Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

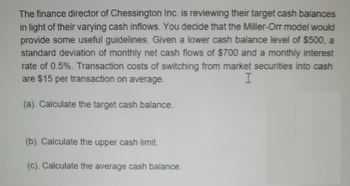

Transcribed Image Text:The finance director of Chessington Inc. is reviewing their target cash balances

in light of their varying cash inflows. You decide that the Miller-Orr model would

provide some useful guidelines. Given a lower cash balance level of $500, a

standard deviation of monthly net cash flows of $700 and a monthly interest

rate of 0.5%. Transaction costs of switching from market securities into cash

are $15 per transaction on average.

I

(a). Calculate the target cash balance.

(b). Calculate the upper cash limit.

(c). Calculate the average cash balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardGarage, Inc., has identified the following two mutually exclusive projects. a. What is the IRR for each project? b. If the required return is 11 percent, what is the NPV for each project? c. What is the crossover rate between these two projects? Year 0 Year 1 Year 2 Year 3 Year 4 Required return SSSSS A (43,500) 21,400 18,500 13,800 7,600 $ ESSASALA $ $ $ $ B (43,500) 6,400 14,700 22,800 25,200 11% Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question.arrow_forwardWebster provides the following information regarding its actual and future sales: February March April January Actual May Actual Forecast Forecast Forecast Cash Sales $ 50,000 $ 80,000 $ 90,000 $ 100,000 $ 120,000 Credit Sales 80,000 $ 12,000 $ 90,000 $ 40,000 $ 60,000 Management expects that 40% of credit sales are collected in the month of the sale. 40% are collected in the month after the month of sale. 20% are collected in the month following. na memo to your team (who are preparing the budgets), management also provides the following information: - The company has an obligation to repay $120,000 in debt in April. There is no debt to be repayed in the other months - Cost of sales is 50% of sales revenue. - The company has regular deliveries of inventory to ensure that it can continue to meet its customer obligations. Inventory deliveries are paid in the following month and expected to be equal to 60% of sales in the delivery month. - Salaries and wage expenses add up to $10,000 per…arrow_forward

- Answer true of false to each of the following. briefly explain your reasoning for each answer a. All else equal, increasing the projected amount of accounts receivable in a financial forecast will increase external funding required. b. Estimates of external funding required based on cash flow forecasts are usually higher than estimates based on pro forma financial statements. c. An annual financial forecast for 2018 showing no external funding required assures a company that no cash shortfalls are likely to occur during 2018.arrow_forwardFind the present values of the following cash flow streams. The appropriate interest rate is 9%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $200 2 400 400 3 400 400 4 400 400 5 200 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A $ Stream B $arrow_forwardUneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 12%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $250 2 400 400 3 400 400 4 400 400 5 250 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream…arrow_forward

- Find the present values of the following cash flow streams. The appropriate interest rate is 6%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $250 2 400 400 3 400 400 4 400 400 5 250 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A $ Stream B $arrow_forwardQ1-1 What risks are present if you take too long to col- lect our accounts receivable? Q1-2. What are some analyses you could perform that would provide insight into how efficiently your company is collecting cash from customers? Are there any KPIS that would be appropriate here? Q1-3. In your opinion, what would be an appropriate benchmark for the average number of days sales outstanding (i.e., Accounts receivable/Sales x 365)? Would management want this number higher or lower?arrow_forwardNow that Hurd has more specifically located the source of the economic exposure, Unit B, it is considering ways to hedge this exposure. Since Unit B finances some of its operations, one idea being considered by Hurd management is a change the financial structure of Unit B to a mix of financing in dollars and financing in pounds. Note: Assume the interest rate on pounds is approximately equal to the interest rate on dollars. Career Success Tips ates, Unit B will need revenue of Unit B. TOTAL SCORE: 2/3 more fewer dollars for loan payments, which would partially offset the effect of this appreciation on the Grade Final Steparrow_forward

- Uneven Cash Flow Stream a. Find the present values of the following cash flow streams. The appropriate interest rate is 9%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF, = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year 1 2 3 4 5 Stream A: $ Stream A $ Cash Stream A $100 400 400 400 200 Stream B: $ b. What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream B $ Cash Stream B $200 400 400 400 100 1 ((1 K A+arrow_forwardThe company A manages cash by using Baumol model for defining the amount of cash. According to the Baumol model the average model the average balance (C */2) is equal to 500$. That moment the negotiable securities yield was 4%. A steep rise caused an increase in interest rates to 9%. Which is the new average cash balance?arrow_forwardSuppose that the First United Bank of America has two loans. Each is due to be repaid one period hence and has independent and identically distributed cash flows. Each loan will repay $300 with a probability of 0.8 and $150 with a probability of 0.2. However, while the bank knows this, the investors cannot distinguish this loan from that of the Third TransAmerica Bank, which has the same number of loans, but will pay $300 with a probability of 0.5 and $150 with a probability of 0.5. There is a prior belief of 0.5 that the First United Bank of America has the higher-valued portfolio. Suppose that the First United wished to securitize these loans, and if it does so without a credit enhancement, the cost of communicating the true value is 7.5% of the true value. Assume that the discount rate is zero and that everybody is risk-neutral. Consider the following securitization scenario. The First United can create two classes of bondholders in a senior- subordinated structure or junior-senior…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education