FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

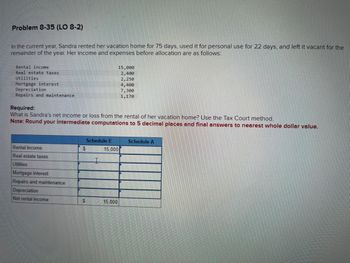

In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows

Rental income 15,000

Real estate taxes 2,400

Utilities 2,250

Mortgage interest 4,400

Depreciation 7,300

Repairs and maintenance 1,170

Required:

What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method.

Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.

Transcribed Image Text:Problem 8-35 (LO 8-2)

In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the

remainder of the year. Her income and expenses before allocation are as follows:

Rental income

Real estate taxes

Utilities

Mortgage interest

Depreciation

Repairs and maintenance

Required:

What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method.

Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.

Rental income

Real estate taxes

Utilities

Mortgage interest

Repairs and maintenance

Depreciation

Net rental income

$

$

15,000

2,400

2,250

4,400

7,300

1,170

Schedule E

15,000

15,000

Schedule A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject:- accountingarrow_forwardSimon rents his cottage when he and his family are not using it. It qualifies as a vacation home rental. In 2021, he had rental income of $5,200. His deductible expenses were: Advertising $350 Commissions $775 Depreciation (rental portion) $1,500 Maintenance (rental portion) $750 Mortgage interest (rental portion) $1,250 Pest control (rental portion) $300 Prior-year carryover $500 Real estate tax $800 What amount of unallowed expense will Simon carry forward to next year? $0 $500 $1,025 $1,500arrow_forwardLily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2018, she sells the following long-term assets used in her business: Sales Asset Price Cost Building $234,200 $204,200 Equipment 84,200 152,200 Accumulated Depreciation $56,200 27,200 Lily's taxable income before these transactions is $164,700. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)arrow_forward

- Kmarrow_forwardDetermine the total amount that will qualify for itemized deduction by the taxpayer. Rita needed some cash to attend a friend's 21st birthday COVID-themed bash in Nashville, but eas bit short of the amount required for the (safe)travel. She borrowed $500 form her sister for the trip and two months later repaid the amount along with $25 extra as an interest payment.arrow_forwardMargaret and Johnny, a married couple, purchased their primary residence for $250,000 in June 2005. They sold their home for $240,000 on August 3, 2022. What is the loss amount they can deduct on their taxes?arrow_forward

- In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income 15,900 2,700 2,475 4,700 7,600 1,260 Schedule E Schedule Aarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forwardLily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2022, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 233,800 83,800 Description Taxable income Tax liability Cost $ 203,800 151,800 Lily's taxable income before these transactions is $194,300. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. $ Amount Accumulated Depreciation $ 55,800 26,800 238,900arrow_forward

- Domesticarrow_forwardAlicia sold her personal residence to Rick for $300,000. Before the sale, Alicia paid the real estate tax of $4,380 for the calendar year. For income tax purposes, the deduction is apportioned as follows; $2,160 for Alicia and $2,220 for Rick. What is Ricks basis in the residence?arrow_forwardDuring the current year, Kristina, a single taxpayer with no dependents, has a salary of $130,000. She has the following income and (losses) from passive activities in 2021: Rental House ($28,850) Restaurant ( 3,900) Golf Course 7,800 Kristina has suspended loss carryforwards into 2021 of ($2,500) on the rental house and ($11,400) on the restaurant. She has a gain of $6,700 from selling the restaurant in 2021. She actively manages the rental house and is the sole owner. 1. What is Kristina's AGI in 2021? 2. What, if any, are Kristina's suspended loss carryforwards by activity? If she does not have any, explain why. 3. Assume Kristina has no deductions For AGI, no qualified business income, and takes the standard deduction; what is her federal income tax liability for 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education