FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

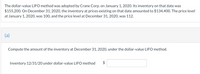

Transcribed Image Text:The dollar-value LIFO method was adopted by Crane Corp. on January 1, 2020. Its inventory on that date was

$155,200. On December 31, 2020, the inventory at prices existing on that date amounted to $134,400. The price level

at January 1, 2020, was 100, and the price level at December 31, 2020, was 112.

(a)

Compute the amount of the inventory at December 31, 2020, under the dollar-value LIFO method.

Inventory 12/31/20 under dollar-value LIFO method

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, the Coldstone Corporation adopted the dollar-value LIFO retail inventory method. Beginning inventory at cost and at retail were $170,000 and $273,000, respectively. Net purchases during the year at cost and at retail were $719,200 and $890,000, respectively. Markups during the year were $9,000. There were no markdowns. Net sales for 2024 were $844,400. The retail price index at the end of 2024 was 1.05. What is the inventory balance that Coldstone would report in its 12/31/2024 balance sheet? Note: Do not round intermediate calculations. Multiple Choice $249,600 $327,600 $202,760 $262,080arrow_forwardHsieh Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiplepools). The following data are available for inventory pool A for the 2 years following adoption of LIFO:At Base- At CurrentInventory Year Cost Year Cost1/1/2020 $334,000 $334,00012/31/2020 361,000 375,44012/31/2021 412,000 449,080arrow_forwardMontana co has determined its year end inventory on a fifo basis tp be 635000. info pertaining to that inventory is as follows selling price 610000 cost to sell 34000 replacement cost 549000 what should be the reported value of montanas inventory?arrow_forward

- On January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardSunland Company adopted the dollar-value LIFO method of inventory valuation on December 31, 2019. Its inventory at that date was $1109000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows: Date December 31, 2020 December 31, 2021 December 31, 2022 Inventory at Current Prices $1285000 1460000 1625000 Current Price Index 106 124 129 What is the cost of the ending inventory at December 31, 2021 under dollar-value LIFO?arrow_forwardPatel Company adopted the dollar-value inventory method on 12/31 / 20 . Inventory data are as follows: Inventory Price Year at Yr End Index 2020 5,785 1.00 2021 9,2501.23 202211,225 1.36 20238,575 1.25 2024 16,425 1.40 Instructions : Calculate the inventory for must show your work . 20, 2021, 2022, 20 and 2024.arrow_forward

- On January 1, 2024, Select Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, end of year Cost $ 51,600 207,640 Retail $ 86,000 360,000 6,000 8,000 337,000 1.04 During 2025 (the following year), purchases at cost and retail were $258,885 and $470,700, respectively. Net markups, net markdowns, and net sales for the year were $5,000, $6,000, and $370,000, respectively. The retail price index at the end of 2025 was 1.06. Estimate ending inventory in 2025 using the dollar-value LIFO retail method. Note: Round ratio calculation to 2 decimal places and round other intermediate calculations and final answer to the nearest whole dollar. Ending inventoryarrow_forwardCrane Company adopted the dollar-value LIFO inventory method on December 31, 2020. Crane's entire inventory constitutes a single pool. On December 31, 2020, the inventory was $968000 under the dollar- value LIFO method. Inventory data for 2021 are as follows: 12/31/21 inventory at year-end prices $ 1300000 Relevant price index at year end (base year 2020) 108 Using dollar value LIFO, Crane's inventory at December 31, 2021 is (Round intermediate calculations and final answer to 0 decimal places, e.g. 10,000.) $1300000. $1203704. $1222560. $1045440.arrow_forwardMercury Company has only one inventory pool. On December 31, 2024, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $215,000. Inventory data are as follows: Year 2025 2026 2027 Ending Inventory at Year-End Costs $ 262,500 350,750 354,000 Ending Inventory at Base Year Costs $ 250,000 305,000 295,000 Required: Compute the inventory at December 31, 2025, 2026, and 2027, using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory at Date Year-End Cost Year-End Cost Index 12/31/2024 12/31/2025 12/31/2026 = Inventory DVL Cost Ending Inventory at Base Year Ending Inventory at Base Year Year-End Cost Index Cost Cost Inventory Layers Converted to Cost Base $ ° Base 2025 $ 0 Base 2025)arrow_forward

- On January 1, 2024, the Coldstone Corporation adopted the dollar-value LIFO retail inventory method. Beginning inventory at cost and at retail were $170,000 and $273,000, respectively. Net purchases during the year at cost and at retail were $719,200 and $890,000, respectively. Markups during the year were $9,000. There were no markdowns. Net sales for 2024 were $844,400. The retail price index at the end of 2024 was 1.05. What is the inventory balance that Coldstone would report in its 12/31/2024 balance sheet? Note: Do not round intermediate calculations. Multiple Choice $249,600 $327,600 $202,760 $262,080arrow_forwardKingbird Company has used the dollar-value LIFO method for inventory cost determination for many years. The following data were extracted from Kingbird's records. Price Ending Inventory Date Index at Base Prices Ending Inventory at Dollar-Value LIFO December 31, 2025 105 $92,700 $86,600 December 31, 2026 ? 97,700 92,150 Calculate the index used for 2026 that yielded the above results. Index used for 2026arrow_forwards Mercury Company has only one inventory pool. On December 31, 2024, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $210,000. Inventory data are as follows: Year 2025 2026 2027 Date Required: Compute the inventory at December 31, 2025, 2026, and 2027, using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. 12/31/2024 12/31/2025 12/31/2026 Ending Inventory at Ending Inventory at Year-End Costs Base Year Costs $ 252,000 333,500 336,000 12/31/2027 $ 240,000 290,000 280,000 Inventory Layers Converted to Base Year Cost Inventory at Year-End Cost Year-End Cost Index = = = = Ending Inventory at Base Year Cost Base Base 2025 Base 2025 2026 Base 2025 2026 2027 Inventory Layers Converted to Cost Ending Inventory at Base Year Cost Year-End Cost Index = Inventory Layers Converted to Cost Inventory DVL Cost $ $ $ $ 0 0 0 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education