Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

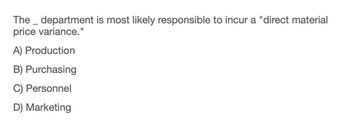

Transcribed Image Text:The department is most likely responsible to incur a "direct material

price variance."

A) Production

B) Purchasing

C) Personnel

D) Marketing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following departments is most likely responsible for the price variance in direct materials? O Receiving Purchasing Warehousing O Productionarrow_forwardThe purchasing personnel O production marketing department is most likely responsible to incur a "direct material price variance." 3 (Please type answer).arrow_forwardWhich of the following statement is true under the Standared Costing System a. Standard cost is a predetermined or estimated cost to either produce a good/service or perform an activity within the organisation b. Standard cost is a control technique that helps to report variances by comparing pre-set standards to actual costs to facilitate action c. Both a and b are incorrect d. Both a and b are correctarrow_forward

- A standard costing system will produce the same income as an actual costing system when standard cost variances are closed to: a. Work-in-process b. Work-in-process and finished goods c. Cost of goods sold d. Cost of goods sold and inventoriesarrow_forwardCost Accountarrow_forwardWhy should a production-volume variance (PVV) that is material be prorated among work-in-process, finished goods, cost and cost of goods sold rather than writing it all off to cost of goods sold? a. If a PVV is always written off to cost of goods sold, then the assets on the balance sheet would be the same as actual costs. b. If a PVV is always written off to cost of goods sold, then the liabilities on the balance sheet would be overstated. c. If a PVV is always written off to cost of goods sold, then the balances in the inventory accounts on the balance sheet would be most accurate. d. If a PVV is always written off to cost of goods sold, a company could set its standard costs to either increase or decrease operating incomes.arrow_forward

- Which of the following is a limitation of the gross profit variance analysis? a. The level of efficiency of asset management department can be computed and shown b. It includes the amount invested in working capital c. Measurement of the impact on gross profit due changes in sales volume cannot be determined d. The gross profit variance analysis is limited only on the product attributable costarrow_forwardGeneral Accountarrow_forwardA variance is the difference between standards and actual performance with materials, labor, or overhead costs. True / Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning