Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide the required balance

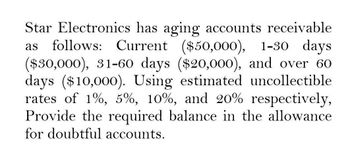

Transcribed Image Text:Star Electronics has aging accounts receivable

as follows: Current ($50,000), 1-30 days

($30,000), 31-60 days ($20,000), and over 60

days ($10,000). Using estimated uncollectible

rates of 1%, 5%, 10%, and 20% respectively,

Provide the required balance in the allowance

for doubtful accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kirchhoff Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.arrow_forwardSequoia, Inc. has given you the following information from its aging of Accounts Receivable. Using this information, determine the amount of the journal entry to record the estimated uncollectible accounts. Current $27,000 2% uncollectible 31 - 60 days 61- 90 days 6,000 5% uncollectible 3,000 15% uncollectible 91 and up 1.800 16% uncollectible The current balance in Allowance for Doubtful Accounts is a $144 debit. O A. $54,000 O B. $1,722 O C. $1,578 O D. $1,434arrow_forwardFrom aging its Accounts Receivable, Marlon De Guzman Company estimates that 18,750 of it's accounts will be uncollectible. At this time, Allowance for Doubtful Accounts has an 8,400 credit balance. The adjusting entry is. A. Debit allowance for doubtful accounts, 18,750; credit accounts receivable, 18,750. B. Debit doubtful accounts expense, 10,350; credit allowance for doubtful accounts, 10,350 C. Debit doubtful accounts expense, 18,750; credit accounts receivable 18,750 D. Debit allowance for doubtful accounts, 10,350; credit doubtful accounts expense, 10,350 (Which one is correct)arrow_forward

- The aging of accounts receivable shows the following data: 0-60 days due: balance is $74,500 with a 3% estimated uncollectible Over 60 days past due: balance is $4,000 with a 24% estimated uncollectible The current balance of Allowance for Bad Debits is a $500 CR Using the aging of receivables method, what is the balance of Allowance for Bad Debt? $3,195 DR $3,195 CR $3,695 CR $2,695 CRarrow_forwardBefore the year-end adjustment the Allowance for Doubtful Accounts has a debit balance of $5,000. Using the aging of receivables method, the desired balance of the Allowance for Doubtful Accounts is estimated as $35,000. a) What is the uncollectible accounts expense for the period? b) What is the journal entry required? c) What is the balance of the Allowance for Doubtful Accounts after adjustment? d) If the accounts receivable balance is $325,000, what is the net realizable value of the receivables after adjustment?arrow_forwardUsing the % of aging-of-accounts receivable to estimate uncollectible accounts, The Valley Corporation estimates a target balance of $10,626 of its total accounts receivable that will be uncollectible. Prior to adjustment, the Allowance for Uncollectible accounts has a credit balance of $3,000. When recording the journal entry to make this adjustment, what is the amount of the debit for bad debt expense? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 ASUS f4 f5 f6 f7 f8 f9 f10 f11 E3 & 4. 5 7 8. T Y 61 16 R %24arrow_forward

- At the of fiscal year before the accounts are adjusted, accounts receivable has a balance of $200000 and allowance for doubtful accounts has a credit balance of $2500. if the estimate of uncollectible accounts determined by aging the receivable is $8500, the amount of bad debt expense is?arrow_forwardAn aging of a company's accounts receivable indicates the estimate of uncollectible receivables totals $4,459. If Allowance for Doubtful Accounts has a $1,125 credit balance, the adjustment to record the bad debt expense for the period will require a:arrow_forwardTanning Company analyzes its receivables to estimate uncollectible accounts. The accounts receivable balance is $368,000 and credit sales are $1,000,000. An aging of accounts receivable estimates that $29,440 of the outstanding receivables will be uncollectible. What adjusting entry will Tanning Company make if Allowance for Doubtful Accounts has a credit balance of $2,000 before adjustment? a. Account Debit Credit Bad Debt Expense 29,440 Allowance for Doubtful Accounts 29,440 b. Account Debit Credit Bad Debt Expense 27,440 Allowance for Doubtful Accounts 27,440 c. Account Debit Credit Bad Debt Expense 94,320 Allowance for Doubtful Accounts 94,320 d. Account Debit Credit Bad Debt Expense 31,440 Allowance for Doubtful Accounts 31,440arrow_forward

- Blossom Inc. uses the allowance method to estimate uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated uncollectibles based on the below information. Accounts receivable % uncollectible Estimated Bad debts $ Total $216,800 0-30 $81,000 2% 31-60 $50,000 5% Number of Days Outstanding $ 61-90 $42,100 6% $ 91-120 $25,700 9% Over 120 $18,000 21%arrow_forwardAssume that accounts receivable and the allowance for doubtful accounts (AFDA) ending balances were OMR500,000 debit and OMR5000 credit balances respectively at December 31, and the uncollectible accounts are estimated to be 5% of accounts receivable. Find out the ending balance of ADFA from the above given information . a . None of the given options b . OMR 30000 C. OMR 25000 d . OMR 20000arrow_forwardCrane Company had a 1/1/20 balance in the Allowance for Doubtful Accounts of $33500. During 2020, it wrote off $22000 of accounts and collected $6620 on accounts previously written off. The balance in Accounts Receivable was $630000 at 1/1 and $730000 at 12/31. At 12/31/20, Crane estimates that 5% of accounts receivable will prove to be uncollectible. What is Bad Debt Expense for 2020? $18380. $25000. $3000. $36500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning