Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Paragraph

Styles

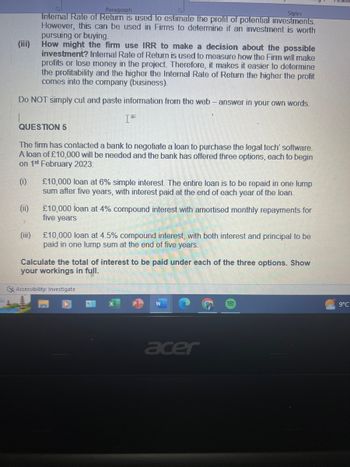

Internal Rate of Return is used to estimate the profit of potential investments.

However, this can be used in Firms to determine if an investment is worth

pursuing or buying.

How might the firm use IRR to make a decision about the possible

investment? Internal Rate of Return is used to measure how the Firm will make

profits or lose money in the project. Therefore, it makes it easier to determine

the profitability and the higher the Internal Rate of Return the higher the profit

comes into the company (business).

Do NOT simply cut and paste information from the web - answer in your own words.

QUESTION 5

The firm has contacted a bank to negotiate a loan to purchase the legal tech' software.

A loan of £10,000 will be needed and the bank has offered three options, each to begin

on 1st February 2023:

(0)

(ii)

(III)

£10,000 loan at 6% simple interest. The entire loan is to be repaid in one lump

sum after five years, with interest paid at the end of each year of the loan.

£10,000 loan at 4% compound interest with amortised monthly repayments for

five years

£10,000 loan at 4.5% compound interest, with both interest and principal to be

paid in one lump sum at the end of five years.

Calculate the total of interest to be paid under each of the three options. Show

your workings in full.

Accessibility: Investigate

acer

9°C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please explain part b of the question step by step through formula, not excelarrow_forwarda)loan of £16,000 is repaid by annual payments of £1,500 each at the end of the year. How long does it take to repay the loan on the basis of an interest rate of 4% p.a.? b)Suppose the payment at t=14 is increased to repay the loan (a balloon payment). What is the value of the payment at t=14? Enter an answer correct to 2 decimal places c)Alternatively, the loan may be repaid via a payment at t=15�=15 (a drop payment). What is the value of the payment at t=15? Enter an answer correct to 2 decimal placesarrow_forwardThe Omega Venture Group needs to borrow to finance a project. Repayment of the loan involves payments of $880 at the end of every month for five years. No payments are to be made during the development period of six years. Interest is 9% compounded quarterly. (a) How much should the Group borrow? (b) What amount will be repaid? (c) How much of that amount will be interest? a) The Group should borrow $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) b) The amount that will be repaid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) c) The amount of interest will be $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.).arrow_forward

- A university offers its students three financing options for a degree course that lasts exactly three years.Option AFees are paid during the term of the course monthly in advance. The fees are £10,000 per annum in the first year and rise by 5% on the first and second anniversaries of the start of the course.Option BThe university makes a loan to the students which is repaid in instalments after the end of the course. The instalments are determined as follows:−No payments are made until three years after the end of the course.−Over the following 15 years, students pay the university £1,300 per year, quarterly in advance.−After 15 years of payments, the quarterly instalments are increased to £1,500 per year, quarterly in advance.−After a further 15 years of payments, the quarterly instalments are increased to £1,800 per year, quarterly in advance, for a further 15-year period after which there are no more payments.Option C−Students pay to the university 3% of all their future earnings…arrow_forwardA loan of £14,000 is repaid by annual payments of £1,400 each at the end of the year. How long does it take to repay the loan on the basis of an interest rate of 1% p.a.? 数字 years Enter an answer correct to 2 decimal places Suppose the payment at t = 10 is increased to repay the loan (a balloon payment). What is the value of the payment at t = 10? £ 数字 Enter an answer correct to 2 decimal places Alternatively, the loan may be repaid via a payment at t = 11 (a drop payment). What is the value of the payment at t = 11? £ 数字 Enter an answer correct to 2 decimal placesarrow_forwardcould you please provide the working outarrow_forward

- A loan of £13,000 is repaid by annual payments of £1,800 each at the end of the year. How long does it take to repay the loan on the basis of an interest rate of 10% p.a.? 数字 years Enter an answer correct to 2 decimal places Suppose the payment at t = 13 is increased to repay the loan (a balloon payment). What is the value of the payment at t = 13? £ 数字 Enter an answer correct to 2 decimal places Alternatively, the loan may be repaid via a payment at t = 14 (a drop payment). What is the value of the payment at t = 14? £ 数字 Enter an answer correct to 2 decimal placesarrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT SOLUTIONS ARE FOR (i) I = £20.55 AND (ii) d = 5.81% pa AND (iii) d^12 = 5.97% paarrow_forward1) A 20-year loan of $1,100 at an effective annual interest rate of 7% is repaid with payments at the end of each year. Each of the first ten payments equals 150% of the amount of interest due. Immediately after the tenth payment, you take out a 10 year loan with payments $100 at the end of each year and effective annual interest rate of i and use this loan to pay off your original loan. Find i.arrow_forward

- An individual borrows £15,000 to be repaid in 10 years with monthly payments at the end of each month. The initial interest rate applied to the loan is 3% p.a. effective. a)Find the monthly repayment P1arrow_forwardI hope you could write the formula and process more clearly. Thank youarrow_forwardA loan of £13,000 is repaid by annual payments of £1,600 each at the end of the year. How long does it take to repay the loan on the basis of an interest rate of 7% p.a.? Number years Enter an answer correct to 2 decimal places Suppose the payment at t = 12 is increased to repay the loan (a balloon payment). What is the value of the payment at t = 12? £ Number Enter an answer correct to 2 decimal places Alternatively, the loan may be repaid via a payment at t = 13 (a drop payment). What is the value of the payment at t = 13? £ Number Enter an answer correct to 2 decimal placesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education