FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

please Do not Give image format and question (not in excel) and provide explained details thanks!

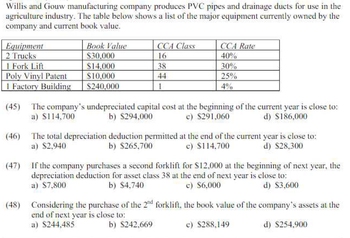

Transcribed Image Text:Willis and Gouw manufacturing company produces PVC pipes and drainage ducts for use in the

agriculture industry. The table below shows a list of the major equipment currently owned by the

company and current book value.

Equipment

2 Trucks

1 Fork Lift

Poly Vinyl Patent

1 Factory Building

(45) The company's

a) $114,700

(46)

Book Value

$30.000

$14,000

$10,000

$240.000

CCA Class

16

38

44

1

CCA Rate

40%

30%

25%

4%

undepreciated capital cost at the beginning of the current year is close to:

b) $294,000

c) $291,060

d) $186,000

The total depreciation deduction permitted at the end of the current year is close to:

a) $2,940

b) $265,700

d) $28.300

c) $114.700

(47)

If the company purchases a second forklift for $12,000 at the beginning of next year, the

depreciation deduction for asset class 38 at the end of next year is close to:

a) $7,800

b) $4.740

c) $6,000

d) $3,600

b) $242,669

(48) Considering the purchase of the 2nd forklift, the book value of the company's assets at the

end of next year is close to:

a) $244,485

c) $288.149

d) $254.900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide only typed answer solution no handwritten solution needed allowed... Please do it neat and clean correctly.arrow_forwardHow do you find UBS Accounting software? What are the users comment of this accounting software (like/dislike/criticism)?arrow_forwardPlease use the below format for your submitted answers, using a table or spreadsheet: Response Spreadsheet or Table Format 1. Segregation of II. Subsidiary ledger Duties errors A1. COSO objective A2. Design adequacy or Operational effectiveness A3. Insignificant, Significant, or Material A4. Overall conclusions B1. IA reporting B2. Management reporting III. Untimely reconciliationsarrow_forward

- show journal entry (for part b) assuming estimate is considered to be accurate. and show a journal entry (from part b) assuming the amount is large enough to intentionally impact decision of users.arrow_forwardHow do you get a report into PDF format? Select an answer: You need to email the report and then convert it to PDF. Click on the Export button and Click on Export as PDF. You cannot export reports into PDF. You have to print the report and then scan it as a PDF.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education