Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

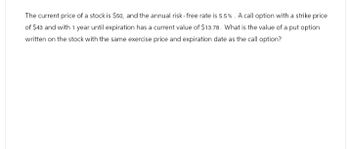

Transcribed Image Text:The current price of a stock is $50, and the annual risk-free rate is 5.5%. A call option with a strike price

of $43 and with 1 year until expiration has a current value of $13.78. What is the value of a put option

written on the stock with the same exercise price and expiration date as the call option?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The current stock price of KLMCO iNC is $111.00. You expect the stock price a year from now to be either $128.00 or $92.00 with equal probabilities . The interest rate at which investors can borrow is 11%. using the binomial opm, what should be the price of a put option with an exercise price of $120.00 an expiration date one year from nowarrow_forwardPLEASE GIVE ME THE CORRECT ANSWERarrow_forwardThe Black-Scholes model is used to value call options on the stock of National Co. The following information was identified:· The share price is P43.· The option matures in 6 months· The risk-free rate is 2%.· Price of the option is at P43.What is the exponent of “e” for in computing the value of the call option using the Black-Scholes model?arrow_forward

- given a stock with a current price of 85.50, exercise price of 83.75, put price of 2.60, call price of 4.52, risk ree rate of 0.025, and days in a year of 365, what is the expiration date of the stock?arrow_forwardYou have written (sold) a three-month European call option at a strike price of $500. The current stock price (So) is $492.00, the annual risk-free interest rate is 4%, and the volatility of the underlying is 10%. Construct a delta hedge of this position using the underlying asset. Report your answer in the number of shares of the underlying purchased/sold. (Positive values indicate a purchase, negative a short)arrow_forwardTDX stock is currently trading at $100. A 3-month call option in this stock has an exercise price of $105 and trading at $1 (the option premium). A put option with similar maturity period and strike price is trading at $0.5.i) Compute the theoretical value of call and put options if TDX stock price at the end of 3 months will be $95, or $100, or $105, or $110, or $115. ii) Draw diagrams showing TDX stock price and theoretical values of call and put. iii) If you purchase one stock and one put option today, what will be the total value of your portfolio at the end of 3 months? iv) Compute your return on investment or holding period return made in part (iii) above.arrow_forward

- Far a nonclividend-paying stock, yOU are giveni) The current stock price is 100 ii) At the end of one year the stock price will either be 100 u or 92 iii) The continuously compounded risk-free interest rate is 0.05 iv) The price of a one-year at the money call option on the stock is 1.78 Calculate uarrow_forwardA stock currently sells for $34.4. A 6-month call option with a strike price of $41 has a premium of $5.5. Let the continuously compounded risk-free rate be 3%. What is the price of the associated 6-month put option with the same strike (to the nearest penny)? Price = $ b) A stock currently sells for $33.35. A 6-month call option with a strike price of $30.1 has a premium of $2.3,and a 6-month put with the same strike has a premium of $0.9. Let the continuously compounded risk-free rate be 4%. What is the present value of dividends payable over the next 6 months (to the nearest penny)?arrow_forwardThe price of a European call option on a non dividend paying stock with a strike price of $79 is $8. The stock price is $75, the continuously compounded risk-free rate (all maturities) is 4.50% and the time to maturity is one year. a. What is the price of a one year European put option on the stock with a strike price of $79? (Hint: Use the Put-Call Parity Formula).arrow_forward

- The current price of a stock is $34, and the annual risk - free rate is 3 %. A call option with a strike price of $32 and with 1 year until expiration has a current value of $5.54. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option? Do not round intermediate calculations. Round your answer to the nearest cent. Please answer fast i give you upvote.arrow_forwardCalculate the value of a call option for the following stock. Use the Black-Scholes formula. Time to expiration Standard deviation Exercise price Stock price Annual interest rate Dividend 6 months 50% per year $50 $50 3% 0 (Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of a call optionarrow_forwardAssuming that a September put option to buy a share for $100 costs $4.50 and is held until September. Under what circumstances will the holder of this option make a profit? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a long position in the option depends on the stock price at the maturity of the option.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education