Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

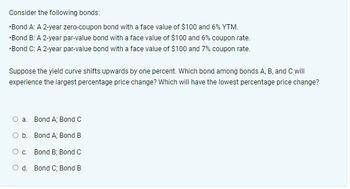

Transcribed Image Text:Consider the following bonds:

•Bond A: A 2-year zero-coupon bond with a face value of $100 and 6% YTM.

•Bond B: A 2-year par-value bond with a face value of $100 and 6% coupon rate.

*Bond C: A 2-year par-value bond with a face value of $100 and 7% coupon rate.

Suppose the yield curve shifts upwards by one percent. Which bond among bonds A, B, and C will

experience the largest percentage price change? Which will have the lowest percentage price change?

O a. Bond A; Bond C

O b. Bond A; Bond B

O c.

Bond B; Bond C

O d. Bond C; Bond B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- This question has TWO parts. Please be sure to scroll down and make sure you answer both parts. Which of the following bonds will be most sensitive to a change in interest rates if all bonds have the same initial yield to maturity? O A. a 10-year bond with a $1,000 face value whose coupon rate is 4.7% APR paid semiannually OB. a 20-year bond with a $1,000 face value whose coupon rate is 8.1% APR paid semiannually OC. a 20-year bond with a $1,000 face value whose coupon rate is 4.7% APR paid semiannually OD. a 10-year bond with a $1,000 face value whose coupon rate is 8.1% APR paid semiannually ... A measurement of the sensitivity of a bond's price to changes in interest rates is known as: (choose the most appropriate answer below) OA. Duration OB. Yield to Maturity (YTM) OC. Repayment Risk OD. Credit Riskarrow_forwardQ2. Duration and Convexity Bond A has face value at $1,000, coupon rate of 6% paid semi-annually, 5 years to maturity, and a yield to maturity of 7%. a. Using the bond pricing formula, calculate the price of the bond and duration. ABC b. Calculate the convexity of the bond. c. Using the calculations from above, what is the "approximated bond price change" using duration and convexity, if the interest rate increases by 1%? d. What is the actual change in the bond price if the interest rate increases by 1%? e. Based on c) and d) above, discuss the roles of duration and convexity in estimating the price change. Which risk measure plays a bigger role? f. Suppose you have two bonds with the same maturity date but one bond has a 10% coupon rate while the other has a 5% coupon rate. Which of these two bonds would have a higher duration?arrow_forwardSuppose a seven-year, $1,000 bond with a 7.7% coupon rate and semiannual coupons is trading with a yield to maturity of 6.51%. a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. If the yield to maturity of the bond rises to 7.38% (APR with semiannual compounding), what price will the bond trade for? a. Is this bond currently trading at a discount, at par, or at a premium? Explain. (Select the best choice below.) OA. Because the yield to maturity is less than the coupon rate, the bond is trading at a premium. B. Because the yield to maturity is greater than the coupon rate, the bond is trading at a premium. C. Because the yield to maturity is less than the coupon rate, the bond is trading at a discount. OD. Because the yield to maturity is greater than the coupon rate, the bond is trading at par.arrow_forward

- Explain why are the bond prices for A and B different or the same? Explain your answer clearly.arrow_forwardAssume the following: Bond A coupon = 6%, maturity = 5 years, yield to maturity = 6% Bond B coupon = 0%, maturity = 5 years, yield to maturity = 6% Bond C coupon = 6%, maturity = 5 years, yield to maturity = 6.5% Which of the following statements concerning duration is correct? Group of answer choices A. Duration of C<Duration of A=Duration of B. B. Duration of A>Duration of B>Duration of C. C. Duration of C < Duration of A < Duration of B. D. Duration of A< Duration of B<Duration of C.arrow_forwardYou have two bonds in your asset portfolio. The first bond has a yield to maturity of 5% and a price of £,1000 and the second bond has a yield to maturity of 8% and a price of £2,000. What is the yield to maturity of your assets? a. 0.06 b. 0.07 c. 0.09arrow_forward

- Please answer 6D.arrow_forwardA bond is currently selling for $880. This indicates that this bond is _____, and you would expect that the coupon rate would be _____ than the current market rate. Attractive; greater than Attractive; less than Unattractive; greater than Unattractive; less thanarrow_forwardK← Consider the case of a two-year discount bond-that is, a bond that pays no coupon and pays its face value after two years rather than one year. Suppose the face value of the bond is $1,000, and the price is $850. What is the bond's yield to maturity? The bond's yield to maturity is%. (Round your response to two decimal places.)arrow_forward

- Comment on the attractiveness of the bonds in two ways: a) How does the yield compare to the benchmark? Market YTM: 3.62% YTM of bond: 3.72% b) How does the current price compare to the benchmark-yield implied price? Price: 100.875 Implied price: 100.923arrow_forwardWhich of the following four bonds has the least Macaulay duration? A bond with A. 4.75% yield and 40-year maturity. B. 5.25% yield and 30-year maturity. C. 6.75% yield and 20-year maturity. D. 7.25% yield and 10-year maturity.arrow_forward6.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education