FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

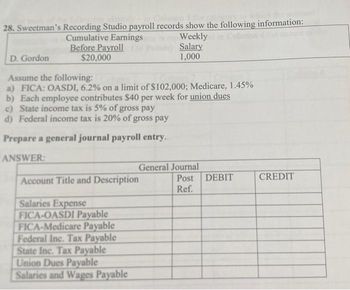

Transcribed Image Text:28. Sweetman's Recording Studio payroll records show the following information:

Cumulative Earnings

Weekly

na

Salary

Before Payroll

$20,000

D. Gordon

1,000

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $102,000; Medicare, 1.45%

b) Each employee contributes $40 per week for union dues

c) State income tax is 5% of gross pay

d) Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

ANSWER:

Account Title and Description

DEBIT

Salaries Expense

FICA-OASDI Payable

FICA-Medicare Payable

Federal Inc. Tax Payable

State Inc. Tax Payable

Union Dues Payable

Salaries and Wages Payable

General Journal

Post

Ref.

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute Payroll An employee earns $32 per hour and 1.75 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and federal income tax to be withheld was $552. a. Determine the gross pay for the week. b. Determine the net pay for the week. Round your answer to two decimal places.arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay General Journal The employee’s federal income taxes withheld by the employer are $70 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee.Note: Round your answers to 2 decimal places. Taxes to be Withheld From Gross Pay (Employee-Paid Taxes) September Earnings Subject to Tax Tax Rate Tax Amount Federal income tax $70.00 Prepare the employer's September 30…arrow_forwardRequired information [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $127,200 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 3.1% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Gross Pay through August 31 $ 6,400 Gross Pay for September 800 а. b. 2,000 120,900 2,100 8,000 C. ssuming situation a, prepare the employer's September 30 journal entries to record salary expense and its related payroll liabiliti this employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. Employee Paid Таxes General Journal Assuming situation a, calculate the employee-paid taxes. The employee's federal income taxes withheld by the employer are $80 for this pay period. (Round your answers to 2 decimal places.) Taxes to be Withheld…arrow_forward

- An employee earns $44 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 60 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $708. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week.arrow_forwardAn employee earns $20 per hour and 1.75 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 50 hours during the week. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and federal income tax to be withheld was $265. a. Determine the gross pay for the week.$fill in the blank 1 b. Determine the net pay for the week. Round your answer to two decimal places.$fill in the blank 2arrow_forwardDixon Sales has six employees that receive weekly paychecks. Each employee earns $14.00 per hour and has worked 40 hours in the pay period. Total federal income tax withholdings are $403.20. Each employee pays 3.0% in state income tax, 6.0%% in Social Security tax, 1.5% in Medicare tax, and 0.5% toward retirement savings. Journalize the recognition of the pay period ending January 19 that will be paid to the employees on January 26 using the chart of accounts below. Medicare Tax Payable Payroll Tax Expense Payroll Tax Payable Sales Wages Expense Sales Wages Payable Social Security Tax Expense Cash Employees Federal Income Tax Expense Employees Federal Income Tax Payable Social Security Tax Payable mployees State Income Tax Expense Prepaid Payroll Taxes Unearned Sales Wages nployees State Income Tax Payable edicare Tax Expense Retirement Savings Payable Sales er your answers into the table below. the account names carefully (exactly as shown above) and follow formatting instructions…arrow_forward

- An employee receives an hourly rate of $25.00, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 42; federal income tax withheld, $281.00; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $769.00 $1,075.00 $688.38 $713.38arrow_forwardAn employee receives an hourly rate of $17, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 49; federal income tax withheld, $80; state income tax withheld is $22; social security tax rate, 6.2%; and Medicare tax rate, 1.45%. What is the net amount to be paid to the employee? Multiple Choice ) $737.92 $680.00 $909.50 $171.58arrow_forwardCalculate Payroll Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $3,210 per week $32 per hour $42 per hour Overtime earnings rate Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances 3 2 1 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal…arrow_forward

- 1/2 items. Calculate Pro Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Gross pay Net pay Consultant $2,510 per week Not applicable Regular earnings rate Overtime earnings rate. Number of withholding allowances 3 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheid for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Check My Work Computer Programmer $32 per hour 2,510 Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your…arrow_forwardTake me to the text An employee had $24,300 in gross earnings up to February 20, 2021. She has the following information for her pay for the week ending February 27, 2021. Her employer contributes 100% toward CPP and 140 % toward El. Vacation pay is accrued at 4% of gross pay. Workers' Compensation is 1% of gross pay. Item Amount Hours 36 Hourly Rate $16.20 Income Tax $116.64 Canada Pension Plan $28.12 Employment Insurance $9.21 Union Dues $10.00 Charitable Donations $20.00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order.arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,700 $ 400 b. 2,300 2,400 c. 131,700 8,300 Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education