FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

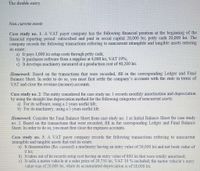

Transcribed Image Text:The double entry

Non-current assets

Case study no. 1: A VAT payer company has the following financial position at the beginning of the

financial reporting period: subscribed and paid in social capital 20,000 lei, petty cash 20,000 lei The

company records the following transactions referring to noncurrent intangible and tangible assets entering

its estate:

a) It pays 1,000 lei setup costs through petty cash;

b) It purchases software from a supplier at 4,000 lei, VAT 19%

c) It develops machinery measured at a production cost of 40,200 lei

Homework: Based on the transactions that were recorded, fill in the corresponding Ledger and Final

Balance Sheet. In order to do so, you must first settle the company's accounts with the state in terms of

VAT and close the revenue (income) accounts.

Case study no. 2: The entity considered for case study no. 1 records monthly amortisation and depreciation

by using the straight line depreciation method for the following categories of noncurrent assets:

a) For its software, using a 2 years useful life;

b) For its machinery, using a 5 years useful life.

Homework: Consider the Final Balance Sheet from case study no. 1 as Initial Balance Sheet for case study

no. 2. Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance

Sheet. In order to do so, you must first close the expenses accounts.

Case study no. 3: A VAT payer company records the following transactions referring to noncurrent

intangible and tangible assets that exit its estate:

a) It disassembles (Ro. casează) a machinery having an entry value of 36,000 lei and net book value of

0 lei,

b) It takes out of its records setup cost having an entry value of 800 lei that were totally amortised,

c) It sells a motor vehicle at a sales price of 29,750 lei, VAT 19 % included; the motor vehicle's entry

value was of 20,000 lei, while its accumulated depreciation is of 18,000 lei.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When I check my work it says that this is incomplete. Can you tell me what I have not done to complete this? Additional information: Purchase investment in bonds for $107,000 Sell land cost and $32,000 for only $23,800 resulting in a $8200 loss on sale of land Purchase $62,000 in equipment by issuing a $62,000 long-term note payable to the seller. No cash is exchanged in the transaction Declare and pay a cash dividend of $26,000 My final line in my statement of cash flow’s under the non-cash activities is purchase equipment issuing a note payable for $62,000. I couldn’t fit it in the photo.arrow_forwardPrepare the journal entry for the following transactions: (1) Geysler Company sold some old equipment that initially cost $30,000 and had $25,000 of accumulated depreciation and received cash in the amount of $2,000. (2) Assume the same facts except Geysler received $8,000. 1) general journal. desscrcription. debit. credit cash. ? ? accum. deprec. ? ? ? ? ? ? ? ? 2) general journal. desscrcription. debit. credit cash. ? ? ? ? ? ? ? ? equipment. ? ?arrow_forwardAbakada Incorporated acquired all the assets and liabilities of Egaha Company on January 1, 2018. The consideration are as follows: Cash Equipment Cash contingency Stock contingency Bank loan, at face value The cash payments are distributed to the following payees: Former owners of Egaha Company Lawyers for legal services Actuarial for valuation of Egaha's net assets Bank, transaction costs for the bank loan 2,000,000 500,000 30,000 50,000 1,000,000 Business Combination Page 4 of 5 1,800,000 80,000 50,000 70,000 Answer the following independent questions: 19. If the fair value of net assets of Egaha amounted to Php3,000,000, how much is the goodwill (bargain purchase gain) on business combination? 20. If bargain purchase gain on the acquisition amounted to Php40,000, how much could be the fair value of net assets acquired?arrow_forward

- Use the following table: Case X Case Y Case Z Cash $ 940 $ 1,470 $ 1,940 Short-term investments 0 0 780 Receivables 0 1,690 1,360 Inventory 3,400 1,560 6,520 Prepaid expenses 2,600 1,020 1,460 Total current assets $ 6,940 $ 5,740 $ 12,060 Current liabilities $ 3,600 $ 1,800 $ 5,750 Required:Calculate the quick ratio in each of the above cases and select the case which is in the best position to meet short-term obligations most easily. (Round your answers to 2 decimal places.)arrow_forwardThe following information on cash transactions were reported by FDNACCT Co.: Proceeds from bank loan = P420,000 Proceeds from sale of equipment = P45,000 Investment of owner = P25,000 Payment of operating expenses = P320,000 Purchase of equipment = P258,000 Payment of principal of Notes Payable = P45,000 How much is cash provided by (used in) Investing Activities? Enter as a negative number if the answer is used in Investing Activities.arrow_forwardOsco Ltd uses the allowance method of accounting for bad and doubtful debts. Bad and doubtful debts expense shown in the statement of financial performance is $10 000 and the amount of bad debts actually written off is $8 000. If sales are $220 000 and accounts receivable have increased by $12 000 over the period, the amount to be shown in the statement of cash flows for receipts from customers is: O $240 000 O $200 000 O $210 000 O $220 000arrow_forward

- A) Prepare Pronghorn's general journal entry for the cash purchase of Ivanhoe 's net assets. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. (ist all debit entries before credit entries.) B) Assume Pronghom Corporation purchased the net assets of Ivanhoe Corporation for$644,000rather than$584,000, prepare the generaljournal entry. (Credit occount titles are automaticolly indented when the amount is entered. Do not indent manuolly. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Please avoid solution image based thnksarrow_forwardData extracts from Dilley's accounts are shown below Ye-Dec-21 Ye-Dec-20 Non-current assets (nbv) 206,000 200,000 Plant Inventory Receivables Cash at Bank Total Assets Share Capital Reserves Long term loans Payables Taxation Interest Total Liabilities & Equity Operating Profits Interest Taxation Profit for the Year Notes: Annual depreciation charges were £20,000. There were no non-current asset disposals. Required: a) Prepare a statement of cashflows for Ye-Dec-21. b) Reconcile the annual movement in non-current assets. c) For Ye-Dec-21 calculate: Interest Cover Ratio, Current & Quick Asset ratios 85,000 74,000 150,000 120,000 46,000 15,000 487,000 409,000 210,000 210,000 77,000 70,000 92,000 32,000 95,000 89,000 8,000 5,000 5,000 3,000 487,000 409,000 50,000 -15,000 -10,000 25,000arrow_forwardDuncan Corp. purchased a building, paying part of the purchase price in cash and issuing a mortgage note payable to the seller for the balance. In a statement of cash flows, what amount is included in investing activities for the above transaction? a. the full purchase price b. the cash payment c. the amount mortgaged d. zero (but disclosed in the notes)arrow_forward

- On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: Please see the attachment for details:arrow_forwardRainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statement Date Statement of Cash Flow Liabilities Notes Receivable Interest Retained Earnings Cash Receivable Revenue Expense Net Income 1.6/1/Y1 2. 1201/Y1 a. 6/1/Y2 (Adjusting entry) 6/1/Y2…arrow_forwardThe following information is available for Davis Company and Bender Inc.: Account Cash Cash equivalents Current notes receivable Accounts receivable Prepaid expenses Inventory Fixed assets Accumulated depreciation-Fixed assets Accounts payable Current accrued liabilities Mortgage payable Equity Total Davis Company Dr. $321 88 56 603 55 714 920 $2,757 Davis Company Cr. $415 260 213 917 952 $2,757 Bender Inc. Dr. $425 95 46 307 85 898 755 $2,611 a. Compute the quick ratio for each company. Round ratios to two decimal places. Bender Inc. Cr. $225 198 149 824 1,215 $2,611arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education