FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows:

|

1

|

|

Dec. 31, 20Y8

|

Dec. 31, 20Y7

|

|

2

|

Assets

|

|

|

|

3

|

Cash

|

$95,000.00

|

$110,000.00

|

|

4

|

|

260,000.00

|

280,000.00

|

|

5

|

Inventories

|

520,000.00

|

450,000.00

|

|

6

|

Prepaid expenses

|

15,000.00

|

5,000.00

|

|

7

|

Equipment

|

1,130,000.00

|

800,000.00

|

|

8

|

|

(235,000.00)

|

(190,000.00)

|

|

9

|

Total assets

|

$1,785,000.00

|

$1,455,000.00

|

|

10

|

Liabilities and

|

|

|

|

11

|

Accounts payable (merchandise creditors)

|

$100,000.00

|

$75,000.00

|

|

12

|

Mortgage note payable

|

0.00

|

500,000.00

|

|

13

|

Common stock, $10 par

|

500,000.00

|

200,000.00

|

|

14

|

Paid-in capital in excess of par—common stock

|

400,000.00

|

100,000.00

|

|

15

|

|

785,000.00

|

580,000.00

|

|

16

|

Total liabilities and stockholders’ equity

|

$1,785,000.00

|

$1,455,000.00

|

Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows:

| a. Net income, $250,000. | |

| b. Depreciation reported on the income statement, $135,000. | |

| c. Equipment was purchased at a cost of $420,000 and fully |

|

| d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. | |

| e. 30,000 shares of common stock were issued at $20 for cash. | |

| f. Cash dividends declared and paid, $45,000. |

Prepare a statement of cash flows , using the indirect method of presenting cash flows from operating activities. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the heading of the statement. Use the minus sign to indicate cash outflows , cash payments, decreases in cash, or any negative adjustments.

|

Labels and Amount Descriptions

|

|

| Cash paid for dividends | |

| Cash paid for equipment | |

| Cash paid for merchandise | |

| Cash paid for purchase of land | |

| Cash paid to retire mortgage note payable | |

| Cash received from customers | |

| Cash received from sale of common stock | |

| December 31, 20Y8 | |

| Decrease in inventories | |

| Decrease in accounts payable | |

| Decrease in accounts receivable | |

| Decrease in prepaid expenses | |

| Depreciation | |

| For the Year Ended December 31, 20Y8 | |

| Gain on disposal of equipment | |

| Gain on sale of investments | |

| Increase in accounts payable | |

| Increase in accounts receivable | |

| Increase in inventories | |

| Increase in prepaid expenses | |

| Loss on disposal of equipment | |

| Loss on sale of investments | |

| Net cash flow from financing activities | |

| Net cash flow from investing activities | |

| Net cash flow from operating activities | |

| Net cash flow used for financing activities | |

| Net cash flow used for investing activities | |

| Net cash flow used for operating activities | |

| Net decrease in cash | |

| Net income | |

| Net increase in cash | |

| Net loss |

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the heading of the statement. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

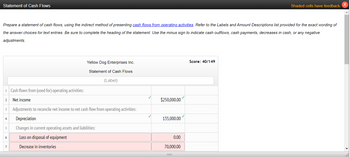

Transcribed Image Text:Statement of Cash Flows

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Refer to the Labels and Amount Descriptions list provided for the exact wording of

the answer choices for text entries. Be sure to complete the heading of the statement. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative

adjustments.

1 Cash flows from (used for) operating activities:

Net income

Adjustments to reconcile net income to net cash flow from operating activities:

Depreciation

Changes in current operating assets and liabilities:

Loss on disposal of equipment

Decrease in inventories

2

3

4

5

6

Yellow Dog Enterprises Inc.

Statement of Cash Flows

(Label)

7

✓

$250,000.00

135,000.00

0.00

70,000.00

Shaded cells have feedback.

Score: 40/149

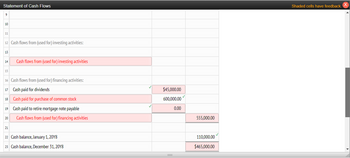

Transcribed Image Text:Statement of Cash Flows

9

10

11

12 Cash flows from (used for) investing activities:

13

14

15

16 Cash flows from (used for) financing activities:

17

Cash paid for dividends

Cash paid for purchase of common stock

Cash paid to retire mortgage note payable

Cash flows from (used for) financing activities

18

19

20

Cash flows from (used for) investing activities

21

22 Cash balance, January 1, 20Y8

23 Cash balance, December 31, 20Y8

$45,000.00

600,000.00

0.00

555,000.00

110,000.00

$465,000.00

Shaded cells have feedback. X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perform a vertical analysis for the balance sheet entry "Accounts Receivable" given below. (Round to the nearest tenth) Assets Current Assets Cash $ 23,000 Accounts Receivables 16,000 Merchandise Inventory 50,000 Supplies 2,500 Total Current Assets 91,500 Property, Plant, and Equipment Machinery and Equipment 23,000 Total Assets $114,500arrow_forwardThe following data apply to the next six problems. Consider Fisher & Company's financial data as follows (unit: millions of dollars except ratio figures):Cash and marketable securities $100Fixed assets $280Sales $1,200Net income $358Inventory $180Current ratio 3.2Average collection period 45 daysAverage common equity $500Find Fisher's accounts receivable.(a) $147.95 (b) $127.65(c) $225.78 (d) $290.45arrow_forwardThe comparative balance sheet of Iglesias Inc. for December 31, 20Y3 and 20Y2, is as follows: 1 Dec. 31, 20Y3 Dec. 31, 20Y2 2 Assets 3 Cash $186,000.00 $180,000.00 4 Accounts receivable (net) 540,000.00 480,000.00 5 Inventories 924,000.00 900,000.00 6 Investments 0.00 120,000.00 7 Land 600,000.00 0.00 8 Equipment 1,680,000.00 1,440,000.00 9 Accumulated depreciation-equipment (720,000.00) (600,000.00) 10 Total assets $3,210,000.00 $2,520,000.00 11 Liabilities and Stockholders’ Equity 12 Accounts payable $408,000.00 $360,000.00 13 Accrued expenses payable 54,000.00 60,000.00 14 Dividends payable 36,000.00 30,000.00 15 Common stock, $4 par 840,000.00 720,000.00 16 Excess of paid-in capital over par 240,000.00 210,000.00 17 Retained earnings 1,632,000.00 1,140,000.00 18 Total liabilities and…arrow_forward

- Sarrow_forwardThe comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, 20Y8 Dec. 31, 20Y7 Assets Cash $70,910 $86,990 Accounts receivable (net) 108,960 117,270 Merchandise inventory 155,660 145,360 Prepaid expenses 6,340 4,400 Equipment 317,080 260,420 Accumulated depreciation-equipment (82,440) (63,870) Total assets $576,510 $550,570 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $121,070 $115,070 Mortgage note payable 0 165,170 Common stock, $1 par 19,000 12,000 Paid-in capital: Excess of issue price over par-common stock 260,000 155,000 Retained earnings 176,440 103,330 Total liabilities and stockholders’ equity $576,510 $550,570 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: Net income, $187,160. Depreciation…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education