FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

|

1.

|

Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide

|

|

2.

|

Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates, where forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department and assembly department overhead costs are allocated based on total direct manufacturing labor costs of the assembly department.

|

|

3.

|

Calculate the budgeted unit cost of basic and deluxe trophies if

Tribute

allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department. |

Transcribed Image Text:Tribute Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Tribute does large custom orders. Tribute budgets to

produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. I

the forming department, indirect manufacturing costs are accumulated in two cost pools, set up and general overhead. In the assembly

department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of

200 but because of the more intricate detail of the deluxe trophies, they are formed in batches of 50.

E (Click the icon to view budgeted information.)

Read the requirements.

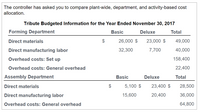

Transcribed Image Text:The controller has asked you to compare plant-wide, department, and activity-based cost

allocation.

Tribute Budgeted Information for the Year Ended November 30, 2017

Forming Department

Basic

Deluxe

Total

Direct materials

$

26,000 $

23,000 $

49,000

Direct manufacturing labor

32,300

7,700

40,000

Overhead costs: Set up

158,400

Overhead costs: General overhead

22,400

Assembly Department

Basic

Deluxe

Total

Direct materials

$

5,100 $

23,400 $

28,500

Direct manufacturing labor

15,600

20,400

36,000

Overhead costs: General overhead

64,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Do not give answer in image formatearrow_forward6. Which of the following statements is true? .Direct labor costs are usually included in the costs that are allocated to activity cost pools in an activity-based costing system. ll. The first stage allocation in a ABC system is the process of assigning overhead costs to activity cost pool. |||. Direct material costs are usually included in the costs in the costs that are allocated to activity cost pools in an activity based costing systemarrow_forwardMirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing Supervising Other Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data appear below: Product MO Product M5 Total $ 3,800 $ 23,800 $ 10,400 MHs (Processing) 9,700 300 10,000 Sales (total) Direct materials (total) Direct labor (total) Batches (Supervising) 500 500 1,000 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product Mº $ 74,100 $ 28,500 $ 27,800 Product M5 $ 89,900 $ 31,400 $ 41,700arrow_forward

- Single Plantwide and Multiple Production Department Factory Overhead Rate Methods and Product Cost Distortion The management of Nova Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering the multiple production department factory overhead rate method. The following factory overhead was budgeted for Nova: $765,000 315,000 $1,080,000 Fabrication Department factory overhead Assembly Department factory overhead Total Direct labor hours were estimated as follows: Fabrication Department Assembly Department Total In addition, the direct labor hours (dlh) used to produce a unit of each product in each department were determined from engineering records, as follows: Production Departments…arrow_forwardPlease do not give solution in image format thankuarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Question Content Area Activity rates and product costs using activity-based costing Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $640,000 Machine hours Assembly 125,000 Direct labor hours Inspecting 30,000 Number of inspections Setup 28,000 Number of setups Materials handling 20,000 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000…arrow_forward

- Activity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forwardAllocate overhead using a single plantwide rate, multiple department rates, and activity-based costing Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: Indirect labor Subassembly Department Final Assembly Department Total The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Setup Quality control Total Budgeted Activity Cost Required: Receivers 80 Loudspeakers 320 Total 400 $400,400 198,800 114,800 $714,000 The activity-base usage quantities and units produced for the two products follow: $138,600 Number of setups 261,800 Number of inspections $400,400 Number of Number of Setups Inspections 450 Activity Base 1,750 2,200 Direct Labor Hours- Subassembly 875 525 1,400 Direct Labor Hours-Final Units Assembly Produced 7,000 7,000 14,000 525 875 1,400 1. Determine a plantwide overhead rate based upon direct…arrow_forwardActivity-based costing (ABC) is a costing technique that uses a two-stage allocation process. Which of the following statements best describes these two stages? Multiple Choice Direct costs are allocated to the production departments based on a predetermined overhead rate. The costs are assigned to departments, and then to the products based upon their use of activity resources. The costs are assigned to activities, and then to the products based upon their use of the activities. Indirect costs are assigned to activities, and then to the products based upon the direct cost resources used by the activities.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education