Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

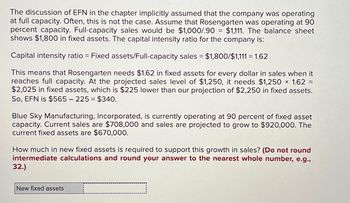

Transcribed Image Text:The discussion of EFN in the chapter implicitly assumed that the company was operating

at full capacity. Often, this is not the case. Assume that Rosengarten was operating at 90

percent capacity. Full-capacity sales would be $1,000/.90 = $1,111. The balance sheet

shows $1,800 in fixed assets. The capital intensity ratio for the company is:

Capital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 = 1.62

=

This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales when it

reaches full capacity. At the projected sales level of $1,250, it needs $1,250 × 1.62

$2,025 in fixed assets, which is $225 lower than our projection of $2,250 in fixed assets.

So, EFN is $565 - 225 = $340.

Blue Sky Manufacturing, Incorporated, is currently operating at 90 percent of fixed asset

capacity. Current sales are $708,000 and sales are projected to grow to $920,000. The

current fixed assets are $670,000.

How much in new fixed assets is required to support this growth in sales? (Do not round

intermediate calculations and round your answer to the nearest whole number, e.g.,

32.)

New fixed assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The discussion of EFN in the chapter implicitly assumed that the company was operating at full capacity. Often, this is not the case. Assume that Rosengarten was operating at 90 percent capacity. Full-capacity sales would be $1,000/.90 = $1,111. The balance sheet shows $1,800 in fixed assets. The capital intensity ratio for the company is: Capital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 = 1.62 This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales when it reaches full capacity. At the projected sales level of $1,250, it needs $1,250 × 1.62 = $2,025 in fixed assets, which is $225 lower than our projection of $2,250 in fixed assets. So, EFN is $565 – 225 = $340. Blue Sky Mfg., Inc., is currently operating at 90 percent of fixed asset capacity. Current sales are $712,000 and sales are projected to grow to $930,000. The current fixed assets are $686,000. How much in new fixed assets is required…arrow_forwardThe discussion of EFN in the chapter implicitly assumed that the company was operating at full capacity. Often, this is not the case. Assume that Rosengarten was operating at 90 percent capacity. Full-capacity sales would be $1,000/.90 $1,111. The balance sheet shows $1,800 in fixed assets. The capital intensity ratio for the company is: Capital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 - 1.62 This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales when it reaches full capacity. At the projected sales level of $1,250, It needs $1,250 1.62 = $2,025 in fixed assets, which is $225 lower than our projection of $2,250 in fixed assets. So, EFN is $565-225= $340. Blue Sky Mfg., Inc., is currently operating at 90 percent of fixed asset capacity. Current sales are $805,500 and sales are projected to grow to $940,000. The current fixed assets are $775,000. How much in new fixed assets is required to support this growth in sales? (Do not round…arrow_forwardSuppose a firm has the following information: Operatingcurrent assets = $2.7 million; operating current liabilities =$1.5 million; long-term bonds = $3 million; net plant andequipment = $7.8 million; and other long-term operating assets =$1 million. How much is tied up in net operating workingcapital (NOWC)? ($1.2 million) How much is tied up in total netoperating capital? ($10 million)arrow_forward

- The income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.arrow_forwardThickburger's net fixed assets = $200,000, total assets = $400,000, inventory =$50,000 and current liabilities = $100,000. All assets are classified as beingeither "current assets" or "fixed assets". What is the firm's current ratio?b. What is Thickburger's quick ratio?arrow_forwardThe activity ratios measure which of the following? Select one: O a the efficiency of the company's supply chain O b. the efficiency with which a company generates sales from its assets Oc the profitability of the company's activities Od the production efficiency of a company's fixed assets If the assumption of financial distress costs is added, then Modigliani and Miller (with taxes) predicts that the optimal capital structure is 100% debt Select one: O True O Falsearrow_forward

- Use the following information to find the external financing needed (EFN): Current sales: $6,000; Current costs: $4,000; Total Assets: $20,000; Total Debt: $8,000; Total equity: $12,000; Projected sales: $9,600. Total assets and costs are proportional to sales. The firm does not plan to distribute any dividends. The level of debt and equity is independent of the level of salesarrow_forwardMarcos has current annual sales of $52600 net fixed assets of $38900, and total asset s of 56300. Tje firm is currently operating at a 79percent capacity. What is the capital intensity ratio at full capacity?arrow_forwardXYZ Corp. has an operating profit margin of 7%, a debt burden of 0.8, and has financed two-thirds of its assets through equity. What asset turnover ratio is necessary to achieve an ROE of 18%? A. 1.26 B. 1.61 C. 2.14 D. 4.02 provide step by step calculation with step titlearrow_forward

- Cream of Tomato Company has the following data available.Net income = $250,000Sales = $2.5 millionTotal asset turnover = 3Equity multiplier = 2.5Cream of Tomato does not have any preferred stock outstanding. Note that the equitymultiplier is defined as total assets to equity. Calculate the return on assets and return onequity for Cream of Tomato.arrow_forwardConsider the following data for the firms Acme and Apex: Acme Apex Required: Equity Debt ($ million) ($ million) 210 1,050 105 350 ROC Cost of Capital (*) (%) 17% 9% 15% 10% a-1. Calculate the economic value added for Acme and Apex. a-2. Which firm has the higher economic value added? b-1. Calculate the economic value added per dollar of invested capital for Acme and Apex. b-2. Which firm has the higher economic value added per dollar of invested capital? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Calculate the economic value added for Acme and Apex. Note: Enter your answers in millions rounded to 2 decimal places. Economic value added for Acme million Economic value added for Apex millionarrow_forwardPlease provide correct answer with correct solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT