FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

thumb_up100%

infoPractice Pack

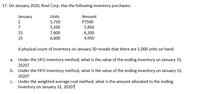

Transcribed Image Text:17. On January 2020, Roel Corp. Has the following inventory purchases.

January

Units

Amount

2

5,750

P7500

7

5,100

5,850

15

7,600

6,300

25

6,600

4,950

A physical count of inventory on January 30 reveals that there are 1,000 units on hand.

а.

Under the LIFO inventory method, what is the value of the ending inventory on January 31,

2020?

b. Under the FIFO inventory method, what is the value of the ending inventory on January 31,

2020?

С.

Under the weighted average cost method, what is the amount allocated to the ending

inventory on January 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me correct answer with explanation.harrow_forwardPanther, Inc. wishes to estimate its ending inventory using a retail method. Information for the year ended December 31, 2020 is as follows: Beginning Inventory (at cost) Beginning inventory (at retail) Purchases (at cost) Purchase Returns (at cost) Purchase Returns (at retail) REQUIRED: $ 20,000 $ 30,000 $110,000 $ 10,000 $ 15,000 Sales (net) Net Mark-Downs Freight-In Purchases (at retail) Net Mark-Ups $240,000 $ 15,000 $ 15,000 $ 230,000 $ 25,000 Assuming Panther wishes to use the LIFO retail method, calculate the estimated ending inventory at December 31, 2020.arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- On January 1, 2021, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2021 and 2022 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2021 December 31, 2021 December 31, 2022 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2021 2021 Cost Retail $39,000 $ 52,000 96,920 114,000 $102,775 $118,600 2,600 3,100 2022 13,000 2,600 111,010 2,200 2022 Cost Retail Required: Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. (Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar.) 9,200 2,800 108,840 4,960 1.00 1.08 1.10arrow_forwardOn January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardSunland Company adopted the dollar-value LIFO method of inventory valuation on December 31, 2019. Its inventory at that date was $1109000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows: Date December 31, 2020 December 31, 2021 December 31, 2022 Inventory at Current Prices $1285000 1460000 1625000 Current Price Index 106 124 129 What is the cost of the ending inventory at December 31, 2021 under dollar-value LIFO?arrow_forward

- The following inventory transactions took place for Sunland Ltd. for the year ended December 31, 2023: Date Jan 1 Jan 5 Feb 15 Mar 10 May 20 Aug 22 Sep 12 Nov 24 Dec 5 beginning inventory sale purchase purchase sale Event purchase sale purchase sale Ending inventory Unit cost of the last item sold $ CA $ Quantity 24,300 LA 6,200 32,200 9,200 40,900 14,800 20,350 9,800 17,300 Cost/ Selling Price $47.00 77.00 38.25 45.00 Calculate the ending inventory balance for Sunland Ltd., assuming the company uses a perpetual inventory system and the first-in, first-out cost formula. Also calculate the per-unit cost of the last item sold. (Round unit costs to 2 decimal places, e.g. 52.75 and ending inventory to O decimal places, e.g. 5,276.) 77.00 42.50 77.00 57.00 77.00arrow_forwardJBD, Inc. has the following information pertaining to it 2025 ending inventory. Requirements: Calculate the value of ending inventory using the following methods: LCM for each individual inventory item LCM for aggregated inventory. Record any necessary journal entries for each of the above methods, assuming the amount is material. Explain the purpose of applying the LCM rule to inventory Item Quantity Cost per Each Market Cost per Each Records Market LCM Each LCM Total R55 300 10 7.5 S49 150 15 12 T21 350 8 6 E33 600 33 35 Date Account Debit Creditarrow_forwardplease assistarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education