Concept explainers

The firm's marginal tax rate is 35%. The firm's currently outstanding 10% annual coupon rate long-term debt sells at $1,051.11. The debt matures in 7 years. Coupon interest is paid semiannually.

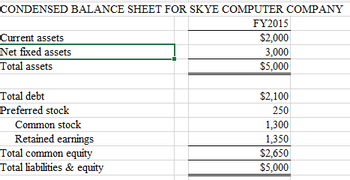

Skye's

Skye's earnings per share last year were $3.20. The common stock sells for $55.00, last year’s dividend (D0) was $2.10, and a flotation cost (i.e, f ) of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%.

The market risk premium is 5%, the risk-free rate is 6%, and Skye's beta is 1.516.

Question: Calculate the cost of preferred stock (rp ) (use excel format and show spreadsheet inputs)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- Marie Corp. has $1,465 in debt outstanding and $2,804 in common stock (and no preferred stock). Its marginal tax rate is 30%. Marie's bonds have a YTM of 6.7%. The current stock price (Po) is $46. Next year's dividend is expected to be $2.81, and it is expected to grow at a constant rate of 7% per year forever. The company's W.A.C.C. is ____%. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34%), but do not round any intermediate work in the process.arrow_forwardA firm can issue a 15-year, $1,000 par value bond with a 10% coupon rate, paying interest semiannually, at a price of $862.35. Their marginal tax rate is 40%. A dividend of $1.25 was just paid on the firm's common stock, and the firm's estimated growth rate is 8%. It can issue new common stock at $25.00 with a 20% floatation cost. The Risk-Free Return is 6%, the Market Return is 12%, and the firm's beta is 1.2. A) Calculate the firm's Cost of Debt, after Tax. B) Calculate the firm's Cost of Retained Earnings using the CAPM. C) Calculate the firm's Cost of new Common Stock. D) A firm has the following component costs of capital: Cost of Debt (after-tax): 10.5% Cost of Retained Earnings: 15.0% It's target capital structure is: Debt 40% Retained Earnings: 60% Estimate the firm's Weighted Average Cost of Capital (WACC)arrow_forwardBlooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 109%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%. Company tax rate is 30%. Required: Complete the following tasks: 3) Calculate the current price of the corporate bond? b) Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%: - c) Calculate the current value of the preferred share if the average return of the shares in the same industry is 12% d) Calculate the current market…arrow_forward

- Tesla inc. has issued a preferred stock currently trading for $120 per share that pays an annual dividend of $12. The companys tax rate is 25% and its bonds have a YTM of 8%. What is the required rate of return on the preferred stockarrow_forwardBlooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%. Company tax rate is 30%. Required: Complete the following tasks: Calculate the current price of the corporate bond? Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%? Calculate the current value of the preferred share if the average return of the shares in the same industry is 12% Calculate the current market…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education