FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer complete question,,,answer in text form please (without image)

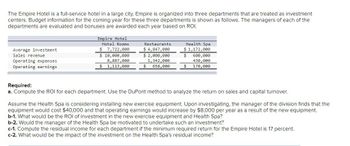

Transcribed Image Text:The Empire Hotel is a full-service hotel in a large city. Empire is organized into three departments that are treated as investment centers. Budget information for the coming year for these three departments is shown as follows. The managers of each of the departments are evaluated and bonuses are awarded each year based on ROI.

| Empire Hotel | Hotel Rooms | Restaurants | Health Spa |

|---------------------|---------------|----------------|---------------|

| **Average investment** | $ 7,722,000 | $ 4,847,000 | $ 1,172,000 |

| **Sales revenue** | $ 10,000,000 | $ 2,000,000 | $ 600,000 |

| **Operating expenses** | 8,887,000 | 1,342,000 | 430,000 |

| **Operating earnings** | $ 1,113,000 | $ 658,000 | $ 170,000 |

**Required:**

a. Compute the ROI for each department. Use the DuPont method to analyze the return on sales and capital turnover.

Assume the Health Spa is considering installing new exercise equipment. Upon investigating, the manager of the division finds that the equipment would cost $40,000 and that operating earnings would increase by $8,000 per year as a result of the new equipment.

b-1. What would be the ROI of investment in the new exercise equipment and Health Spa?

b-2. Would the manager of the Health Spa be motivated to undertake such an investment?

c-1. Compute the residual income for each department if the minimum required return for the Empire Hotel is 17 percent.

c-2. What would be the impact of the investment on the Health Spa's residual income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jasmine Thompson AutoSave Document4 Word O Search B Share Comment File Insert Draw Design Layout References Mailings Review View Help Home O Find X Cut Calibri (Body) A A Aa A EE v E EE T AaBbCcDd AaBbCcDd AaBbC AABBCCC AaB AaBbCcD AaBbCcDd AaBbCcDd v 12 S Replace Dictate Editor Copy Paste Emphasis BIU ab x, x' A ~ A EEEE E - 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select V Format Painter Styles Editing Voice Editor Clipboard Font Paragraph 3 4 5. 6. 1 2. In Year 2, Chalon Company records the payment of $450 cash for an expense accrued in Year 1 and records the accrual of $425 for another expense. Additionally, Chalon Company pays $475 for supplies that were purchased in Year 1 on account. The impact of these three entries on Year 2 total expenses and total liabilities is: Total Expenses Liabilities a. increase by $425 decrease by $500 b. increase by $450 decrease by $25 c. increase by $425 increase by $25 d. increase by $900 decrease by $500 e. increase…arrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardHow do I fill out the chart?arrow_forward

- Please answer questions correctlyarrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forwardSafari File Edit View History Bookmarks Window Help uLink - Student... W 1. 2. uLink - Student... 3. 4. learn-eu-central-1-prod-fleet01-xythos.content.blackboardcdn.com uLink - Student... 21 445 Entity A enters into the following transactions. You are required to show the impact of the transactions below on the accounting equation. e Content 9 Bb https://learn-eu-... Entity A purchased 1 000 bags of cement from K Ltd on credit. K Ltd normally sells a bag for R45. Entity A received a 10% discount for the 1 000 bags. Entity A returned 150 bags of cement, as they were defective. On the same day, the outstanding balance was settled through an online payment. This transaction did not affect the discount offered to Entity A. Select the correct values from the dropdown menus in the table provided in the Blackboard activity. MAR 7 In an attempt to assist the business, the owner of Entity A deposited R100 000 into the entity's bank account. A quarter of the amount is payable to the owner and…arrow_forward

- ne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forwardTopic: Uni X U2_AS i Topic: Uni X M Question X M Question x M Question √x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 253A%252F%252Flms.mheducation.com%252Fmghmiddle Complete this question by entering your answers in the tabs below. Required 1 Required 2 F2 Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,600 cash. It originally bought the machine for $21,400 three years ago and has taken $8,000 in depreciation. b. Moab Incorporated held stock in ABC Corporation, which had a value of $23,000 at the beginning of the year. That same stock had a value of $26,230 at the end of the year. c. Moab Incorporated sold some of its inventory for $9,200…arrow_forwardAny help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education