Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Don't use

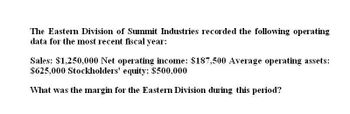

Transcribed Image Text:The Eastern Division of Summit Industries recorded the following operating

data for the most recent fiscal year:

Sales: $1,250,000 Net operating income: $187,500 Average operating assets:

$625,000 Stockholders' equity: $500,000

What was the margin for the Eastern Division during this period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forwardNeed help with this questionarrow_forward

- The following data are for the Akron Division of Consolidated Rubber, Incorporated: Sales $ 750,000 Net operating income $ 45,000 Average operating assets $ 250,000 Stockholders' equity $ 75,000 Residual income $ 15,000 For the past year, the minimum required rate of return wasarrow_forwardThe following data are for the Akron Division of Consolidated Rubber, Incorporated: Sales $ 750,000 Net operating income $ 45,000 Average operating assets $ 250,000 Stockholders' equity $ 75,000 Residual income $ 15,000 For the past year, the turnover used in ROI calculations wasarrow_forwardThe following data are for the Akron Division of Consolidated Rubber, Incorporated: Sales Net operating income Average operating assets Stockholders' equity Residual income For the past year, the minimum required rate of return was: Multiple Choice O O 22.07% 42.00% 7.04% $ 810,000 $ 57,000 $ 310,000 $ 81,000 $ 21,000 11.61%arrow_forward

- The following data are for the Akron Division of Consolidated Rubber, Incorporated: Sales Net operating income Average operating assets Stockholders' equity Residual income For the past year, the turnover used in ROI calculations was: Multiple Choice O 1.4 3.0 3.3 $750,000 $ 45,000 $ 250,000 $ 75,000 $ 15,000 10.0arrow_forwardAccounting Davis Corporation reported the following financial data for one of its divisions for the year; average assets of $540,000; sales of $1,140,000; and income of $133,000. The investment turnover is:arrow_forwardLouisville Inc. reported the following financial data for one of its divisions for the year; average invested assets of $560,000; sales of $1,020,000; and income of $123,420. The investment center profit margin is: Multiple Choice 182.1%. 22.0%. 12.1%. 54.9%. 453.7%.arrow_forward

- The Holmes Division recorded operating data as follows for the past year: Sales Operating Income Average Operating Assets Shareholders' Equity Residual Income $200,000 $ 25,000 $100,000 $ 80,000 $ 13,000 For the past year, what was the minimum required rate of return? A) B) C) D) 12%. 11%. 14%. 13%.arrow_forwardBaxter Industries reported the following financial data for one of its divisions for the year: • Average invested assets = $600,000 • Sales = $1,200,000 Income = $140,000 What is the investment turnover? a) 2.75 b) 3.40 c) 2.00 d) 4.25 e) 5.00arrow_forwardLousiville Inc. reported the following financial data for one of its divisions for the year; average invested assets of $490,000; sales of $990,000; and income of $113,000. The investment turnover is: Multiple Choice 2.02. 21.30. 433.60. 49.50. 11.40.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning