FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

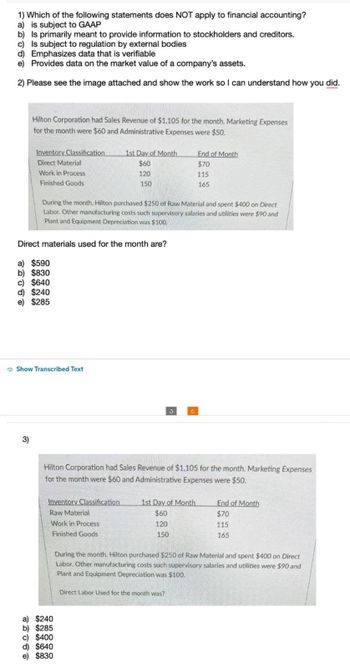

Transcribed Image Text:1) Which of the following statements does NOT apply to financial accounting?

a) is subject to GAAP

b) Is primarily meant to provide information to stockholders and creditors.

c) Is subject to regulation by external bodies

d) Emphasizes data that is verifiable

e) Provides data on the market value of a company's assets.

2) Please see the image attached and show the work so I can understand how you did.

Hilton Corporation had Sales Revenue of $1,105 for the month. Marketing Expenses

for the month were $60 and Administrative Expenses were $50.

Inventory Classification

Direct Material

Work in Process

Finished Goods

3)

a) $590

b) $830

c) $640

d) $240

e) $285

Direct materials used for the month are?

Show Transcribed Text

During the month, Hilton purchased $250 of Raw Material and spent $400 on Direct

Labor. Other manufacturing costs such supervisory salaries and utilities were $90 and

Plant and Equipment Depreciation was $100.

1st Day of Month

$60

120

Inventory Classification

Raw Material

Work in Process

Finished Goods

150

a) $240

b) $285

c) $400

Hilton Corporation had Sales Revenue of $1,105 for the month. Marketing Expenses

for the month were $60 and Administrative Expenses were $50.

d) $640

e) $830

End of Month

$70

115

165

1st Day of Month

$60

120

150

Direct Labor Used for the month was?

End of Month

$70

115

165

During the month, Hilton purchased $250 of Raw Material and spent $400 on Direct

Labor. Other manufacturing costs such supervisory salaries and utilities were $90 and

Plant and Equipment Depreciation was $100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I have attached the screenshot of the question. Apply Financial Statement Linkages to Understand TransactionsConsider the effects of the independent transactions, a through g, on a company’s balance sheet, income statement, and statement of cash flow. Complete the table below to explain the effects and financial statement linkages. Use “+” to indicate the account increases and “−” to indicate the account decreases. Refer to Exhibit 2-10 as a guide for the linkages a b c d e f g Balance Sheet Cash Noncash assets 355030 Total liabilities 241272 Contributed capital 35867 Retained earnings Other equity Statement of Cash Flows Operating cash flow Investing cash flow Financing cash flow Income Statement Revenues…arrow_forward(Usefulness, Objective of Financial Reporting) Indicate whether the following statements about the conceptual framework are true or false. If false, provide a brief explanation supporting your position.(a) Accounting rule-making that relies on a body of concepts will result in useful and consistent pronouncements.(b) General-purpose financial reports are most useful to company insiders in making strategic business decisions.(c) Accounting standards based on individual conceptual frameworks generally will result in consistent and comparable accounting reports.(d) Capital providers are the only users who benefit from general-purpose financial reporting.(e) Accounting reports should be developed so that users without knowledge of economics and business can become informed about the financial results of a company.(f) The objective of financial reporting is the foundation from which the other aspects of the framework logically result.arrow_forwardLocate the financial statements for a publicly traded company that provides segmented financial information. Prepare an overview of what is revealed about the company through its segmented data. Discuss the benefits of reporting financial information this way. Provide a link to the financial statements with your initial post and include the company name in the subject line. Do not choose a company that one of your peers has already posted on. Participate in follow-up discussion by critiquing the posts provided by your peers or defending their challenges to your post. (Hint: Utilize Appendix 5A in the textbook to help you learn about segment reporting and how to analyze the information).arrow_forward

- Please answer all four questions within the attached document.arrow_forward2. Discuss how using debt ratios applies to your personal finances.3. What does the P/E ratio or EPS tell you about a companies’ overall financial condition? 4. What industry statistics can a business use for comparison?5. How can they use that information in their business? Please give a specific example.arrow_forwardIs a company's net income INDIRECTLY included in the company's balance sheet? Please explain.arrow_forward

- A business will construct its financial statements in a particular order because they are interrelated. This means that items formulated in an earlier statement feed into the subsequent statements, and changes to items on one financial statement can have compounding effects on the overall financial position of a company. 1. Which of the following is one reason the statement of owner's equity is prepared after the income statement? 2. Which of the following is one reason the statement of owner's equity is prepared before the balance sheet?arrow_forwardWhich type of financial data do companies generally not provide to the public? Which type of financial data do companies generally not provide to the public? Staff Salaries Balance Sheets Statements of Cash Flows Income Statementsarrow_forwardWhich of the basic financial statements is best used to answer the question, "How profitable is the business?" a. Income statement O b. Statement of shareholder's equity O c. Accounts receivable aging schedule O d. Balance sheetarrow_forward

- What kinds of limitations exist in analyzing a company just by reading its financial reports?arrow_forwardConsider the following statements. For each one of them state whether the statement is true or false and provide a brief explanation to support your answer. a) Financial accounting is targeted at external users while management accounting focuses on internal users. b) The trial balance is part of a company’s financial statements. c) Bank loans are always non-current liabilities. d) In accounting, revenues are recognised whenever there is a cash transfer. e) As understandability is one of the key characteristics of accounting according to the IASB conceptual framework, transactions that are too difficult should not be recognised in the accounts.arrow_forwardThe following describes Financial Statements, except; * It is an art of recording, classifying, summarizing and interpreting of accounting transaction. A collection of summary-level reports about an organization's financial results which consists of four major financial reports. Financial information which is communicated by an enterprise to external parties Historical in nature but it all depends on management's judgement The objective of financial statement is to * know the financial status of the organization, whether the business is making profit or running at loss, and what corrective action to be taken. form a Private Finance Initiative (PFI) establishment. use accounting techniques such as marginal costing budgetary controls and standard costing. finance hire purchase.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education