FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

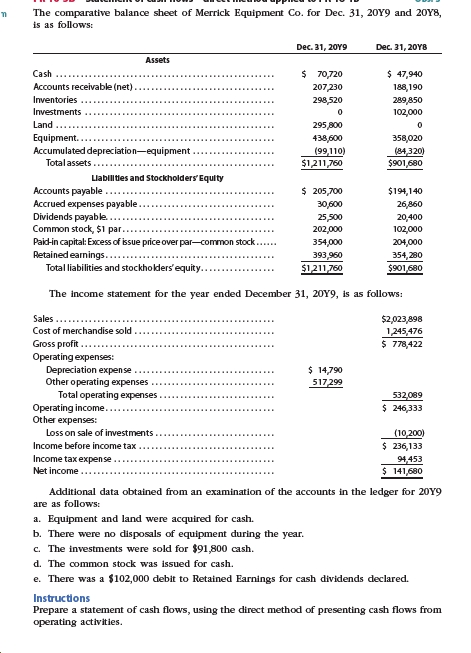

Transcribed Image Text:The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8,

is as follows:

Dec. 31, 20Y9

Dec. 31, 20Y8

Assets

$ 70,720

$ 47,940

Cash

Accounts receivable (net)

207,230

188,190

Inventories

298,520

289,850

102,000

Investments

Land

295 800

Equipment.

438,600

358,020

(84,320)

$901,680

Accumulated depreciation-equipment

(99,110)

$1211,760

Totalassets

Llabilitles and Stockholders' Equity

Accounts payable

Accrued expenses payable.

Dividends payable..

Common stock, $1 par..

$ 205,700

$194,140

30,600

26,860

25,500

20,400

102,000

202,000

Paid-in capital: Excess of issue price over par-common stock...

Retained earnings.....

Total liabilities and stockholders'equity..

354,000

204,000

393,960

$1211,760

354,280

$901,680

The income statement for the year ended December 31, 20Y9, is as follows:

Sales

$2,023,898

Cost of merchandise sold

Gross profit

Operating expenses:

Depreciation expense

Other operating expenses

1,245,476

$ 778,422

$ 14,790

517,299

Total operating expenses.

Operating income.

Other expenses:

532,089

$ 246,333

Loss on sale of investments

(10,200)

$ 236,133

Income before income tax

Income tax expense

Net income..

94,453

$ 141,680

Additional data obtained from an examination of the accounts in the ledger for 20Y9

are as follows:

a. Equipment and land were acquired for cash.

b. There were no disposals of equipment during the year.

c. The investments were sold for $91,800 cash.

d. The common stock was issued for cash.

e. There was a $102,000 debit to Retained Earnings for cash dividends declared.

Instructions

Prepare a statement of cash flows, using the direct method of presenting cash flows from

operating activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Computation.arrow_forwardThe following data were taken from the comparative balance sheet of Osborn Sisters Company for the years ended December 31, 20Y9 and December 31, 20Y8: Dec. 31, 20Y9 Dec. 31, 20Y8 Cash $608,800 $459,600 Temporary investments 649,600 503,500 Accounts and notes receivable (net) 597,600 548,900 Inventories 835,200 680,400 Prepaid expenses 380,800 215,600 Total current assets $3,072,000 $2,408,000 Accounts payable $371,20 $392,000 Accrued liabilities 268,800 168,000 Total current liabilities $640,000 $560,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. 20Y9 . 20Y8 Working capital Current ratio Quick ratio b. The liquidity of Osborn Sisters Company has from 20Y8 to the 20Y9. The working capital, current ratio, and quick ratio have all Most of these changes are the result ofarrow_forwardThe comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $296,640 $278,810 Accounts receivable (net) 107,460 100,130 Inventories 303,350 296,470 Investments 0 114,860 Land 155,600 0 Equipment 334,700 262,120 Accumulated depreciation—equipment (78,360) (70,680) Total assets $1,119,390 $981,710 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $202,610 $193,400 Accrued expenses payable (operating expenses) 20,150 25,520 Dividends payable 11,190 8,840 Common stock, $10 par 60,450 48,100 Paid-in capital in excess of par—common stock 227,240 133,510 Retained earnings 597,750 572,340 Total liabilities and stockholders’ equity $1,119,390 $981,710 Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: Equipment and land…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education