FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

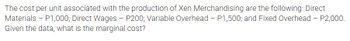

Transcribed Image Text:The cost per unit associated with the production of Xen Merchandising are the following: Direct

Materials - P1,000; Direct Wages - P200; Variable Overhead - P1,500; and Fixed Overhead - P2,000.

Given the data, what is the marginal cost?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Taunton Company uses the high-low method to estimate its cost function. The information for 2017 is provided below: Machine-hours Labor Costs Highest observation of cost driver 4,000 ���$332,000 Lowest observation of cost driver 3,000 $312,000 What is the estimated cost function for the above data? A. y = 332,000 + 83X B. y = 312,000 + 104X C. y = 92.00X D. y = 252,000 + 20.00Xarrow_forwardWindhoek Manufacturers produces two products, Amber and Black. The following cost estimates have been prepared using the traditional absorption costing approach. Selling price per unit Production costs per unit: Material costs Direct labour costs Manufacturing overhead cost Profit per unit Additional information. Estimates sales demand Machine hours per unit Required 1.1 1.2 Amber N$ Amber 69 27 6 12 24 9 000 0.75 Calculate the return per machine hour for each product if through put accounting approach is used. Calculate the profit for the period, using a throughput accounting approach, assuming the company priorities Black Black N$ Black 93 24 15 18 36 12 000 1.20 TIOLE.(arrow_forwardI want the correct answer with questionarrow_forward

- Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. A. Wood used to produce desks ($125.00 per desk) B. Production labor used to produce desks ($15 per hour) C. Production supervisor salary ($45,000 per year) D. Depreciation on factory equipment ($60,000 per year) E. Selling and administrative expenses ($45,000 per year) F. Rent on corporate office ($44,000 per year) G. Nails, glue, and other materials required to produce desks (varies per desk) H. Utilities expenses for production facility I. Sales staff commission (5% of gross sales)arrow_forward13. If Job Q includes 30 units, what is its unit product cost? 14. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 15. What is Sweeten Company’s cost of goods sold for the year?arrow_forwardHow can you obtain better estimates of fixed and variable costs? Why would these better estimates be useful to Gower?arrow_forward

- Tashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 7,095 $252,840 2,795 162,540 4,350 186,920 a. Determine the variable cost per unit and the total fixed cost. Variable cost (Round to two decimal places.) $fill in the blank 1 per unit Total fixed cost $fill in the blank 2 b. Based on part (a), estimate the total cost for 3,560 units of production. Total cost for 3,560 units: $fill in the blank 3arrow_forwardNeed ANSWER please provide Solutionsarrow_forwardThe JAG Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. JAG Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. The following are data from the most recent periods: Cost Hours $25,000 5,025 25,100 4,000 34,000 7,515 60,370 15,500 38,000 9.500 Required: (a) Using the high-low method, estimate the cost function. Round to two decimal places. Show work to receive partial credit!! (b) Calculate the estimated total costs at an operating level of 6,000 hours. Show work to receive partial credit!!!arrow_forward

- Poleskiʼs controller would like to have the worksheet display an income statement in a contribution margin format (Sales – variable costs = contribution margin – fixed costs = net income). CVP Cost-Volume-Profit Analysis Data Section Fixed Variable Production costs Direct materials $2.30 Direct labor 4.70 Factory overhead $225,000 3.00 Selling expenses Sales salaries & commissions 97,000 0.75 Advertising 47,500 Miscellaneous selling expense 16,200 General expenses Office salaries 92,000 Supplies 12,300 0.25 Miscellaneous general expense 15,000 $505,000 $11.00 Projected unit sales 120,000 Selling price per unit $16.00 Target net income $250,000 Answer Section Contribution margin per unit $5.00 Contribution margin ratio 31.25% Break-even point in units 101,000 Units needed to…arrow_forwardTashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 5,100 $437,920 1,700 281,520 3,400 417,280 a. Determine the variable cost per unit and the total fixed cost. Variable cost (Round to two decimal places.) $fill in the blank 1 per unit Total fixed cost $fill in the blank 2 b. Based on part (a), estimate the total cost for 2,450 units of production. Total cost for 2,450 units: $fill in the blank 3arrow_forwardFixed manufacturing costs are $40 per unit, and variable manufacturing costs are $120 per unit. Production was 113,000 units, while sales were 108,480 units. a. Determine whether variable costing operating income is less than or greater than absorption costing operating income. b. Determine the difference in variable costing and absorption costing operating income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education