000 up front for the right to collect $1 00,000 of the overdue accounts. That will immediately boost operating cash flows. Second, he indicates that the club paid about $200,000 last month to relocate the 18th fairway and green closer to the clubhouse. The treasurer indicates that although these costs have been reported as expenses in the club’s own monthly financial statements, he feels an argument can be made for reporting them as part of land and land improvements (a long-lived asset)…arrow_forwardBnB Caribbean Inc. (BnB) is a leading construction company founded in 2001 and is based in Jamaica. Thecompany has within recent years been experiencing increases in revenues from its construction relatedservices such as design, build, expansion and remodeling, and emergency services. It’s main line of businessis from the construction of roads and commercial buildings within Jamaica and to a lesser extent a few otherCaribbean countries. Since the growth of the tourism sector in the Caribbean, BnB Caribbean has becomeconcerned about the number of other construction companies which have entered the market to providesimilar services around the Caribbean region. Business overseas contributes to 40% of the company’srevenues, while the other 60% comes mainly from works done in the domestic market.The COVID-19 pandemic has caused a slowdown in overall operations leading to prolonged delays in deliveryof raw materials from abroad. The CEO of the company is optimistic that there will be a…arrow_forward

- You are a Corporate Credit Analyst for your bank. A new corporate customer in the manufacturing sector approached your bank for a large credit facility in the sum of $20 million for production equipment and warehousing. The customer submitted the following financials to you. The cash position increased from $6.7 million in 2019 to $16 million in 2021. Does this signal a strengthening of the liquidity position of the firm? Explain.arrow_forwardFriendly Freddie’s is an independently owned major appliance and electronics discount chain with seven stores located in a Midwestern metropolitan area. Rapid expansion has created the need for careful planning of cash requirements to ensure that the chain is able to replenish stock adequately and meet payment schedules to creditors. Fred Ferguson, founder of the chain, has established a banking relationship that provides a $200,000 line of credit to Friendly Freddie’s. The bankrequires that a minimum balance of $8,200 be kept in the chain’s checking account at the end of each month. When the balance goes below $8,200, the bank automatically extends the line ofcredit in multiples of $1,000 so that the checking account balance is at least $8,200 at month-end.Friendly Freddie’s attempts to borrow as little as possible and repays the loans quickly in multiples of $1,000 plus 2 percent monthly interest on the entire loan balance. Interest payments and any principal payments are paid at the…arrow_forwardTechSpecialist (Pty) Ltd (hereafter referred to as “TechSpecialist”) is a small to medium-sized enterprise involved in the purchase and sale of IT hardware and accessories. TechSpecialist is located around Thohoyandou industrial area. The Thulamela Municipality is their largest client, which they have obtained through the annual tender process. The entity has experienced cash flow difficulties due to the Covid 19 pandemic. TechSpecialist has enjoyed tremendous support from the Thulamela Municipality; however, as is customary with government institutions, the Thulamela Municipality have a 60- day payment policy. In other words, the Thulamela Municipality has up to 60 days to pay an invoice before they can allow their suppliers to charge them interest. The Thulamela Municipality has on certain occasions paid supplier invoices within 20 days but on other occasions, they have paid the invoices on the 60th day. On 28 July 2021, TechSpecialist delivered IT equipment to the Thulamela…arrow_forward

- 33. subject:- Accountingarrow_forwardFriendly Freddie’s is an independently owned major appliance and electronics discount chain with seven stores located in a Midwestern metropolitan area. Rapid expansion has created the need for careful planning of cash requirements to ensure that the chain is able to replenish stock adequately and meet payment schedules to creditors. Fred Ferguson, founder of the chain, has established a banking relationship that provides a $200,000 line of credit to Friendly Freddie’s. The bank requires that a minimum balance of $8,200 be kept in the chain’s checking account at the end of each month. When the balance goes below $8,200, the bank automatically extends the line of credit in multiples of $1,000 so that the checking account balance is at least $8,200 at month-end. Friendly Freddie’s attempts to borrow as little as possible and repays the loans quickly in multiples of $1,000 plus 2 percent monthly interest on the entire loan balance. Interest payments and any principal payments are paid at…arrow_forwardHarderarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education