FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Could you check the working and help with the

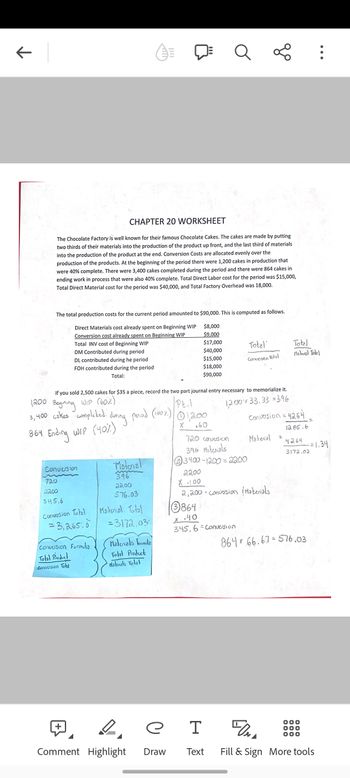

Transcribed Image Text:CHAPTER 20 WORKSHEET

The Chocolate Factory is well known for their famous Chocolate Cakes. The cakes are made by putting

two thirds of their materials into the production of the product up front, and the last third of materials

into the production of the product at the end. Conversion Costs are allocated evenly over the

production of the products. At the beginning of the period there were 1,200 cakes in production that

were 40% complete. There were 3,400 cakes completed during the period and there were 864 cakes in

ending work in process that were also 40% complete. Total Direct Labor cost for the period was $15,000,

Total Direct Material cost for the period was $40,000, and Total Factory Overhead was 18,000.

The total production costs for the current period amounted to $90,000. This is computed as follows.

$8,000

Direct Materials cost already spent on Beginning WIP

Conversion cost already spent on Beginning WIP

Total INV cost of Beginning WIP

$9,000

$17,000

DM Contributed during period

$40,000

DL contributed during he period

$15,000

FOH contributed during the period

$18,000

Total:

$90,000

1200 Begining

3,400 cakes completed

If you sold 2,500 cakes for $35 a piece, record the two part journal entry necessary to memorialize it.

WIP (60%)

12.00x 33.33=396

864 Ending WIP (40%)

Conversion

720

2200

345.6

Conversion Total

= 3,265.6

Conversion Formula

Total Product

Conversion Tohl

during

+

Pt.l

period (100%) 01,200

X .60

Material

396

22.00

576.03

Material Total

=3172.03

Materials formula

Total Product

Malenals Total

де

Comment Highlight Draw

go

Total

Conversion Total

720 conversion

396 Materials

@3400-1200-2200

3864

X-40

345, 6 Conversion

Material

2200

X.100

2,200 = Conversion Materials

Conversion = 4264

12.85.6

Total

Malerel Totel

4264

3172.03

864 66.67-576.03

=

000

000

000

-21.34

T

Text Fill & Sign More tools

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hi thank you for the help. I have a question though the beginning materials was calculated 12,000 x 0.33 = 400. but shouldnt it be 396?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hi thank you for the help. I have a question though the beginning materials was calculated 12,000 x 0.33 = 400. but shouldnt it be 396?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education