ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

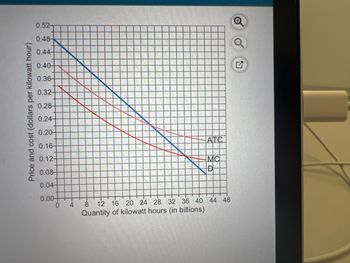

The figure to the right shows the market demand for electricity and the average total cost and marginal cost of producing electricity for a utility company.

Suppose the utility company is a regulated natural monopoly . If government regulators want to achieve economic efficiency, then they will regulate a price of $ —— per kilowatt hour. (Enter a numeric response using a real number rounded to two decimal places.)

Transcribed Image Text:Price and cost (dollars per kilowatt hour)

0.52-

0.48-

0.44-

0.40-

0.36-

0.32+

0.28

0.24-

0.20

0.16-

0.12-

0.08-

0.04-

0.00+

0

4

ATC

MC

D

8 12 16 20 24 28 32 36 40 44 48

Quantity of kilowatt hours (in billions)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- am. 122.arrow_forwardWhat are the four most important ways a firm becomes a monopoly? Will a monopoly that maximizes profit also be maximizing revenue? Will it be maximizing output? Explain. Assume the graph below represents the market for a monopolist. What quantity will the monopolist produce, and what price will she charge? What will her total revenue, costs, and profit be at this production level? What will the deadweight loss for society be at this level of production? (Assume the MC curve is a straight line between the relevant points for this calculation.)arrow_forwardAssume that Hydro One is the sole electricity distributor in Ontario, i.e. the market for distributing electricity is an actual monopoly. The demand of electricity is given by P 250,000 – 3Q where Q the quantity is measured in Gigawatt-hour (GWh). The price is measured in dollars per GWh. The total cost of Hydro One is given by: Cost = 100 Q? + 90,000Q + 1,500,000,000 a. Distinguish between natural and legal monopolies. Is Hydro One legal or natural monopoly? Explain your answer. b. Draw the marginal revenue curve for Hydro One. c. Determine the profit maximizing level of output for Hydro One. d. What is the selling price of electricity that Hydro One should charge? Compute its profit at this price. Can Hydro One sustain this profit over long term? e. Compute the deadweight loss resulting from the monopoly.arrow_forward

- To answer this question, you will want to work out the answer using a graph on a piece of scratch paper (not turned in). You are going to compare the outcomes in the case where there is perfect competition to the monopoly case. So, as an intermediate step, you will need to compute the equilibrium outcomes under competition and monopoly. Suppose that you have the following information about the demand for oil. Price ($/barrel) 80 70 60 50 40 30 20 10 Suppose that the marginal cost to produce a barrel of oil is $20. What is the deadweight loss if the oil market is a monopoly? Quantity demanded(# barrels) 5 6 7 8 9 10 11 12arrow_forwardQuestion a)monopoly faces a demand curve: D(p)=200-p. MC-10, FC= 100. Calculate the profit- maximaizing quantity and answer the following questions: P= CS= PS= TR= Marginal revenue function: MR= Inverse demand function: P= profit= TC= SW(Social welfare)= Optimal quantity: Q= Find the values for the above quantities using the following set of options: 9900 100 1900 90 4050 20 200-Q 110 200-20 8000 8100 12150 180 b) The average cost function of a competitive firm is AC= 3/Q+ 2+ 3*Q The optimal quantity is: 2 How much is the profit? c) The marginal utility of x is 100-14x, and that of y is 200- Ay. The price of x is 1, the price of y is 2, the income of the consumer is 100. How many of y is there in the optimal basket?arrow_forwardYou own a road resurfacing business called Dahyun Bricks services located in Seoul. You are the only reservicing business in South Korea. Therefore, you have a local monopoly. Your experience running the company for many years has taught you that market demand for your service can be described by the demand function: p = 20 - Q. The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes your production. Of course, if you are the only supplier than q = Q. a) Compute profit maximising price and output. Compute profits. b) The monopoly profit that you have been earning has attracted attention from another firm that will set up operations in South Koreaand compete for market share. You are concerned with losing market share and profit. So, you offer the potential entrant the following deal. Both firms agree to maximise industry profits (joint profits). The potential entrant…arrow_forward

- Suppose you have been tasked with regulating a single monopoly firm that sells 50-pound bags of concrete. The firm has fixed costs of $30 million per year and a variable cost of $6 per bag no matter how many bags are produced. Instructions: Enter your answers as a whole number. In part e, round your answer to two decimal places. a. If this firm keeps increasing its output level, will ATC per bag ever increase? (Click to select) ♥ Is this a decreasing-cost industry? (Click to select) ♥ b. If you wished to regulate this monopoly by charging the socially optimal price, what price would you charge? $ per bag At that price, the size of the firm's (Click to select) would be $ million. Will the firm want to exit the industry? (Click to select) V c. You find out that if you set the price at $7 per bag, consumers will demand 30 million bags. At that price, the firm's profit or loss will be $ million. d. If consumers instead demanded 40 million bags at a price of $7, how big would the firm's…arrow_forwardIn 2009, Detroit, Michigan experienced an aggressive recession as compared to the rest of country. With unemployment rates topping 15%, the city was faced with many challenges financially, economically, and socially. In addition to the financial challenges, the city was also experiencing political instability and corruption. Various major city officials were being investigated for fraud, bribery, and other criminal charges. Spirit Electric, operating as a natural monopoly, was the only company in the area providing electric services to Detroit households. Like many other companies, it was experiencing financial difficulties and could no longer continue without some intervention. This was mainly due to high operating costs, foreclosures in the area, and the fact that many households were not paying their bills. As a result, Spirit Electric came to a standstill in the latter part of 2009. Matt Green, Spirit Electric CEO, gathered the Board of Directors and determined that the company…arrow_forwardplease help and if it's on paper please please write in a way that is understandable!arrow_forward

- Answer everything in the photo please.arrow_forwardConsider a price discriminating monopoly facing the demand equations and total cost equation below. Market 1: Q1 = 150 – ½P1 Market 2: Q2 = 200 – P2 Total Cost: TC = 100 + 10Q; where Q = Q1 + Q2 a. Calculate for the firms profit and graphically illustrate the resultsb. Calculate and discuss what happens to output, price and profit if the monopoly was unable to maintain the separation between the two marketsarrow_forwardSuppose a certain city has a monopoly cable-television company. This company has total costs TC = Q2 + 10Q + 75. (Hint: using calculus, this means MC = 2Q + 10 since MC is the derivative of TC with respect to output.) The demand in the community is approximated by the equation Qd = 85 - P/2 (alternatively, you can write the demand equation as Qd = 85 – 0.5P). Graphically depict the demand curve as well as the marginal cost (MC) curve. If the cable company is free to choose its own price Pm and quantity Qm, graphically depict the monopoly equilibrium price and quantity. Add any other curve(s) to your diagram that may be required to obtain this outcome. Compute and state the exact monopolist equilibrium price Pm and quantity Qm that you depicted graphically.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education