Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Calculations to determine which – if any – additional investment opportunities should be undertaken.

1. If the projects are divisible

2. If the projects are not divisible

.

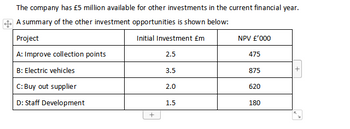

Transcribed Image Text:The company has £5 million available for other investments in the current financial year.

A summary of the other investment opportunities is shown below:

Initial Investment £m

Project

A: Improve collection points

B: Electric vehicles

C: Buy out supplier

D: Staff Development

+

2.5

3.5

2.0

1.5

NPV £'000

475

875

620

180

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How can we calculate the terminal project balance of the Project?arrow_forward1. State the criterion for accepting or rejecting independent projects under each of the following methods. - Profitability index - Discounted payback period - Accounting rate of return - Net present value - Payback period - Internal rate of returnarrow_forwardTechnique commonly used when an uncertain single factor determines the selection of an alternative of an engineering project. O a. Uncertainty analysis O b. Breakeven analysis O. Economic analysis O d. Balanced assets analysisarrow_forward

- Explain the uses, limitations and merits of the Payback Period compared to Net Present Value in investment appraisal.arrow_forwardWhen choosing between two projects of different scales, which of the following methodologies is best employed? a. Probability index to rank projects b. Equivalent annuities method c. Replacement chain method d. IRR methodarrow_forwardDiscuss what reason to decide whether to accept or reject a project. Your should refer to all four investment appraisal methodsarrow_forward

- What is the process of economically evaluating a project's desirability?arrow_forwardIllustrate Investment Decision for a Nonsimple Project?arrow_forwardFor a capital investment project to be acceptable, it must generate a rate of return A) Less than the required rate of returnB) Equal to or greater than the cost of capitalC) equal to the initial investmentD) none of the abovearrow_forward

- Describe the Incremental Analysis for Cost-Only Projects?arrow_forwardWhat type of projects does the Payback method favor?arrow_forwardWhy is it important to make the distinction between company required rate of return (WACC) and project required rate of return when evaluating projects?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education