Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

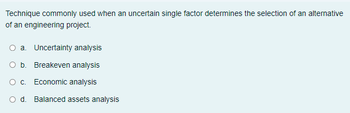

Transcribed Image Text:Technique commonly used when an uncertain single factor determines the selection of an alternative

of an engineering project.

O a. Uncertainty analysis

O b. Breakeven analysis

O. Economic analysis

O d. Balanced assets analysis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The life-cycle concept and WBS are important aids to O a. Reducing the cost and profit structure for a project b. Developing the cost and revenue structure for a project c. Reducing the cost and revenue structure for a project d. Developing the cost and profit structure for a projectarrow_forwardWhy is the reporting of segment information required? Justify your response. Why is the reporting of estimates and assumptions required? Justify your response.arrow_forwardIn order to determine whether an investment is visible, what factors should be considered?arrow_forward

- Under IFRS, how are investment properties subsequently measured? a) The cost model must be used. b) The cost or fair value models may be used. c) The cost or revaluation models may be used. d) The fair value model must be used.arrow_forwardAssume you were trying to decide when to stop or cease within an investment (which has been ongoing). On what criteria would be your decision? What data do you think you would need? arrow_forwardWhich is the most important breakeven in the analysis of a project?arrow_forward

- Prove that Homotheticity is required for the method of representative agent method to find the asset pricing. Otherwise, you have to use upper convultion to find the representative agent utilityarrow_forwardClassify the following fixed costs as normally being either committed or discretionary:f. Management development and training.arrow_forwardThe main elements of the relative valuation approach are: a. The valuation target, the comparison asset and the valuation measure. b. The valuation target and the relative performance measure. c. The relative valuation anchor, the valuation indicator and the valuation reference point. d. The target, the measure, the anchor, and the loss point.arrow_forward

- What should be done to calculate accurately a project's true IRR,?arrow_forwardQuestion Content Area The present value index is computed using which of the following formulas?arrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education