FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

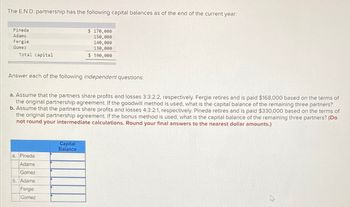

Transcribed Image Text:The E.N.D. partnership has the following capital balances as of the end of the current year:

Pineda

Adams

Fergie

Gomez

Total capital

Answer each of the following independent questions:

$ 170,000

150,000

140,000

130,000

$ 590,000

a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $168,000 based on the terms of

the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners?

b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $330,000 based on the terms of

the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do

not round your intermediate calculations. Round your final answers to the nearest dollar amounts.)

a. Pineda

Adams

Gomez

b. Adams

Fergie

Gomez

Capital

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The E.N.D. partnership has the following capital balances as of the end of the current year: Pineda Adams Fergie Gomez Total capital Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $270,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $350,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your Intermediate calculations. Round your final answers to the nearest dollar amounts.) a. Pineda Adams $ 300,000 260,000 230,000 210,000 $1,000,000 Gomez b. Adams Fergie Gomez Capital Balancearrow_forwardThe E.N.D. partnership has the following capital balances as of the end of the current year: $ 190,000 170,000 Pineda Adams Fergie 160,000 Gomez 150,000 Total capital $ 670,000 Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $203,000 based on the terms the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $290,000 based on the terms the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (D not round your intermediate calculations. Round your final answers to the nearest dollar amounts.) Capital Balance a. Pineda Adams Gomez b. Adams Fergie Gomezarrow_forwardJohn has a $24,000 basis in his partnership interest. He receives a current distribution of $4,000 cash, accounts receivable ($12,000 A/B. $16.000 FMV) and land ($3,000 A/B, $8.000 FMV) The basis of his partnership interest following the distribution is Selected Answer: Ⓒa. 50 Answers: 0.50 b. $5,000 c. $1,000 d. ($4,000) Darrow_forward

- The E.N.D. partnership has the following capital balances as of the end of the current year: $ 280,000 240,000 210,000 190,000 $ 920,000 Pineda Adams Fergie Gomez Total capital Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $262,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $305,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.) Capital Balance a. Pineda Adams Gomez b. Adams Fergie Gomezarrow_forwardThe E.N.D. partnership has the following capital balances as of the end of the current year: Pineda $ 270,000 Adams 240,000 Fergie 230,000 Gomez 220,000 Total capital $ 960,000 Answer each of the following independent questions: Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $269,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $355,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.)arrow_forwardMilton has a basis in his partnership of $300,000, including his $80,000 share of partnership liabilities. At the end of the current year the partnership pays off the liabilities and makes a proportionate current distribution to its partners. Milton receives a parcel of land (partnership basis of $120,000 and FMV of $135,000) and inventory (partnership basis of $160,000 and FMV of $180,000). Following the distribution what is Milton's basis in the inventory? I'm not sure if it's 160,000 or notarrow_forward

- es A partnership has the following capital balances: Artur, Capital Bella, Capital Callo, Capital $ 60,000 30,000 90,000 Profits and losses are split as follows: Artur (20%), Bella (30%), and Callo (50%). Callo wants to leave the partnership and is paid $100,000 from the business based on provisions in the articles of partnership. Required: Assuming the partnership uses the bonus method, compute the balance of Bella's capital account after Callo withdraws. Note: Amounts to be deducted should be indicated with minus sign. Bella's capital balance before withdrawal bonus to Callo Allocation of Callo's bonus Bella's capital balance after Callo's withdrawalarrow_forwardThe SSC, a cash-method partnership, has a balance sheet that includes the following assets on December 31 of the current year: Basis FMV $ 180,000 $ 180,000 0 Cash Accounts receivable 60,000 120,000 $ 270,000 $360,000 Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale? Group of answer choices $10,000 capital gain $10,000 ordinary income $20,000 ordinary income; $10,000 capital gain $10,000 capital loss; $20,000 ordinary income Land Total 90,000arrow_forwardThe E.N.D. partnership has the following capital balances as of the end of the current year: Pineda 160,000 Adams 140,000 Fergie 130,000 Gomez 120,000 Answer each A. Assume that the partners and losses 3:3:2:2,respectively. Fergie retires and is paid 151,000 based on the terms of the orginal partnership agreement. If the Goodwill method is used;what is the capital of the remaining three partners? B. Assume that the partners share profit and losses 4:3:2:1, respectively. Peneda retires and is paid 305,000 based on the terms of the orginal partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round intermediate calculations. Round to the nearest amounts. A. Pineda capital Balance__________ Adams capital Balance__________ Gomez capital Balance__________ B. Pineda capital Balance__________ Adams capital Balance__________ Gomez capital Balance__________arrow_forward

- Myles Etter and Crystal Santori are partners who share in the income equally and have capital balances of $199,800 and $62,680, respectively. Etter, with the consent of Santori, sells one-third of his interest to Lonnie Davis. Assume the sale occurs on December 31. What entry is required by the partnership if the sales price is (a) $66,600? (b) $87,700?arrow_forwardLiam, Michael and Noah own interests in the LMN Partnership. Their current capital account balances are as follows: Liam $450,000 Michael 350,000 Noah 200,000 Partnership income is shared in a 1:5:4 ratio. Olivia buys a 20% interest in the partnership by acquiring 20% of each existing partner's interest, paying the three partners a total of $300,000. Partnership identifiable net assets are currently reported at amounts approximating fair value. Using the recognition of implied goodwill approach, implied goodwill is: Select one: a. $500,000 b. $800,000 c. $300,000 d. $100,000arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education