Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

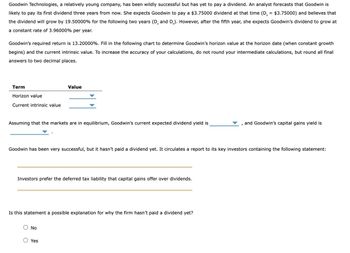

Transcribed Image Text:Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is

likely to pay its first dividend three years from now. She expects Goodwin to pay a $3.75000 dividend at that time (D, = $3.75000) and believes that

the dividend will grow by 19.50000% for the following two years (D and D₂). However, after the fifth year, she expects Goodwin's dividend to grow at

a constant rate of 3.96000% per year.

Goodwin's required return is 13.20000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth

begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final

answers to two decimal places.

Term

Horizon value

Current intrinsic value

Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is

Value

Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement:

Investors prefer the deferred tax liability that capital gains offer over dividends.

Is this statement a possible explanation for why the firm hasn't paid a dividend yet?

No

Yes

, and Goodwin's capital gains yield is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.00 coming 3 years from today. The dividend should grow rapidly - at a rate of 23% per year - during Years 4 and 5, but after Year 5, growth should be a constant 8% per year. If the required return on Computech is 12%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. LAarrow_forwardComputech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $0.50 coming 3 years from today. The dividend should grow rapidly-at a rate of 31% per year-during Years 4 and 5, but after Year 5, growth should be a constant 10% per year. If the required return on Computech is 16%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardSimpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the first dividend of $1.25 coming 3 years from today. The dividend should grow rapidly - at a rate of 60% per year - during Years 4 and 5. After Year 5, the company should grow at a constant rate of 9% per year. If the required return on the stock is 13%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round your answer to the nearest cent. DISCLAIMER: this is my second time posting this question (the answer is NOT $40.40) thank you!arrow_forward

- Metallica Bearings, Inc., is a youngstart-up company. No dividends will be paid on the stock over the next nine yearsbecause the firm needs to plow back its earnings to fuel growth. The company will pay a$17 per share dividend 10 years from today and will increase the dividend by 3.9 percentper year thereafter. If the required return on this stock is 12.5 percent, what is the currentshare price?arrow_forwardComputech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.75 coming 3 years from today. The dividend should grow rapidly-at a rate of 45% per year-during Years 4 and 5; but after Year 5, growth should be a constant 5% per year. If the required return on Computech is 16%, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations. $arrow_forwardComputech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.75 coming 3 years from today. The dividend should grow rapidly - at a rate of 47% per year - during Years 4 and 5; but after Year 5, growth should be a constant 6% per year. If the required return on Computech is 17%, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations.arrow_forward

- DFB, Inc. expects earnings next year of $4.48 per share, and it plans to pay a $2.54 dividend to shareholders (assume that is one year from now). DFB will retain $1.94 per share of its earnings to reinvest in new projects that have an expected return of 15.7% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 11.8%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $3.54 per share at the end of this year and retained only $0.94 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesti in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forwardComputech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.75 coming 3 years from today. The dividend should grow rapidly—at a rate of 44% per year—during Years 4 and 5, but after Year 5, growth should be a constant 4% per year. If the required return on Computech is 17%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. $ _____arrow_forwardComputech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $2.00 coming 3 years from today. The dividend should grow rapidly—at a rate of 26% per year—during Years 4 and 5, but after Year 5, growth should be a constant 4% per year. If the required return on Computech is 17%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

- Microtech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Microtech to begin paying dividends, beginning with a dividend of $2.30 coming 3 years from today. The dividend should grow rapidly-at a rate of 23% per year-during Years 4 and 5; but after Year 5, growth should be a constant 6.2% per year. If the required return on Microtech is 10.30%, what is the value of the stock today? Question 11 options: $93.16 $90.13 $74.17 $60.96arrow_forwardThe VSE Corporation currently pays no dividend because of depressed earnings. A recent change in management promises a brighter future. Investors expect VSE to pay a dividend of $0.5 next year (the end of year 1). This dividend is expected to increase to $1.25 the following year and to grow at a rate of 12 percent per annum for the following 2 years (years 3 and 4). Chuck Brown, a new investor, expects the price of the stock to increase 50 percent in value between now (time zero) and the end of year 3. If Brown plans to hold the stock for 2 years and requires a rate of return of 19 percent on his investment, what value would he place on the stock today? Use Table II to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education