FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

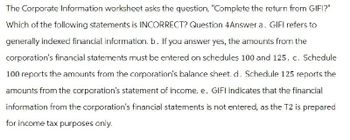

Transcribed Image Text:The Corporate Information worksheet asks the question, "Complete the return from GIFI?"

Which of the following statements is INCORRECT? Question 4Answer a. GIFI refers to

generally indexed financial information. b. If you answer yes, the amounts from the

corporation's financial statements must be entered on schedules 100 and 125. c. Schedule

100 reports the amounts from the corporation's balance sheet. d. Schedule 125 reports the

amounts from the corporation's statement of income. e. GIFI indicates that the financial

information from the corporation's financial statements is not entered, as the T2 is prepared

for income tax purposes only.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which pronouncements are not issued by the FASB? a. Statements of Financial Accounting Concepts b. Technical Bulletins c. Opinions d. Interpretationsarrow_forwardTo determine the amount of debt a corporation has, the user should examine: O A. Income statement B. Statement of Retained Earnings C. Statement of Cash Flows D. Balance Sheetarrow_forward8. What is meant by Generally Accepted Accounting Principles, and do these principles add to the integrity of financial accounting information. Mention all principles and conventions.arrow_forward

- Question 13 Match the following external users of financial accounting information with the type of decision that user will make with the information 1. Creditor 2. Investor 3. Regulatory Agency 4. Federal Tax Authority Is the company operating within prescribed guidelines? Is the company able to pay its debts? Is the company a good investment? Is the company complying with tax laws? A. 1 B. 3 C.2 D.4arrow_forwardA worksheet is a: formal document shown with a company's annual report. formal document required by the Bureau of Internal Revenue formal document required by creditors a multicolumn document used by accountants to aid in the preparation of the financial statementsarrow_forwardIs a company's net income INDIRECTLY included in the company's balance sheet? Please explain.arrow_forward

- Which of the following systems provides the internal financial information needed to manage a business? a. MRS b. IRS c. GL/FRS d. TPSarrow_forwardwhich of the following represents a form of communication through financial reporting but not through financial statements? A. balance sheet B. presidents letter C. income statement D. notes to financial statementsarrow_forwardThe following describes Financial Statements, except; * It is an art of recording, classifying, summarizing and interpreting of accounting transaction. A collection of summary-level reports about an organization's financial results which consists of four major financial reports. Financial information which is communicated by an enterprise to external parties Historical in nature but it all depends on management's judgement The objective of financial statement is to * know the financial status of the organization, whether the business is making profit or running at loss, and what corrective action to be taken. form a Private Finance Initiative (PFI) establishment. use accounting techniques such as marginal costing budgetary controls and standard costing. finance hire purchase.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education