Concept explainers

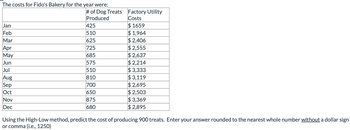

1. Using the High-Low method, predict the cost of producing 900 treats. Enter your answer rounded to the nearest whole number without a dollar sign or comma (i.e., 1250)

2. ABC Company leases a copy machine with terms that include a fixed fee each month plus a charge for each copy made. ABC made 9,000 copies and paid a total of $ 473 in January. In April, they paid $ 287 for 5,000 copies. What is the variable cost per copy if ABC uses the high-low method to analyze costs? Enter your answer with two decimals (i.e., .xx)

High Low Method - This method is used to segregate the variable and fixed cost. This method is basically used to calculate the per unit variable cost. Since production level constitutes mixed cost, a portion represents variable cost and other part is fixed cost. We can have a separate cost using the high-low method.

Variable cost per unit = (Highest Activity Cost - Lowest Activity Cost) / Highest Activity Units - Lowest Activity Units)

Variable Cost - Variable cost is the cost which is per unit fixed and varies with the level of production, If the production is high then there is high variable cost and if production is low then low variable cost and similarly if there is no production then no variable cost is required to be incurred.

Fixed Cost - as the name suggest this is fixed cost which means it has no relevance to the level of production, If there is no production then a fixed cost has to be incur. This cost remains same at all levels of activity/production.

Step by stepSolved in 4 steps

- To make a product it costs $24 per liter. The importation cost is a fixed cost of $ 150 additional of the unit costs. The time that takes from placing the order to receiving it is 5 weeks. During this time the average consumed is 80 liters with a std dev. of 4 liters. If the products ends the costs is $45 per liter. They work 52 weeks a year. The anual interest is 20% What is the order size and reorder point if we want to accomplish 90% of demand in the cycles? What is the order size and reorder point if we want to minimize average costs? what would be service level type 2?arrow_forwardA restaurant has 145 seats needs $60,000 to earn the annual interest payment to the bank. Its monthly fixed labor cost is $7,800 along with other annual fixed cost of $270,000. It has a guest check average of $22 and per guest average cost of $15.50. What revenue is needed to cover all costs? What average daily seat turnover will be needed, assuming the operation is closed 3 days a year?arrow_forwardWaterway Industries produces flash drives for computers, which it sells for $26 each. The variable cost to make each flash drive is $13. During April, 800 drives were sold. Fixed costs were $1400 for the month. How much is the monthly break-even level of salles in dollars for Waterway? O $2800 O $16000 O $108 $8800arrow_forward

- Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,065,000 each month plus variable expenses of $3.50 per carton of calendars. Of the variable expense, 71% is cost of goods sold, while the remaining 29% relates to variable operating expenses. The company sells each carton of calendars for $13.50. Read the requirements. Requirement 1. Compute the number of cartons of calendars that Team Spirit Calendars must sell each month to breakeven. Begin by determining the basic income statement equation. Variable expenses Sales revenue ... The breakeven sales is 106,500 cartons. Fixed expenses Using the basic income statement equation you determined above solve for the number of cartons to break even. = Operating income Requirement 2. Compute the dollar amount of monthly sales Team Spirit Calendars needs in order to earn $304,000 in operating income. Begin by determining the formula. Fixed expenses + Target operating income ( (Round the contribution…arrow_forwardAvocado Company sells guitars to Mexican restaurants. The guitars sell for $600, and the fixed monthly operating costs are as follows: Rent and utilities $4800 Wages and benefits to employees 2300 Other expenses 485 Avocado understand that for every dollar of sales, $0.65 went to cover fixed costs, and anything above that point was profit. What is the amount of revenue that Avocado should earn each month to break even? (Round your answer to the nearest dollar.) O $4285 O $4769 O $5515 O $10,243arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs and Markson paid $360 for 5,000 copies and $280 for 3,000 copies,arrow_forward

- Munabhaiarrow_forwardHow to solve this question on excel using excel formulas?arrow_forwardKaplan, Inc. produces flash drives for computers, which it sells for $27 each. The variable cost to make each flash drive is $13. During April, 700 drives were sold. Fixed costs for April were $2 per unit for a total of $1,400 for the month. How much is the monthly break-even level of sales in dollars for Kaplan? Group of answer choices $100 $2,700 $8,400 $14,000arrow_forward

- Markson and Sons leases a copy machine with terms that include a fixed fee each month of $400 plus a charge for each copy made. The company uses the high-low method to analyze costs. If Markson paid $580 for 5,000 copies and $400 for 3,000 copies, how much would Markson pay if it made 8,400 copies? Total cost $ 886 X Feedback V Check My Work For the two listed amounts, find the difference between the highest and lowest amounts each to apply the high low method. The differences between the two highest and lowest amounts from both columns are used to calculate the variable cost per unit using the method. Once that amount is determined, the total costs is made up of the total fixed and variable costs. Apply the variable cost per unit times the number of copies and add in the fixed costs to determine the required amount.arrow_forwardA distributor sells water cooling units for $860 each. The operating profit is 25% on cost and markup is 60% on cost. a. Calculate the cost per cooling unit. Round to the nearest cent b. Calculate the rate of markdown offered during a sale if it made a profit of $51.40 per machine. % Round to two decimal places c. What should be the rate of markdown offered to sell the machines at the cost price? % Round to two decimal placesarrow_forwardMackler, Inc. sells a product with a contribution margin of $50 per unit. Fixed costs are $8,000 per month. How many units must Mackler sell to break even? Please show the formula you used and show your work in the space provided.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education