FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

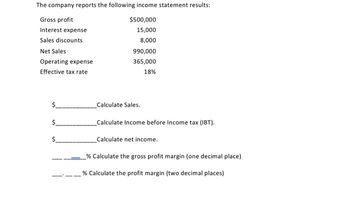

Transcribed Image Text:The company reports the following income statement results:

Gross profit

$500,000

Interest expense

15,000

Sales discounts

8,000

Net Sales

Operating expense

Effective tax rate

$

$

$

990,000

365,000

18%

Calculate Sales.

Calculate Income before Income tax (IBT).

Calculate net income.

% Calculate the gross profit margin (one decimal place)

% Calculate the profit margin (two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following sales-related information. Sales, gross Sales discounts $ 260,000 Sales returns and allowances 5,200 Sales salaries expense $ 15,000 11,200 Prepare the net sales portion only of this company's multiple-step income statement. Multiple-Step Income Statement (Partial) Net salesarrow_forwardPlease do both of the questions below:- 1. Use the following information to work out the net profit before tax:Cost of sales. $60,000 Interest payable. $4000 expenses. $20,000. sales turnover. $100,000 2. Vindhya Limited earns $200,000 in sales, has expenses of $80,000 and cost of goods sold amount to $90,000. What is the firm's gross profit?arrow_forwardA company shows the following balances: $2,500,000 Sales Revenue Sales Returns and 450,000 Allowances Sales Discounts 50,000 Cost of Goods Sold 1,400,000 What is the gross profit percentage? a) 44% O b) 56% c) 70% d) 30%arrow_forward

- Financial Information for the Diaz Corp. is presented below: Operating expenses-45000 sales returns and allowances-4000 Allowance for doubtful accounts-300 sales discounts-7000 purchase allowances-14000 sales revenue-150000 cost of goods sold-96000 What amount of net sales should be reported on the company's income statement?arrow_forwardFinancial information is presented below: Operating Expenses $ 44,000 Sales Returns and Allowances 13,000 Sales Discounts 6,000 Sales 170,000 Cost of Goods Sold 77,000. Gross profit would be?arrow_forwardPlease help me. Thankyou.arrow_forward

- NYFG, Inc.I has sales including sales taxes for the month of $742,000. If the sales tax rate is 6%, how much does NYFG owe for sales tax? Select one: O a. $48,000 O b. $42,000 c. $38,260 d. $45,420 e. $44,520arrow_forwardIf Swifty Corporation has net sales of $515000 and cost of goods sold of $365000, Swifty gross profit rate is 71%. 41%. 100%. 29%.arrow_forwardA company reports the following sales-related information. $ 220,000 Sales returns and allowances 4,400 Sales salaries expense Prepare the net sales portion only of this company's multiple-step income statement. Sales, gross Sales discounts Net sales Multiple-Step Income Statement (Partial) $ 15,000 10,400arrow_forward

- 16 )arrow_forwardThe following is the income statement belongs to Shining Star LLC for the year 31 December 2019: Shining Star LLC Income Statement for the year ending 31 December 2019 Net Sales OMR 25000 Cost of Goods Sold 7000 Gross Profit 18000 Operating Expenses 8000 Operating 10000 Income Other Income: Interest Income 4000 Net Income OMR 14000 If the company must pay an income tax expense on its profit and the tax rate is 30%, determine the Net income after-tax Select one: O a. OMR 10000 O b. OMR 9800 C. OMR 18200 O d. OMR 4200arrow_forwardPlease answer this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education