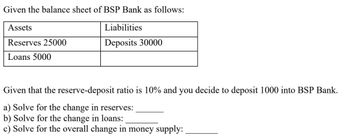

Please xplain why the answer is this:

a) 0.1 * 1000 = 100

b) 1000-100 = 900

c) Let CU be currency in circulation

Old MS = CU + R*[1/reserve deposit ratio] = CU + existing created deposits = CU + 30000

New MS after deposit = [CU – 1000] + [existing created deposits] + [newly created deposits]

= [CU -1000] + [30000] + [1000*1/0.1]

Difference = -1000 + [1000/0.1] = 9000

a) 0.1 * 1000 = 100

b) 1000-100 = 900

c) Let CU be currency in circulation

Old MS = CU + R*[1/reserve deposit ratio] = CU + existing created deposits = CU + 30000

New MS after deposit = [CU – 1000] + [existing created deposits] + [newly created deposits]

= [CU -1000] + [30000] + [1000*1/0.1]

Difference = -1000 + [1000/0.1] = 9000

Step by stepSolved in 3 steps with 1 images

The final answer should have been 9000 as:

c) Let CU be currency in circulation

Old MS = CU + R*[1/reserve deposit ratio] = CU + existing created deposits = CU + 30000

New MS after deposit = [CU – 1000] + [existing created deposits] + [newly created deposits]

= [CU -1000] + [30000] + [1000*1/0.1]

Difference = -1000 + [1000/0.1] = 9000

Why is this so?

The final answer should have been 9000 as:

c) Let CU be currency in circulation

Old MS = CU + R*[1/reserve deposit ratio] = CU + existing created deposits = CU + 30000

New MS after deposit = [CU – 1000] + [existing created deposits] + [newly created deposits]

= [CU -1000] + [30000] + [1000*1/0.1]

Difference = -1000 + [1000/0.1] = 9000

Why is this so?

- Suppose First National Bank holds $100 million in assets with an average duration of 4 years, and it holds $85 million in liabilities with an average duration of 2 years. Further suppose there is a 4-percentage-point increase in interest rates. Calculate the percentage decrease in First National Bank's net worth relative to the total original asset value. A 4-percentage-point increase in interest rates decreases First National Bank's net worth by % of the total original asset value. (Round your response to two decimal places.)arrow_forward(a) In this case, Cunneen thinks that the RBA wants to [maintain] the value of the Australian dollar. (b) If the RBA wanted to reduce the value of the Australian dollar, it would need to [reduce] Australian interest rates. (c) If the RBA’s strategy was to increase the value of the Australian dollar, it would have taken steps to cause [less] capital to flow into Australian financial markets. (d) A strategy of reducing the value of the Australian dollar via conventional monetary policy would be [more, less, just as] difficult, if interest rates overseas were to rise. (e) Were the RBA to want the value of the Australian dollar to be higher, they would need the demand curve for the Australian dollar in the FX market to [shift to the right, shift to the left, not shift at all] . (f) Were the RBA to want the value of the Australian dollar to be lower, they would need the supply curve for the Australian dollar in the FX market to [shift to the right,…arrow_forwardAssume that the currency-deposit ratio is 0.5, the required reserve ratio is 0.1, and the excess reserves to deposit ratio is 0.15. If the monetary base is $2 trillion, fınd (a) the amount of currency in circulation in billions of dollars (b) required reserves in billions of dollars (c) excess reserves in billions of dollars.arrow_forward

- 9. How would you incorporate security considerations/costs into the transactions demand model? What would this imply for the demand for currency in a relatively insecure urban environment (a) compared with a relatively safe one, (b) when owner-identified smart cards become available? Do these factors affect the demand for demand deposits? How would the proportion of currency to demand deposits be affected in these cases? 10. Can the transactions demand model be used to explain why financial innovations in recent decades have reduced the transactions demand for M1? 11. Are transactions demand models useless, as Sprenkle (1969) argued? If they are, how would you explain the demand for M1 or just for demand deposits in the economy?arrow_forwardLet us assume that a capitalist employs a worker for the production of bags for ladies. Production of one bag requires 12 hours of direct labor. Capitalist provides tools for production of bags. The direct labor content (equivalent) of these tools to produce one bag is 20 hours. Let us also assume that one hour of direct labor in that country is worth one schilling ( schilling is the national money of that country) Given these a) What will be the value of one bag (in schillings) in that country? b) What is the justified share (in schillings) of the capitalist (according to Marx) from the sale of one bag. c) If capitalist pays only 0.5 schillings per hour to the worker; what will be the surplus value and the capitalist for one bag?arrow_forwardThe final answer should have been 9000 as: c) Let CU be currency in circulation Old MS = CU + R*[1/reserve deposit ratio] = CU + existing created deposits = CU + 30000 New MS after deposit = [CU – 1000] + [existing created deposits] + [newly created deposits] = [CU -1000] + [30000] + [1000*1/0.1] Difference = -1000 + [1000/0.1] = 9000Why is this so?arrow_forward

- Bank credit creation is seen by Werner as a reason for the Japanese economic boom in the 80’s and subsequent collapse in the 90’s, and generally boom bust cycles occur, because, (a) Banks were merely intermediaries, taking deposits and giving loans, causing the rise and fall. (b) “Good” debt from asset lending allowed banks to lend to the real sector increasing nominal GDP, when asset prices fell, the “bad” debt caused banks to withdraw credit to the real sector causing a recession. (c) Banks lent heavily to assets, causing asset prices to rise and then withdrew credit from assets causing a collapse (d) Both (b) and (c) (e) All of the abovearrow_forwardI need help soon as possiblearrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education