FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I required Only - d

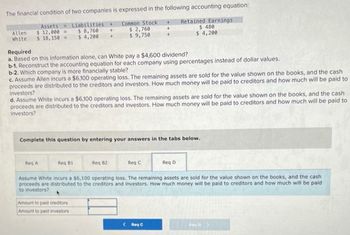

Transcribed Image Text:The financial condition of two companies is expressed in the following accounting equation:

Assets

$12,000=

Liabilities +

$8,760 +

Allen

White $18, 150

Common Stock +

$ 2,760

$ 9,750

Retained Earnings

$ 480

$ 4,200

$ 4,200 +

Required

a. Based on this information alone, can White pay a $4,600 dividend?

b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values.

b-2. Which company is more financially stable?

c. Assume Allen incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

investors?

d. Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

investors?

Complete this question by entering your answers in the tabs below.

Red A

Req B1

Req B2

Req C

Reg D

Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid

to investors?

Amount to paid creditors

Amount to paid investors

<Req C

Reyd

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Define Profi t and loss (P&L) statementarrow_forwardFans Company has two service departments-product design and engineering support, and two production departments - assembly and finishing. The distribution of each service department's efforts to the other departments is shown below: Design SERVICE DEPARTMENT Product Design 0% Engineering Support 20% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Product Design Engineering Support Assembly Finishing Multiple Choice $1,863,265 SERVICES PROVIDED TO Support 10% 0% $623,878 $1,036,122 Assembly 30% 45% $100,000 $ 200,000 $540,000 $ 820,000 The total cost accumulated in the assembly department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) Finishing 60% 35% Darrow_forwardCompare the Mutually Exclusive Alternatives, based on IRR?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education