Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

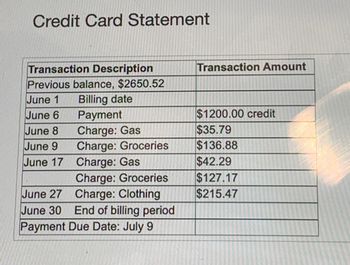

Transcribed Image Text:Credit Card Statement

Transaction Description

Previous balance, $2650.52

June 1 Billing date

June 6

June 8

June 9

June 17

June 27

June 30

Payment

Charge: Gas

Charge: Groceries

Charge: Gas

Charge: Groceries

Charge: Clothing

End of billing period

Payment Due Date: July 9

Transaction Amount

$1200.00 credit

$35.79

$136.88

$42.29

$127.17

$215.47

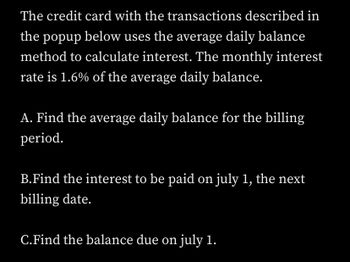

Transcribed Image Text:The credit card with the transactions described in

the popup below uses the average daily balance

method to calculate interest. The monthly interest

rate is 1.6% of the average daily balance.

A. Find the average daily balance for the billing

period.

B.Find the interest to be paid on july 1, the next

billing date.

C.Find the balance due on july 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the table, what is the average daily balance of the credit card for the November 1 - November 30 billing period? Round your answer to the nearest cent.Do not include a dollar sign or comma in your answer. For example, $5, 678.00 should be entered as 5678.00. Day Activity Adjustment Closing Balance 1 7500 11 Payment -500 7000 21 Payment -750 6250 30 Purchase +250 6500arrow_forwardPlease help me figure out the notes and general journal for this problem.arrow_forwardA credit card has a monthly rate of 1.6% and uses the average daily balance method for calculating interest. Here are some of the details in the June 1-June 30 itemized billing: June 1 Unpaid Balance: $450.98 Payment Received June 9: $130 Purchases Charged to the Account: $259.1 Average Daily Balance: $355.65 Last Day of the Billing Period: June 30 Payment Due Date: July 9. Click the icon to view the table. O A. a. $5.51 b. $326.49 c. $20.00 O c. a. $5.69 b. $585.77 c. $58.58 a. Find the interest due on the payment. due date. b. Find the total balance owed on the last day of the billing period. c. Minimum payment terms are shown in the accompanying table. What is the minimum payment due by July 9? C OB. a. $5.76 b. $320.98 c. $20.00 OD. a. $5.76 b. $676.63 3. $58.58arrow_forward

- A credit card issuer calculates interest using the average daily balance method. The monthly interest rate is 1.1% of the average daily balance. The following transactions occurred during the November 1 – November 30 billing period. Transaction Description Transaction Amount Previous balance, $4620.80 November 1 Billing date November 7 Payment $650.00 credit November 11 Charge: Airline Tickets $350.25 November 25 Charge: Groceries $125.70 November 28 Charge: Gas $38.25 November 30 End of billing period Payment Due Date: December 9 Find the average daily balance for the billing period. Round to the nearest cent. Find the interest to be paid on December 1, the next billing date. Round to the nearest cent. Find the balance due on December 1. This credit card requires a $10 minimum monthly payment if the balance due at the end of the billing period is less than $360. Otherwise, the…arrow_forwardOn the April 5 billing date, Michaelle Chappell had a balance due of $978.09 on her credit card. From April 5 through May 4, Michaelle charged an additional $454.12 and made a payment of $600. a) Find the finance charge on May 5, using the previous balance method. Assume that the interest rate is 1.5% per month. b) Find the new balance on May 5.arrow_forwardUsing the table, what is the average daily balance of the credit card for the August 1 - August 31 billing period? Round your answer to the nearest cent. Provide your answer below: Day Activity Adjustment Closing Balance 1 850 8 Payment -400 450 16 Purchase +350 800 24 Purchase +600 1,400arrow_forward

- Alexis Monroe, a biologist from Dyersburg, Tennessee, is curious about the accuracy of the interest charges shown on her most recent credit card billing statement. Interest Charged Interest Charge on Purchases $6.40 Interest Charge on Cash Advances $4.65 TOTAL INTEREST FOR THIS MONTH $11.05 Use the average daily balances provided to recalculate the interest charges, and compare the result with the amount shown on the statement. Round your answers to the nearest cent. Annual Percentage Balances Subject to Type of Balance Rate (APR) Interest Rate Interest Charge Purchases 15.14% (V) $513.39 $ Cash Advances 22.43% (V) $252.98 $ Balance Transfers 0.00% $637.50 $ Penalty APR 28.99% $ 0.00 $arrow_forwardPlease written by computer source For the period beginning October 14, the average daily balance on Perry’s credit card was $810. If the balance at the end of the cycle was $465 and the APR on the card is 7.5%, what was the balance due on November 14?arrow_forwardCalculate the discount period for the bank to wait to receive its money: (Use Days in a year table): date of note length of note date note discounted discount period (days) july 14th 50 days august 5 ?arrow_forward

- Use the average daily balance method to compute the finance charge on the credit card account for the month of August (31 days). The starting balance from the previous month is $300. The transactions on the account for the month are given inthe table to the right. Assume an annual interest rate of 25% on the account and that the billing date is August 1. August 4 made payment of $94.August 14 charged $140 for hiking boots August 17 charged $18 for gasoline August 29 charged $31 for restaurant meal. What is the finance charge for August?arrow_forwardOn august 10, a credit card account had a balance of $345. A purchase of $64 was made on august 15, and $165 was charged on august 27. A payment of $71 was made on august 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on September 10 bill. (Round your answer to two decimal places)arrow_forwardOn August 10, a credit card account had a balance of $345. A purchase of $52 was made on August 15, and $161 was charged on August 27. A payment of $71 was made on August 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on the September 10 bill. (Round your answer to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education