FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

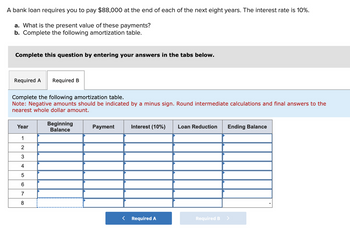

Transcribed Image Text:A bank loan requires you to pay $88,000 at the end of each of the next eight years. The interest rate is 10%.

a. What is the present value of these payments?

b. Complete the following amortization table.

Complete this question by entering your answers in the tabs below.

Required A Required B

Complete the following amortization table.

Note: Negative amounts should be indicated by a minus sign. Round intermediate calculations and final answers to the

nearest whole dollar amount.

Year

1

2

3

4

5

6

7

8

Beginning

Balance

Payment

Interest (10%) Loan Reduction Ending Balance

Required A

Required B

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 1. A lender is offering you a $300,000 30Y FRM at 7.2%. What is your monthly payment over the life of the loan? $2,036.36 2. You decide to originate the loan, but move at the end of 5 years. What is the remaining balance you owe the bank given the due-on-sale clause? Number 2 pleasearrow_forwardYou have just purchased a new warehouse. To finance the purchase, you've arranged for a 34-year mortgage loan for 80 percent of the $3,240,000 purchase price. The monthly payment on this loan will be $15,700. a. What is the APR on this loan? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the EAR on this loan? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardSuppose you borrow from a bank $1,756.06 today (t=0). You agree to pay back $3,637.64 in 4 years (t=4). The interest rate (%) that the bank charge you is closest to ________%. Input your answer without the % sign and round your answer to two decimal places.arrow_forward

- A personal account earmarked as a retirement supplement contains $292,400. Suppose $250,000 is used to establish an annuity that earns 7%, compounded quarterly, and pays $5500 at the end of each quarter. How long will it be until the account balance is $0? (Round your answer UP to the nearest quarter.) Please Introduction and explanation step by step without plagiarism and I humble request plz use math tools no handwritingarrow_forwardOn January 1, Yumati Electric borrows $700,000 at an interest rate of 6% today and will repay this amount by making 14 semiannual payments beginning May 31. What is the approximate amount of each payments that Yumati will need to make? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.)arrow_forwardPlease help mearrow_forward

- For each case, provide the missing information. Assume payments occur at the end of each period. (Use the present value and future value tables, the formula method, financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places X.XXXXX. Round all final answers to the nearest cent, $X.XX, and round the loan maturity date to the nearest whole year.) (Click the icon to view the cases.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Cases Amount borrowed Interest rate Number of periodic payments per year Maturity (in years) Periodic payment (1) (a) 4% 4 10 $ 10,354.90 (2) $ 675,000 $ 4% 2 10 (b) S CO (3) 456,000 6 % 1 (c) 81.685.59 (4) $ 750.000 12 % T (d) I Xarrow_forwardYou receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 3.9 percent per year, compounded monthly for the first six months, increasing thereafter to 18.8 percent per year, compounded monthly. Assuming you transfer the $19,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Interest owedarrow_forwardyour credit card has a balance of $4,500 and an annual interest rate of 16%. you decide to pay off the balance over 3 years. if there are no further purchases charged to the card, a.- how much must you pay each month? b.-what is the total interest paid over 3 years?arrow_forward

- If you withdraw part of your money from a certificate of deposit before the date of maturity, you must pay an interest penalty. Suppose you invested $7000 in a one-year certificate of deposit paying 8.3% interest. When you decide to withdraw $7000 early, your interest penalty is 3 months simple interest on the $7000. What interest penalty do you pay? (Round your answer to two decimal places.)arrow_forwardYou receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 1.8 percent per year, compounded monthly for the first six months, increasing thereafter to 17 percent compounded monthly. Assuming you transfer the $6,900 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardYou expect to have the given amount in an account with the given terms. Find how much you can withdraw periodically in order to make the account last the specified amount of time. Round your answer to the nearest cent. Account balance: $700,000 Interest rate: 4.65% monthly 17 years Frequency Time: Periodic Withdraw: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education