Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

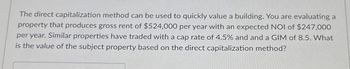

Transcribed Image Text:The direct capitalization method can be used to quickly value a building. You are evaluating a

property that produces gross rent of $524,000 per year with an expected NOI of $247,000

per year. Similar properties have traded with a cap rate of 4.5% and and a GIM of 8.5. What

is the value of the subject property based on the direct capitalization method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- This question is based on the following in formation: An investment is Machinery costing P 250,000 with a 4-year life and no salvage value is expected to produce the following net income after taxes of 30%: End of year 1 P 17,000 2 22,000 3 25,000 4 26,000 How much is the annual tax shield?How much is the annual tax shield?A. P 17,580B. P 17,850C. P 18,570D. P 18,750What is the ROI (using the cash income)? A. 6.3%B. 9%C. 31.3%D. 34%arrow_forwardConsider an asset that costs $528,000 and is depreciated straight-line to zero over its 6-year tax life. The asset is to be used in a 3-year project; at the end of the project, the asset can be sold for $66,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset? $115,038.00 $104,082.00 $109,560.00 $51,480.00 $429,012.00arrow_forwardThe following information is available for a potential investment for Panda Company:arrow_forward

- The following proforma shows unleveraged cash flows for a property if an investor were to purchase it today and resell it at the end of the third year: (Show answer in Excel) What is the present value of the each of the discounted cash flows from Year 1, Year 2, and Year 3, using a discount rate of 8.75% (hint: calculate each on separately)? What is the Net Present Value of this investment?arrow_forwardMf1. Consider an asset that costs $492,800 and is depreciated straight-line to zero over its 6-year tax life. The asset is to be used in a 2-year project; at the end of the project, the asset can be sold for $61,600. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset?arrow_forwardConsider an asset that costs $1,075, 196 and is depreciated straight-line to zero over its 15-year tax life. The asset is to be used in a 5-year project; at the end of the project, the asset can be sold for $109, 800. If the relevant tax rate is 0.39, what is the aftertax cash flow from the sale of this asset (SVNOT)?arrow_forward

- An investor is considering an investment property, but will only pay the price that will result in their desired IRR, given expected cash flows. The property is expected to generate the following cash flows from operations: year 1: $12.000; year 2: $12,600, year 3: $13,230, and year 4: $13,890. Assume that at the end of year 4, the property could be sold to net $190,000. What price must an investor offer to receive an expected IRR of 10%? O $139,518 o $153,396 o $159,752 o $145,254 o $170,522arrow_forwardK You have a depreciation expense of $546,000 and a tax rate of 22%. What is your depreciation tax shield? The depreciation tax shield will be $ (Round to the nearest dollar.)arrow_forwardThe following data are from an after-tax cash flow analysis in year 1 for anew MACRS 5-year property. How much money would be saved in year 1 if 100% bonus depreciation is used? Initial Investment = $180,000 Regular MACRS Depreciation Deduction in Year 1 = $36,000 Before-Tax-and-Loan Cash Flow = $280,000 Loan Principal Payment = $17,500 Interest on Loan = $5,650. a. $30,240 b. $75,600 c. $37,800 d. $36,000.arrow_forward

- Assume that you purchase a property for $200,000 and it generates annual cash flows of $30,000 in years 1-3; and $45,000 in years 4&5. You are able to sell it at the end of year 5 for $400,000. Calculate the IRR for this investment property.arrow_forwardExplain how did it get the after-tax cash flow, NPV, EVA, and MVAarrow_forwardTwo potential real estate investments are under review by an investment firm. One is a 75,000 square foot office building in Portland, Oregon with a projected pre-tax leveraged IRR of 18.8% and the other is a 54-unit garden apartment building in Scranton, Pennsylvania with a projected pre-tax leveraged IRR of 14.5%. The investment firm should: a. Carefully weigh the projected returns relative to the potential risks of each investment during the due diligence process to determine whether either investment should be chosen b. Choose the Scranton apartment building with the lower expected IRR because it must be a safer investment c. Choose neither investment because both IRRs seem too good to be true in today’s market d.Choose the Portland industrial building with the higher expected IRR because it will definitely appreciate in value more over timearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education