Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need help turing these trasnactions into a journal entry.please don't give solution image format thanku

Transcribed Image Text:A B

fx

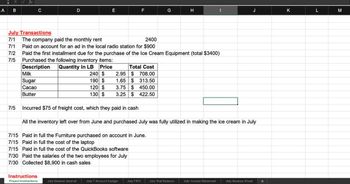

July Transactions

7/1

7/1

C

Milk

Sugar

Cacao

Butter

D

The company paid the monthly rent

2400

Paid on account for an ad in the local radio station for $900

Instructions

Project Instructions

E

July General Journal

F

7/2 Paid the first installment due for the purchase of the Ice Cream Equipment (total $3400)

7/5

Purchased the following inventory items:

Description

Quantity in LB Price

240 $

2.95

190 $

1.65

120 $

3.75

130 $ 3.25

July T Account Ledger

Total Cost

$708.00

$313.50

$450.00

$422.50

G

July FIFO

7/5 Incurred $75 of freight cost, which they paid in cash

All the inventory left over from June and purchased July was fully utilized in making the ice cream in July

7/15 Paid in full the Furniture purchased on account in June.

7/15 Paid in full the cost of the laptop

7/15 Paid in full the cost of the QuickBooks software

7/30 Paid the salaries of the two employees for July

7/30 Collected $8,900 in cash sales

H

July Trial Balance

I

July Income Statement

J

July Balance Sheet +

K

L

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of inventory on credit with payment terms of 1/15, net 45. Using the net price method, prepare journal entries to record Johnsons purchases on October 23 and the subsequent payment on October 31. Using the information from RE7-8, prepare journal entries to record Johnsons purchase on October 23 and the subsequent payment on November 30.arrow_forwardWilliams Corporation had the following purchases for May: May 3Bought ten lawn rakes from Owens Company, invoice no. J34Y9, 250.25; terms net 15 days; dated May 1; FOB shipping point, freight prepaid and added to the invoice, 15 (total 265.25). 11Bought one weed trimmer from Lionels Lawn Landscaping, invoice no. R7740, 219.72; terms 2/10, n/30; dated May 9; FOB shipping point, freight prepaid and added to the invoice, 35 (total 254.72). 15Bought five bags of fertilizer from Wrights Farm Supplies, invoice no. 478, 210.97; terms net 30 days; dated May 13; FOB destination. 25Bought one lawn mower from Gutierrez Corporation, invoice no. 2458, 425.39; terms net 30 days; dated May 22; FOB destination. Assume that Williams Corporation had beginning balances on May 1 of 3,492.29 (Accounts Payable 212), 4,239.49 (Purchases 511), and 234.89 (Freight In 514). Record the purchases of merchandise on account in the purchases journal (page 13) and then post to the general ledger.arrow_forwardSunrise Flowers sells flowers to a customer on credit for $130 on October 18, with a cost of sale to Sunrise of $50. What entry to recognize this sale is required if Sunrise Flowers uses a perpetual inventory system?arrow_forward

- Purchase-related transactions The following selected transactions were completed by Epic Co. during August of the curr ent year: Aug. 3. Purchased merchandise on account for $33400, terms FOB destination. 2/10. n/30. 9. Issued debit memorandum for $2500 ($2450 net of 2% discount) for merchandise from the August 3 purchase that was damaged in shipment. 10. Purchased merchandise on account, $25,000, terms FOB shipping point, n/com. Paid $600 cash to the freight company for delivery of the merchandise. 13. Paid for invoice of August 3, less debit memorandum of August 9 31. Paid for invoice of August 10. Instructions Illustrate the effects of each of the preceding transactions on the accounts and financial statements of Epic Co. Identify each transaction by date.arrow_forwardRescue Sequences LLC purchased inventory by issuing a 30,000, 10%, 60-day note on October 1. Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a perpetual inventory system and a 360-day calendar fiscal year. Rescue Sequences LLC uses a perpetual inventory system.arrow_forwardAnalyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following transactions: a. Made credit sales of $825,000. The cost of the merchandise sold was $560,000. b. Collected accounts receivable in the amount of $752,600. c. Purchased goods on credit in the amount of $574,300. d. Paid accounts payable in the amount of $536,200. Required: Prepare the journal entries necessary to record the transactions. Indicate whether each transaction increased cash, decreased cash, or had no effect on cash.arrow_forward

- Sunland Company purchased merchandise inventory with an invoice price of $11500 and credit terms of 2/10, n/30. What is the net cost of the goods if Sunland Company pays within the discount period? a.) $10350 b.) $11270 c.) $11500 d.) $10580arrow_forwardBisson Corp unes a perpetual inventory system. The company had the following inventory transactions in Apr Purchased merchandise from Groupe Lad for $28.560, terma n/30 Fl shipping point The appropriate company paid freight costs of $714 on the merchandine purchased on April 3 7 Purchased supplies on account for $5.100 Apr 3 30 1. 2 3 Returned merchandise to Grouper and received a credit of $3.570 The merchandise was returned to inventory for future rese Paid the amount due to Grouperin ful Additional information: The cost of the merchandise sold on Aprit 3 was $19.380. Grouper expected a return rate of 15% The cost of the merchandise returned on April was $2.346 Grouper uses a perpetual inventory system Record the transactions in the books of Grouper Lht all debit entries before credit entries. Cet account des ant automatically indented when the amount is entered De not indent manually if ne entry is requirest, select "No Entry for the account titles and enter Ofor the amounts econd…arrow_forwardYou are given the following transactions for an entity that uses the periodic inventory system: Transaction Details of 1 Credit sales for the week, R30 705(VAT inclusive). 2 3 Electronic funds transfer (EFT) payment received from of R3 540 Green Wholesalers in full settlement of account. Settlement discount granted R690. Bought equipment for cash from Capital Equip for R23 000(VAT inclusive). Instructions: For each transaction, you must indicate which subsidiary journal the transaction will be entered. ■You must then indicate whether the VAT Input account or the VAT Output account in the general ledger must be debited or credited. You must then calculate the VAT amount and enter it in the amount column. Transaction Subsidiary journal General ledger account Amount 1 3arrow_forward

- Hi, please answer the attached question BR,arrow_forwardMarigold Company purchased merchandise inventory with an invoice price of $6000 and credit terms of 2/10, n/30. What is the net cost of the goods if Marigold Company pays within the discount period? $5880 $6000 $5520 $5400arrow_forwardPurchase-Related Transactions Journalize entries for the following related transactions of Manville Heating & Air Company: a. Purchased $48,000 of merchandise from Wright Co. on account, terms 2/10, n/30. Merchandise Inventory fill in the blank 13255f0bbfa806d_2 Accounts Payable-Wright Co. fill in the blank 13255f0bbfa806d_4 b. Paid the amount owed on the invoice within the discount period. Accounts Payable-Wright Co. fill in the blank 287657090fdcf92_2 Cash fill in the blank 287657090fdcf92_4 c. Discovered that $9,600 of the merchandise purchased in (a) was defective and returned items, receiving credit. Accounts Payable-Wright Co. fill in the blank bebb1cfe102e03e_2 Merchandise Inventory fill in the blank bebb1cfe102e03e_4 d. Purchased $7,600 of merchandise from Wright Co. on account, terms n/30. Merchandise Inventory fill in the blank 2d88fb0c1027f88_2 Accounts…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning