ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:7 Assignment - ECN204 021 - Introductory Macroeconomics - W2023

Chapter 17 Assignment

1

02:45:27

Mc

Graw

Hill

<

Price

>

0

P+ Tariff QsTariff

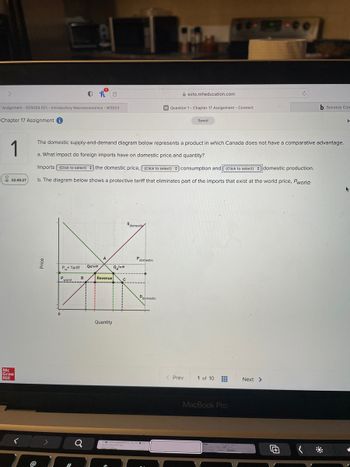

The domestic supply-and-demand diagram below represents a product in which Canada does not have a comparative advantage.

a. What impact do foreign imports have on domestic price and quantity?

Imports (Click to select) the domestic price, (Click to select) consumption and (Click to select)

domestic production.

b. The diagram below shows a protective tariff that eliminates part of the imports that exist at the world price, Pworld-

P.

world

#

B

a

A

0

Revenue

Quantity

QTariff

$domestic

Pdomestic

Ddomestic

ezto.mheducation.com

M Question 1- Chapter 17 Assignment - Connect

< Prev

Saved

1 of 10

MacBook Pro

d

Next >

b Success Con

4+1

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Refer to the diagram below, where Sd and Dd are the domestic supply and demand for a product, Pt is the domestic price with a tariff, and Pc is the world price of that product. Open this image in a program or approximate this drawing on paper and color in the area that represents gains from trade if no trade barriers exist.arrow_forwardThe graph below shows the effects of restricting trade. Match the right with the left side correctly: Domestic Demand supply Domestic supply + imports 1 PNO Trade P Trade 2 с 45 A 3 Q Qs Q Qd Consumer surplus with NO TRADE [ Choose ] Producer surplus with NO TRADE [ Choose ] Consumer surplus WITH TRADE [ Choose ] Producer surplus WITH TRADE [ Choose ] DWL with NO TRADE [ Choose ] > > > > Barrow_forwardSuppose the free trade market price of a car is $10,000. It contains $5000 worth of steel. The importing country imposes 25% tariff on car imports. a. Calculate the effective rate of protection if there is no duty on steel imports. b. Calculate the effective rate of protection if the importing country imposes a 20% tariff on steel imports. c. Suppose it also takes $2000 worth of copper (besides $5000 worth of steel) to produce a car. Calculate the effective rate of protection if there is no import tariff on the imports of either steel or copper. d. Suppose there is an import duty of 20% and 15% on imports of steel and copper, respectively. Calculate the effective tariff rate.arrow_forward

- Discuss how imposing tariffs on imports ultimately harm US consumers. Elaborate on how producer and consumer surpluses are affected.arrow_forwardConsider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forwardA small country imports T-shirts. With free trade at a world price of $10, domestic production is 10 million T-shirts and domestic consumption is 42 million T-shirts. The country's government now decides to impose a quota to limit T-shirt imports to 20 million per year. With the import quota in place, the domestic price rises to $12 per T- shirt and domestic production rises to 15 million T-shirts per year. The quota on T- shirts causes domestic consumers to A) gain $7 million. B) lose $7 million. C) lose $70 million. D) lose $77 millionarrow_forward

- Economics Questionarrow_forwardWhen a government imposes a tariff on a product, the domestic price will equal the world price. a. True b. Falsearrow_forward12. If the free trade price is lIP and this country imposes a trade tariff of $3, what will be the resulting net welfare loss to the economy? a)$3 b)$27 C)$13.5 d)$40.5 e)$9 13. if the free trade price is IP and this country imposes an import quota of 6 units, what will be the welfare loss to this economy? a)$3 b)$27 c)$13.5 d)$40.5 e)$18arrow_forward

- When the United states puts tariffs on imports, who do you think ultimately pays these tariffs? Is it the foreign companies selling here, American consumers, or both?arrow_forwardTrade, tariffs, and protectionism. a) Explain, with aid of a diagram, the welfare effects of a tariff on the importing country.arrow_forwardAssume that Canada is an importer of televisions and that there are no trade restrictions. Canadian consumers buy 1.2 million televisions per year, of which 600,000 are produced domestically and 600,000 are imported. Suppose that a technological advance among Japanese television manufacturers causes the world price to fall $800 to $700. Draw a graph to show how this change affects the welfare of Canadian consumers and Canadian producers and how it affects total surplus in Canada. Label the diagram carefully to show all the areas using letters of alphabets. (Do not shade the areas). After the fall in price, consumers buy 1.4 million televisions, of which 400,000 are produced domestically and 1 million are imported. Calculate the change (this will be only the area either gained or lost by consumers and producers) in consumer surplus, producer surplus and total surplus due to price reduction. Provide numerical answers by calculating the area of change in surplus due to fall in…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education