FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

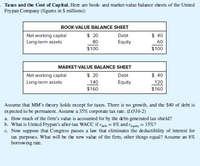

Transcribed Image Text:Taes and the Cost of Capital. Here are book- and market-value balance sheets of the United

Fry pan Company (figures in $ millions):

BOOK-VALUE BALANCE SHEET

Net working capital

Long-term assets

$ 20

80

$ 40

60

Debt

Equity

$100

$100

MARKET-VALUE BALANCE SHEET

$ 20

$ 40

120

Net working capital

Debt

Long-term assets

140

Equity

$160

$160

Assume that MM's theory holds except for taxes. There is no growth, and the $40 of debt is

ex pected to be permanent. Assume a 35% corporate tax rate. (LO16-2)

a. How much of the firm's value is accounted for by the debt-generated tax shield?

b. What is United Frypan's after-tax WACC if ra= 8% and reguty = 15%?

c. Now suppose that Congress passes a law that eliminates the deductibility of interest for

tax purposes. What will be the new value of the firm, other things equal? Assume an 8%

borrowing rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- c. What will the marginal cost of capital be immediately after that point? (Equity will remain at 45 percent of the capital structure, but will all be in the form of new common stock, Kn.) Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Marginal cost of capital % d. The 5.0 percent cost of debt referred to above applies only to the first $36 million of debt. After that, the cost of debt will be 8.5 percent. At what size capital structure will there be a change in the cost of debt? Note: Enter your answer in millions of dollars (e.g., $10 million should be entered as "10"). Capital structure size (Z) million e. What will the marginal cost of capital be immediately after that point? (Consider the facts in both parts cand d.) Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Marginal cost of capital %arrow_forwardAssume that Clampett, Inc. has $200,000 of sales, $150,000 of cost of goods sold, $60,000 of interest income, and $40,000 of dividends. What is Clampett, Inc.'s excess net passive income? $25,000. $75,000. $100,000. $0. None of the choices are correct.arrow_forwardPLEASE SHOW ALL WORK AND FORMULAS IF ANSWERED CORRECTLY I WILL UPVOTE EMC Corporation has never paid a dividend. Its current free cash flow of $500,000 is expected to grow at a constant rate of 4.2%. The weighted average cost of capital is WACC = 10.5%. Calculate EMC's estimated value of operations. Round your answer to the nearest dollar.arrow_forward

- Assume a firm has EBAT of $590,000, and no amortization. It is in a 40 percent tax bracket. a. Compute its cash flow. $ 354,000 b. Assume it has $590,000 in amortization. Recompute its cash flow. $ 590,000 c. How large a cash flow benefit did the amortization provide? $T] Cash flow Cash flow Benefit in cash flowarrow_forwardI need help solving FCFE and Cash Flow per Share. See below and advise. All in MM. Exploration Expense: -12.8 Asset Retirement Obligation Accretion: -6.0 Depreciation, Depletion and Amortization: -378.9 Working Capital (Increase) / Decrease: (30.0) Capital Expenditures: 156.1 Net Debt: -11.0 Number of Shares Outstanding: 251arrow_forwardNeed all three partsarrow_forward

- Albrecht Inc. is a no-growth firm whose sales fiuctuate seasonally, causing total assets to vary from $320,000 to $410,000, but fixed assets remain constant at $260,000. If the firm follows a maturity matching (or moderate) working capital financing policy, what is the most likely total of long-term debt plus equity capital? a $274.360 b. $260,642 c. $304,000 d. $320,000 e. $288,800arrow_forwardHere are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): Book-Value Balance Sheet $ 35 65 $ 100 Net working capital Long-term assets Market-Value Net working capital Long-term assets Balance $ 35 190 $225 Debt Equity Sheet Debt a. PV tax shield b. WACC c. New value of the firm Equity $ 40 60 $ 100 Assume that MM's theory holds except for taxes. There is no growth, and the $40 of debt is expected to be permanent. Assume a 21% corporate tax rate. $ 40 185 $ 225 a. How much of the firm's value is accounted for by the debt-generated tax shield? Note: Enter your answer In million rounded to 2 decimal places. b. What is United Frypan's after-tax WACC if "Debt = 6.9% and Equity = 16.1% ? Note: Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of 5 years. What will be the new…arrow_forward3:44 (Capital structure analysis) The Karson Transport Company currently has net operating income of $496,000 and pays interest expense of $190,000. The company plans to borrow $1.14 million on which the firm will pay 11 percent interest. The borrowed money will be used to finance an investment that is expected to increase the firm's net operating income by $397,000 a year. a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? b. What effect will the loan and the investment have on the firm's times interest earned ratio? a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? The times interest earned ratio is ||| Vo) 1 LTE2.II 4G = times. (Round to two decimal places.) O 59%arrow_forward

- Capital Structure Analysis The Rivoli Company has no debt outstanding, and its financial position is given by the following data: $ 45 6 ✔ Expected EBIT Growth rate in EBIT, gL Cost of equity, rs Shares outstanding, no Tax rate, T (federal-plus-state) a. What is Rivoli's intrinsic value of operations (i.e., its unlevered value)? Round your answer to the nearest dollar. 4500000✔✔ $ What is its intrinsic stock price? Its earnings per share? Round your answers to the nearest cent. Intrinsic stock price: $ Earnings per share: $ 4.50 b. Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 35% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 8%. Based on the new capital structure, what is the new weighted average cost of capital? Round your answer to three decimal places. 9.9 % What is the levered value of the firm? What is the…arrow_forwardTarget Corporation (TGT) has $2.14 million in assets that are currently financed with 100% equity. TGT’s EBIT is $385,000, and its tax rate is 25%. If TGT changes its capital structure to include 50% debt, its return on equity will increase. Assume the interest rate on debt is free. (justify your answer with numerical calculation) True Falsearrow_forwardAssuming that there is an unlevered firm and a levered firm. The basic information is given by the following table. Table1: Information of the firms Unlevered firm Levered firm EBIT 20000 20000 Interest Taxable income Tax (tax rate: 34%) Net income CFFA Assuming that: The size of the debt is 8000; cost of debt =8%; unlevered cost of capital =10%; systematic risk of the asset is 1.5 Fill in the blanks What is the present value of the tax shield? Calculate the following values:a) Calculate value of unlevered firm; b) value of the levered firm; c) equity value; d) Cost of equity; e) cost of capital; f) systematic risk of the equity Suppose that the firm changes its capital structure so that the debt-to-equity ratio is 1.6, then recalculate the systematic risk of the equity If the firm now has the following project: in year 0, the cashflow is 5000, in year 1, the cashflow is -5500. Based on the IRR rule,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education