ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

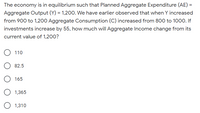

Transcribed Image Text:The economy is in equilibrium such that Planned Aggregate Expenditure (AE) =

Aggregate Output (Y) = 1,200. We have earlier observed that when Y increased

from 900 to 1,200 Aggregate Consumption (C) increased from 800 to 1000. If

investments increase by 55, how much will Aggregate Income change from its

current value of 1,200?

110

82.5

165

1,365

1,310

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ADVANCED ANALYSIS Suppose that the linear equation for consumption in a hypothetical economy is C = 60 + 0.75Y. Also suppose that income (Y) is $600. Determine the following values: Instructions: For parts a, b, d, and f, round your answers to 2 decimal places if necessary. For parts c and e, enter your answers as a whole number. a. MPC = b. MPS = c. Level of consumption = $ d. APC = e. Level of saving = $ f. APS =arrow_forwardAggregate planned expenditure (trillions of 2009 dollars) 7 1 45° line AE2 AEO 2a) b) plan in th B A AE1 3a) 15 3 4 14 0 14 15 16 17 18 19 Real GDP (trillions of 2009 dollars) In the above figure the economy is initially at point A on the aggregate expenditure curve AEQ. Suppose investment decreases. As a result the AE curve shifts upward to a curve such as AE2. the AE curve shifts downward to a curve such as AE1. O there is a movement along AEO to a point such as B. O there is a movement along AEO to a point such as C. 5 6 7 81 90 100 109 b) T c) T d) It e) $1arrow_forwardIf aggregate expenditure is greater than real GDP, we could expect which of the following toarrow_forward

- 11:04 AM ECON 122 CAT ONE.docX Phoenix Files QUESTION ONE Is it desirable for a country to have a large gross domestic product? Explain (2 marks) QUESTION TWO You are given data on the following variables in an economy Government spending 300 Planned investment Net exports Autonomous taxes Income tax rate Marginal propensity to consume 0.5 a) Consumption (C) is 600 when income (Y) is equal to 1500. Solve for autonom ous consumption (2 ma rks) ii) 200 S 50 b) Solve for the equilibrium level of output in the following two scenarios: i) There is an income tax t=0.1, Edit 0.1 250 Q Search © | 46| 472 [ 66 c) In the economy with an income tax of 10%, what is the budget balance of the government? (2 marks) O X: × There is no income tax in the economy. Denote these two variables by Yw and YN respectively. (4 marks) d) Solve for the change in net exports that would bring the equilibrium output lev el in the economy with the income tax to the level of YN that you found in part b. specify both…arrow_forwardClassify each of the following items as a final good or an intermediate good, and identify whether it is a component of consumption expenditure, investment, or government expenditure on goods and services: Item 1. Packing boxes bought by Amazon.com. Item 2. Starbuck's grande mocha frappuccino bought by a student. Item 3. A new limousine for the president. Item 4. New airplanes bought by United Airlines. Item 1 is and item 2 is O A. an intermediate good; a final good that is consumption expenditure B. a final good that is consumption expenditure; a final good that is consumption expenditure C. a final good that is consumption expenditure; a final good that is investment D. an intermediate good; a final good that is investment Item 3 is and item 4 is O A. an intermediate good; an intermediate good O B. a final good that is government expenditure; a final good that is investment O C. an intermediate good; a final good that is investment D. a final good that is government expenditure; an…arrow_forwardUse the initial settings (or any other non-zero value) for the Change in Autonomous Spending and MPC. Click the "Spending Rounds" button at the top of the Settings window. Which of the following describes how the Change in Spending value in each row is related to the Disposable Income value in the same row? O In each row, Change in Spending is Disposable Income minus MPC*(Change in Autonomous Spending). Change in Spending in each row is MPC x Disposable Income for that row. O Change in Spending is always half of Disposable Income. O Change in Spending is Disposable Income times the spending multiplier.arrow_forward

- The table below shows disposable income and desired consumption for a hypothetical economy. Disposable income ($) 0 100 200 Select one: The marginal propensity to consume out of an increase in disposable income from $0 to $100 is. a. 0.75 b. 0.25 OC. 0.80 Consumption ($) d. 0.35 100 175 250 cross out cross out cross out cross outarrow_forwardFill in the aggregate saving column in the following table. (Include a minus sign if necessary.) Aggregate Income, Y $0 100 200 300 400 500 600 Aggregate Consumption, C $200 250 300 350 400 450 500 The value of the MPC is one decimal place.) T Aggregate Saving, S $-200 150 100 50 0 50 100 (Round your response to CXIE DE Aggregate consumption, C Aggregate saving, S 700- 600- 500- 400 300- 200 100- 0 -100- -200- 300- -400- 100 200 300 400 500 Aggregate income, Y 600arrow_forwardIn the GDP equation, business spending is referred to as: O Consumption Investment O Government O Net Exportsarrow_forward

- If Michelle's income is reduced to zero after she loses her job, her consumption will be and her saving will be O greater than zero; greater than zero O less than zero; greater than zero O greater than zero; less than zero O less than zero; less than zeroarrow_forwardEconomicsarrow_forwardSuppose two successive levels of disposable personal income are $13.8 and $18.8 billion, respectively, and the change in consumption spending between these two levels of disposable personal income is $3.65 billion, then the MPS will be equal to O 0.25 O 0.27 O 0.35 O 0.65 O 0.73arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education