ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

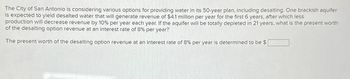

Transcribed Image Text:The City of San Antonio is considering various options for providing water in its 50-year plan, including desalting. One brackish aquifer

is expected to yield desalted water that will generate revenue of $4.1 million per year for the first 6 years, after which less

production will decrease revenue by 10% per year each year. If the aquifer will be totally depleted in 21 years, what is the present worth

of the desalting option revenue at an interest rate of 8% per year?

The present worth of the desalting option revenue at an interest rate of 8% per year is determined to be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Ford Motor Company has re-designed its best selling truck by substituting aluminum for steel in many key body parts. This saves 600 pounds of weight and decreases gas consumption. The fuel consumption will be 27 miles per gallon (mpg), up from 24 mpg of the previous year's model. Ford will increase the sticker price of the re-designed vehicle by $470. Assume this vehicle will be driven 16,000 miles per year and its life will be 9 years. The owner's MARR is 8% per year and gasoline costs $3.02 per gallon. What is the present worth of the incremental capital outlay for the lighter truck? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. The present worth of the incremental capital outlay for the lighter truck is $ (Round to the nearest dollar.)arrow_forwardKim has $35057 to invest for 10 years. She has the following options: [A]term deposit at 5% compounded annually; [B] Shares, paying a rate of 4.98% per annum with dividend paid quarterly; and [C] A building society account, paying a return of 5.06% per annum with monthly rests. Advise Kim on which option to take if all the investments are equally secure. Calculate all the resulting values per situationarrow_forwardAn oil and gas producing company owns 49,000 acres of land in a southeastern state. It operates 650 wells which produce 19,000 barrels of oil per year and 1.5 million cubic feet of natural gas per year. The revenue from the oil is $1,900,000 per year and for natural gas the annual revenue is $583,000 per year. What bid should be made to purchase this property if the potential buyer is hoping to make 17% per year on his investment over a period of 9 years. Click the icon to view the interest and annuity table for discrete compounding when i = 17% per year. $ million or less should be offered for the property. (Round to two decimal places.)arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThe city of Oak Ridge is considering the construction of a three kilometer (km) greenway walking trail. It will cost $1,000 per km to build the trail and $320 per km per year to maintain it over its 23-year life. If the city's MARR is 10% per year, what is the equivalent uniform annual cost of this project? Assume the trail has no residual value at the end of 23 years.arrow_forwardFor each of the following problems, (a) draw the cash flow diagram; (b) present clean and clear manual solutions to the problem; (c) highlight the final answer (only the final answer as required by the problem) by enclosing it within a box. Company C wants to start saving money for replacement of network servers. If the company invests $100,000 at the end of year 1 but decreases the amount invested by 5% each year, how much will be available 5 years from now at an earning rate of 10% per year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education